In today’s interconnected world, cross-border payments are crucial for economic collaboration. However, traditional banking systems often suffer from inefficiencies, resulting in slow and expensive transactions. Enter blockchain technology, which is rapidly transforming the landscape of international payments.

This article examines how blockchain is reshaping cross-border transactions, its advantages and challenges, real-world implementations, and future prospects.

Understanding Blockchain-Based Cross-Border Payments

Blockchain is a decentralized, distributed ledger technology that tackles many of the obstacles associated with cross-border payments. Unlike conventional payment systems that rely on central banks and intermediaries, blockchain facilitates direct, peer-to-peer transactions. This innovation offers businesses and individuals alike the chance to execute international transfers that are not only faster but also more economical and secure.

Challenges of Traditional Cross-Border Payments

Before exploring blockchain’s benefits, it’s important to highlight the common issues with traditional cross-border payment methods:

- High Transaction Costs: Fees from banks, currency conversions, and intermediary commissions can add up quickly, making transactions expensive.

- Slow Processing Times: Transactions can take several days to complete due to time zone differences and multiple verification steps.

- Lack of Transparency: Tracking a transaction’s status from sender to recipient can be difficult, leading to delays and uncertainty.

These pain points underscore the urgent need for a more efficient solution that enhances speed, reduces costs, and increases transparency.

The Mechanics of Blockchain-Based Payments

Blockchain-based cross-border payments utilize distributed ledger technology (DLT) to enable seamless international transactions. By eliminating intermediaries, blockchain allows for real-time validation and tracking of transactions on an immutable ledger. Each transaction is transparent and traceable, making it particularly useful for high-value international transfers.

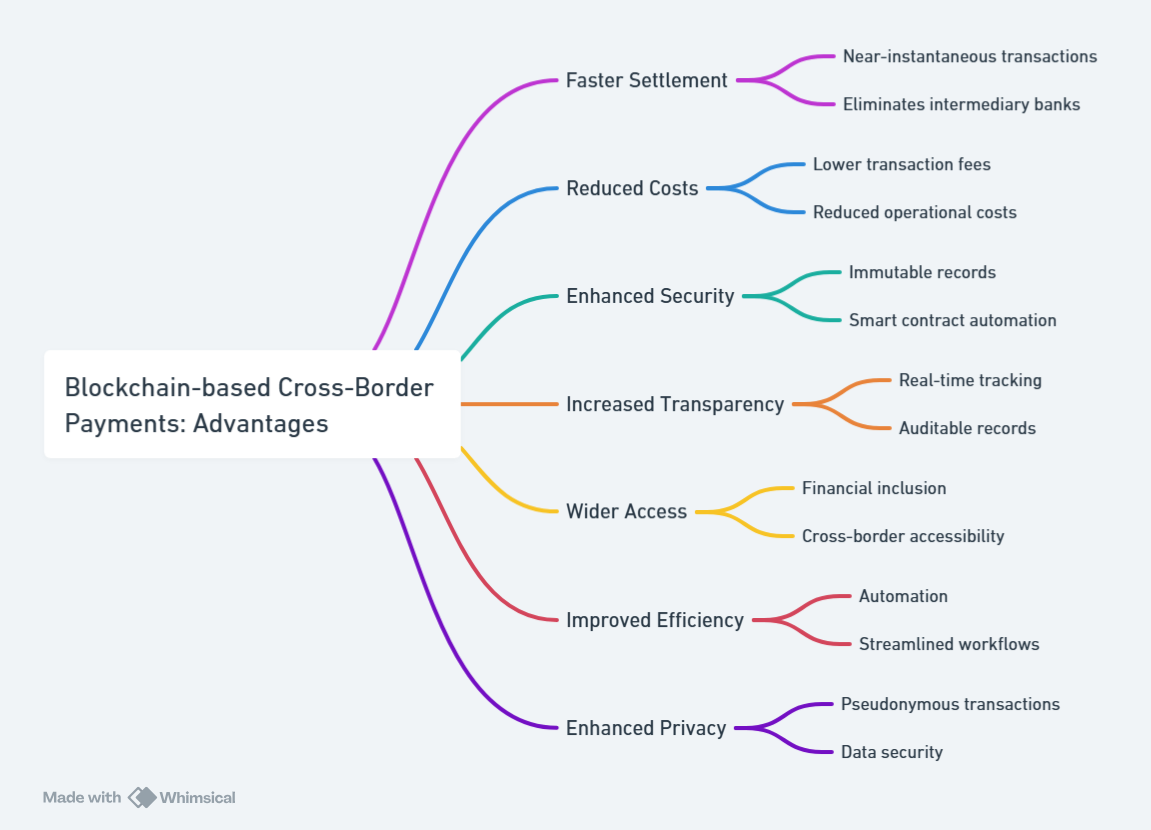

Advantages of Blockchain for Cross-Border Transactions

Blockchain technology offers a range of benefits for international payments:

- Lower Fees: By minimizing the number of intermediaries and reducing conversion costs, blockchain lowers transaction fees for both senders and recipients.

- Increased Speed: Transactions that traditionally take days can now be settled within minutes, irrespective of geographical boundaries.

- Enhanced Transparency and Security: The public ledger records each transaction, making it secure and resistant to fraud, while also enhancing trust among participants.

How Blockchain Simplifies Payments

Blockchain simplifies cross-border payments through several key features:

- Decentralized Verification: Transactions are validated by a global network of nodes, removing dependence on banks and centralized systems.

- Immutability: Once a transaction is logged on the blockchain, it cannot be altered, enhancing security and reliability.

- Smart Contracts: Some blockchain platforms support smart contracts, which automatically execute transactions based on pre-defined conditions, further streamlining processes.

This architecture makes blockchain suitable for both small remittances and large-scale business transfers.

Leading Blockchain Networks in Cross-Border Payments

Several blockchain platforms are at the forefront of revolutionizing cross-border payments:

- Ripple (RippleNet): RippleNet enables swift and low-cost international transactions, with its XRP token serving as a bridge currency. It is favored by banks for its scalability and security.

- Stellar: Focused on financial inclusion, Stellar connects financial institutions to facilitate affordable international transfers, particularly benefiting underbanked regions.

- Ethereum: Known for its smart contract functionality, Ethereum supports various decentralized finance (DeFi) platforms that facilitate cross-border transactions, often using stablecoins to mitigate volatility.

The Role of Stablecoins

Stablecoins, which are pegged to fiat currencies, play a critical role in blockchain payments. They provide price stability, allowing users to engage in transactions without the fear of sudden value fluctuations. Widely used stablecoins, such as USDC and Tether (USDT), help ensure predictable transaction values, promoting smoother cross-border trade.

How Stablecoins Enhance Cross-Border Payments

Faster Settlement Times

Stablecoin transactions on blockchain networks are processed much more quickly than traditional banking methods, minimizing delays and improving efficiency for businesses and individuals.

Lower Transaction Costs

By removing intermediaries like banks and payment processors, stablecoin transactions significantly reduce fees, making cross-border payments more affordable, especially for small businesses and individuals.

Increased Transparency and Security

Blockchain technology ensures a transparent and tamper-proof record of all transactions, enhancing security and trust while reducing the risks of fraud and errors.

Reduced Currency Exchange Risk

Stablecoins, pegged to established fiat currencies, help mitigate the impact of fluctuating exchange rates, providing greater financial predictability for businesses engaged in international trade.

Global Accessibility

The decentralized nature of blockchain allows for seamless peer-to-peer transactions, making it easier for individuals and businesses to send and receive payments across borders, enhancing financial inclusion worldwide.

Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies represent another frontier in blockchain payments. Countries are exploring CBDCs to create digital versions of their national currencies, aiming to streamline and enhance the efficiency of cross-border transactions. Nations like China and Sweden are already piloting CBDC initiatives, which could significantly reduce exchange fees and transaction times.

Why Are CBDCs Important?

Central banks are investigating CBDCs for several key reasons:

- Enhancing Financial Inclusion: CBDCs have the potential to provide financial services to those who are unbanked or underbanked.

- Improving Payment Efficiency: They can streamline payment systems, resulting in faster and more effective transactions.

- Strengthening Monetary Policy: CBDCs could offer innovative tools for implementing monetary policy, such as direct funds distribution to citizens.

- Promoting Innovation: By fostering new financial technologies, CBDCs can drive the development of novel products and services in the sector.

Types of CBDCs

- Retail CBDC: Intended for everyday transactions by individuals and businesses.

- Wholesale CBDC: Designed for transactions between financial institutions, particularly for interbank settlements.

How CBDCs Function

- Issuance: Central banks can issue CBDCs either to commercial banks or directly to consumers.

- Storage: CBDCs are stored in digital wallets.

- Transactions: Users can make payments using CBDCs via mobile applications or point-of-sale systems.

- Settlement: Transactions are recorded on a blockchain or similar distributed ledger technology.

Regulatory Challenges

Despite its advantages, blockchain-based payments face several regulatory hurdles:

- Compliance Requirements: Many jurisdictions mandate adherence to financial regulations, such as the GDPR in Europe.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance: Blockchain platforms must integrate these procedures to align with international laws and prevent fraud.

The decentralized nature of blockchain complicates the establishment of uniform regulatory standards. However, as adoption increases, regulatory frameworks are gradually adapting to accommodate blockchain technology.

Future Outlook for Blockchain in Payments

The future of blockchain in cross-border payments is bright, with several trends emerging:

- Growth of DeFi: Decentralized finance platforms are enabling borderless financial services, often bypassing traditional banking systems.

- AI Integration: Artificial intelligence could enhance blockchain networks by optimizing payment routes and improving fraud detection.

- Wider Adoption of CBDCs: As more central banks issue digital currencies, cross-border payments could become faster and more universally interoperable.

This evolution has the potential to enhance financial inclusion and unlock new opportunities for global trade.

Real-World Examples

Several companies are successfully utilizing blockchain for cross-border payments:

- Santander’s One Pay FX: Using RippleNet, Santander offers same-day, low-cost international payments, highlighting blockchain’s transformative impact on established financial institutions.

- IBM’s World Wire: In partnership with Stellar, IBM’s World Wire aims to facilitate cross-border payments in emerging markets by simplifying currency exchange and transfer processes.

Conclusion

Blockchain technology is fundamentally changing the landscape of cross-border payments by providing faster, cheaper, and more transparent alternatives to traditional systems. By eliminating intermediaries and enhancing security, blockchain is fostering a more inclusive and efficient global financial environment. As regulatory frameworks evolve and adoption accelerates, blockchain-based payment solutions are set to become integral to international finance.

FAQs

What Type of Blockchain is Suitable for Cross-Border Payment Solutions?

For cross-border payment solutions, public blockchains and consortium blockchains are ideal. Public blockchains, such as Bitcoin and Ethereum, offer decentralized and transparent transactions accessible to anyone, ensuring security and wide acceptance. Consortium blockchains, on the other hand, are governed by a group of organizations, enhancing privacy and efficiency, making them preferable for banks and financial institutions in interbank transactions.

What is a Blockchain-Based Strategic Solution?

A blockchain-based strategic solution applies blockchain technology to solve specific business challenges or improve operational efficiency. Examples include supply chain management for transparency, identity verification for enhanced security, and cross-border payments to streamline international transactions. These solutions leverage blockchain’s unique features—decentralization, immutability, and transparency—to create more effective and secure processes.

How Do You Implement a Blockchain Solution?

Implementing a blockchain solution involves several key steps. First, define your objectives by identifying the specific problem to solve. Next, choose the appropriate blockchain type—public, private, or consortium—based on your needs. Develop the architecture, create a prototype, and conduct thorough testing for security and usability. Once ready, launch the final version and monitor its performance, making adjustments as needed for optimization.

How Does Blockchain Work for Beginners?

Blockchain can be understood as a decentralized digital ledger that records transactions across multiple computers. Each block in the chain contains transaction data, a timestamp, and a unique hash linking it to the previous block. This structure ensures security and integrity through decentralization, as no single entity controls the entire network. Consensus mechanisms, like Proof of Work, validate transactions, while the immutability of added blocks prevents alterations, providing a secure and trustworthy data record.