Blockchain and Artificial Intelligence (AI) are two of the most transformative technologies in the modern era, disrupting industries far and wide. Together, they hold the potential to revolutionize the financial processes within supply chains. Supply chain finance (SCF), in particular, stands to benefit immensely from the integration of blockchain and AI, as both technologies address long-standing challenges like transparency, security, speed, and efficiency. By providing a secure, automated, and data-driven approach to managing finances, blockchain and AI pave the way for a smarter, more interconnected financial system within supply chains.

In this article we will understand more about the contribution of Blockchain and AI in Supply Chain Finance.

Understanding Supply Chain Finance

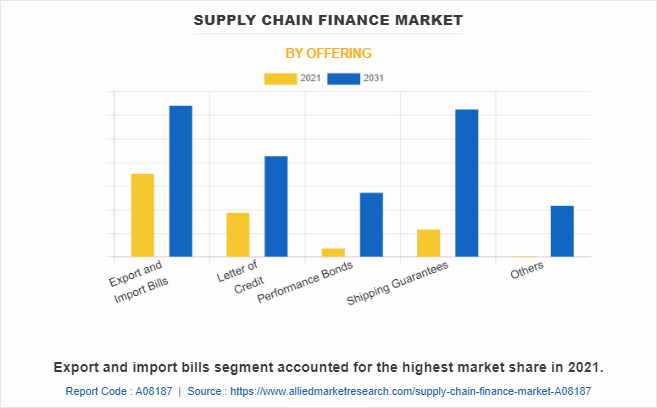

Supply chain finance (SCF) is a strategic approach that enhances working capital efficiency by enabling faster payments to suppliers while allowing buyers to negotiate more flexible payment terms. The primary goal of SCF is to optimize liquidity throughout the supply chain, effectively closing the gap between when goods are delivered and when payments are made.However, traditional supply chain finance often encounters significant challenges, including payment delays, convoluted contractual agreements, and a lack of transparency in financial processes. These issues can result in elevated operational costs and liquidity shortages, which can adversely impact the entire supply chain ecosystem.By using innovative financing solutions and technology, SCF aims to streamline these processes, reducing inefficiencies and fostering healthier cash flow dynamics. This not only benefits suppliers with quicker access to funds but also provides buyers with improved financial flexibility, ultimately leading to a more resilient and responsive supply chain. Global Supply Chain Finance Market was valued at USD 5.7 billion in 2023 and is anticipated to grow with a CAGR of 8.7% through 2029.

How Blockchain is Transforming Supply Chain Finance

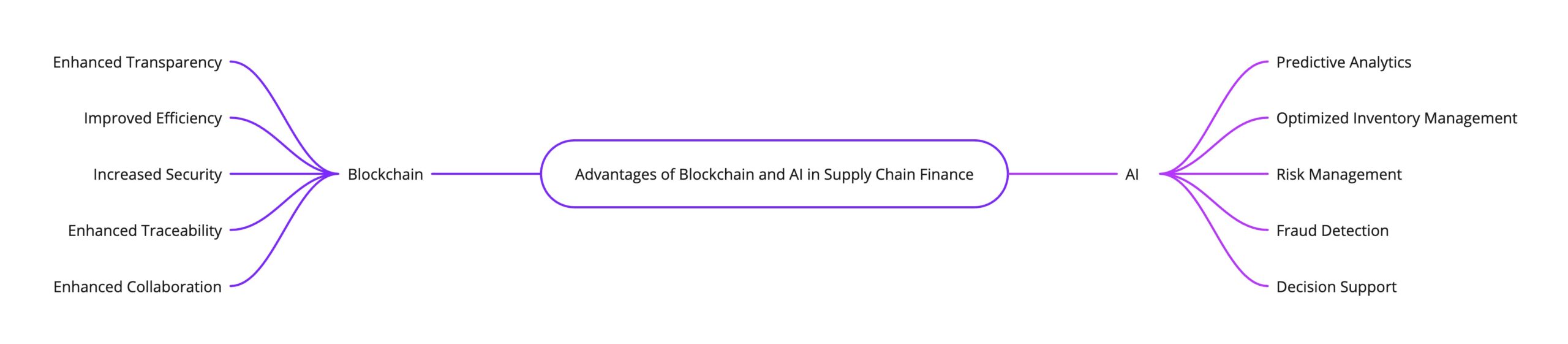

Blockchain brings several key benefits to supply chain finance. First and foremost, it provides a transparent and immutable record of all transactions, ensuring that all stakeholders in the supply chain have access to the same information. This transparency reduces the risk of fraud, as every transaction can be verified independently. Additionally, blockchain eliminates the need for intermediaries, speeding up payment processes and reducing operational costs.

Specific Use Cases of Blockchain in Supply Chain Finance

- Invoice Financing: Blockchain technology enhances invoice financing by providing a secure and transparent platform for verifying invoice authenticity. This visibility helps suppliers access working capital more easily and minimizes the risk of fraudulent claims, ensuring a smoother financing process.

- Trade Finance: By automating the issuance, transfer, and settlement of letters of credit, blockchain can significantly streamline trade finance operations. This automation reduces transaction costs, enhances efficiency, and lowers the risks associated with manual processes, making international trade more reliable.

- Supply Chain Financing: Blockchain facilitates innovative supply chain financing methods like reverse factoring and dynamic discounting. These mechanisms enable suppliers to receive early payments, improving their cash flow and financial stability while allowing buyers to optimize their payment terms.

- Traceability and Sustainability: The use of blockchain in supply chains enhances product traceability, allowing companies to track the origin of goods and ensure adherence to ethical and environmental standards. This transparency not only supports regulatory compliance but also helps build consumer trust in the brand’s commitment to sustainability.

The Role of AI in Supply Chain Finance

AI plays a critical role in optimizing supply chain finance through its ability to process and analyze large volumes of data. One of AI’s most powerful capabilities is its predictive analytics function, which allows businesses to forecast cash flow, assess risks, and make informed financial decisions. AI also automates many of the routine tasks involved in supply chain finance, such as invoice processing and credit assessments, reducing the need for human intervention and speeding up financial operations.

Specific Use Cases of AI in Supply Chain

Demand Forecasting:

- Sales Predictions: AI analyzes historical data and trends to forecast future demand.

- Seasonal Patterns: Identifies seasonal fluctuations, enabling better inventory management.

Inventory Optimization:

- Optimal Levels: Determines ideal inventory based on forecasts and lead times.

- Preventing Stockouts: Automates replenishment orders and adjusts procurement to avoid excess stock.

Transportation Optimization:

- Route Planning: Optimizes delivery routes considering distance, traffic, and deadlines.

- Load Optimization: Maximizes space utilization in transportation to reduce costs.

- Disruption Detection: Monitors data sources for potential supply chain disruptions.

- Contingency Plans: Develops strategies to mitigate impacts from disruptions.

Quality Control:

- Defect Detection: Uses AI vision systems to inspect products for quality assurance.

- Predictive Maintenance: Analyzes equipment data to anticipate maintenance needs.

Supplier Performance Evaluation:

- Performance Assessment: Evaluates suppliers based on delivery, quality, and pricing data.

- Improvement Opportunities: Identifies areas for supplier performance enhancement.

Customer Service:

- Personalized Recommendations: Analyzes customer data for tailored product suggestions.

- Order Fulfillment: Optimizes processes to improve delivery speed and satisfaction.

Sustainable Supply Chain:

- Sustainability Tracking: Monitors metrics like carbon emissions and waste.

- Improvement Opportunities: Identifies ways to reduce the environmental impact.

Predictive Analytics in Supply Chain Finance

Predictive analytics in supply chain finance employs data mining techniques to forecast future trends and outcomes. It predicts demand, optimizes inventory, manages risks, assesses credit, forecasts cash flow, and detects fraud. By leveraging predictive analytics, businesses can make informed decisions, enhance risk management, optimize inventory, improve cash flow, and prevent fraud, ultimately gaining a competitive advantage and improving their financial performance.

Case Studies of Blockchain in Supply Chain Finance

Blockchain technology has shown great promise in transforming supply chain finance across various sectors. Here are some noteworthy case studies:IBM Food Trust:

- Sector: Food and Beverage

- Application: Enhancing traceability, transparency, and safety in food supply chains.

- Outcomes: Consumers can track the origin of their food products, leading to reduced instances of foodborne illnesses and improved overall supply chain efficiency.

- Sector: Shipping and Logistics

- Application: Streamlining trade operations by minimizing paperwork and enhancing transparency.

- Outcomes: This collaboration has resulted in shorter shipping times, reduced costs, and increased trust among supply chain partners.

Provenance:

- Sector: Luxury Goods

- Application: Authenticating and verifying the provenance of high-end products.

- Outcomes: The use of blockchain helps combat counterfeiting, strengthens brand reputation, and boosts consumer confidence in luxury items.

Algorand’s Trade Finance Platform:

- Sector: Trade Finance

- Application: Simplifying trade finance transactions to reduce costs and improve operational efficiency.

- Outcomes: This platform facilitates faster, more secure transactions while minimizing paperwork and fostering trust among trading partners.

Walmart’s Blockchain Food Safety Initiative:

- Sector: Food and Beverage

- Application: Tracking food products from their source to the consumer to ensure safety and traceability.

- Outcomes: The initiative has led to a decrease in foodborne illnesses, enhanced supply chain efficiency, and strengthened consumer trust.

These examples illustrate how blockchain can significantly enhance transparency, efficiency, and security in supply chain finance, paving the way for future innovations in the industry.

Future Trends in Supply Chain Finance

The landscape of supply chain finance is rapidly evolving, influenced by technological advancements and changing market demands. Key trends include:

Blockchain Adoption

- Transparency: Provides clear tracking of products and transactions.

- Efficiency: Streamlines operations and reduces paperwork.

- Security: Enhances data protection and minimizes fraud.

Advancements in AI

-

- Predictive Analytics: Forecasts demand and optimizes inventory.

- Automation: Improves logistics efficiency and reduces labor costs.

- Operational Optimization: Identifies bottlenecks for smoother processes.

IoT Integration

-

- Real-time Insights: Offers live data on product status and location.

- Operational Efficiency: Enhances route planning and inventory management.

- Predictive Maintenance: Monitors equipment to prevent downtime.

Sustainability Focus

-

- Ethical Sourcing: Rising consumer demand for responsibly produced goods.

- Environmental Responsibility: Pressure to reduce ecological impact.

- Circular Economy: Emphasis on minimizing waste and reusing resources.

Digitalization and Automation

-

- Paperless Operations: Reduces paperwork and streamlines processes.

- Task Automation: Boosts productivity through automated functions.

Collaboration and Partnerships

-

- Network Building: Strategic alliances for resilient supply chains.

- Data Sharing: Improves decision-making and reduces costs.

These trends will make supply chain finance more data-driven, automated, and sustainable, positioning forward-thinking companies for success in a competitive landscape.

Conclusion

The integration of blockchain and artificial intelligence is set to transform supply chain finance by enhancing transparency, security, and efficiency. These technologies streamline operations, improve cash flow management, and foster stronger relationships among stakeholders.With real-time data insights and predictive analytics, businesses can make informed decisions and adapt to market changes while addressing risks effectively. The emphasis on sustainability and ethical practices meets growing consumer expectations for transparency.As trends like IoT integration and digitalization continue to rise, companies that leverage these innovations will gain a competitive edge and contribute to a more resilient and efficient supply chain. Embracing these advancements is essential for success in the evolving landscape of supply chain finance.

FAQs

What Problems Does Blockchain Solve in Supply Chain Management?

Blockchain enhances transparency by providing an immutable record of transactions, reduces fraud through secure data verification, improves traceability of products, boosts efficiency by eliminating intermediaries, and lowers costs through streamlined processes.

Will Blockchain Replace Banks?

Blockchain is unlikely to completely replace banks but will transform them by streamlining processes, enhancing security, and enabling new services like digital currencies and smart contracts, thus complementing traditional banking.

Does Amazon Use AI in Supply Chain?

Yes, Amazon utilizes AI for demand forecasting, warehouse automation, personalized recommendations, and logistics optimization, improving efficiency and customer experience.

What Are the Limitations of Blockchain in Supply Chain?

Limitations of blockchain include scalability issues, complex integration with existing systems, potential data privacy concerns, high energy consumption, and regulatory uncertainty surrounding its use.