Insurance claims processing is a critical aspect of the insurance industry, traditionally plagued by inefficiencies, manual errors, and delays. The advent of AI and Blockchain technologies is set to revolutionize this landscape by automating processes, enhancing data security, and improving customer experiences. This transformative approach reshapes how insurers handle claims, offering a glimpse into the future of a more efficient, transparent, and reliable system.

Today, AI and Blockchain are at the forefront of the insurtech revolution, addressing long-standing challenges in claims processing. Insurers are now leveraging the power of machine learning algorithms, predictive analytics, and smart contracts to streamline operations, reduce fraud, and boost customer satisfaction. Let’s dive deeper into how these technologies work in tandem to redefine insurance claims processing.

Understanding Automated Insurance Claims Processing

Automated insurance claims processing refers to using technology to handle claims without human intervention. This process relies on AI to analyze data, assess damages, and make decisions based on predefined criteria. Blockchain further enhances this process by providing a secure and transparent data sharing and verification platform.

What is Automated Insurance Claims Processing?

In traditional claims processing, insurers manually review claims, verify information, and determine payouts. This method is often slow, error-prone, and susceptible to fraud. Automated claims processing leverages AI to handle these tasks more efficiently. Using machine learning models and predictive analytics, AI can evaluate claims data, assess risks, and make payout decisions in real-time.

Key Components of Automation

Several key components drive the automation of insurance claims:

- Machine Learning Models: Used to analyze historical data and predict future outcomes.

- Natural Language Processing (NLP): Helps extract relevant information from unstructured data, such as customer emails or documents.

- Smart Contracts: Blockchain-based contracts that automatically execute actions when predefined conditions are met.

AI in Claims Processing: Transforming the Insurance Landscape

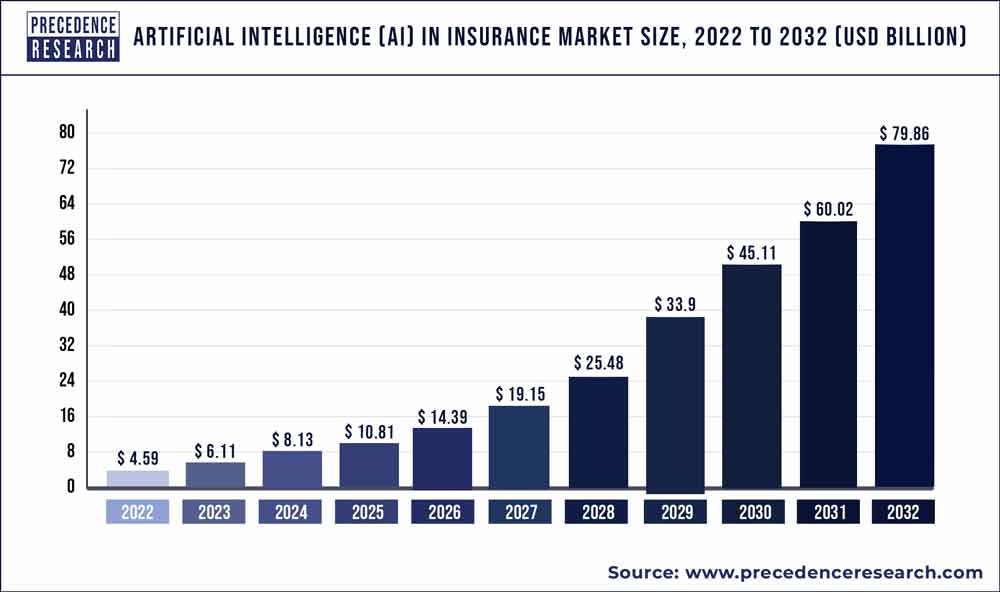

Artificial Intelligence (AI) is revolutionizing the insurance sector, especially in claims processing. By automating repetitive tasks, enhancing accuracy, and elevating customer experience, AI is redefining how insurers handle claims, driving efficiency and innovation in the industry. The global artificial intelligence (AI) in insurance market size was estimated at USD 4.59 billion in 2022 and it is expected to be worth around USD 79.86 billion by 2032, growing at a CAGR of 33.06% from 2023 to 2032.

Critical Roles of AI in Claims Processing

Automation of Routine Tasks

- Data Extraction: AI can swiftly extract information from diverse documents, such as medical records, accident reports, and images, minimizing manual input and reducing errors.

- Document Validation: AI algorithms can authenticate documents, ensuring legitimate claims and reducing the risk of fraudulent submissions.

- Initial Assessment: AI can evaluate the validity of claims using set criteria, flagging complex cases for human review.

Fraud Detection

- Anomaly Detection: AI identifies unusual patterns in claims data, signalling potential fraud and helping insurers take proactive measures.

- Social Media Insights: AI tools can analyze social media to detect inconsistencies in claims, aiding in fraud investigations by comparing reported incidents with publicly available information.

Enhanced Accuracy and Efficiency

- Error Reduction: AI minimizes mistakes in data handling, calculations, and decision-making processes, leading to more reliable claims outcomes.

- Accelerated Processing: By automating mundane tasks, AI drastically reduces processing times, boosting customer satisfaction with faster resolutions.

Improved Customer Experience

- 24/7 Availability: AI-powered chatbots offer round-the-clock support, answering customer queries promptly, even outside business hours.

- Personalization: AI analyzes customer data to provide tailored advice and support, creating a personalized and responsive claims experience.

Predictive Analytics

- Risk Forecasting: AI uses historical data to predict future claims trends, allowing insurers to manage risks better and adjust their strategies.

- Dynamic Pricing: AI optimizes pricing by assessing risks and claims data, ensuring fair and competitive rates for policyholders.

Blockchain: Revolutionizing the Insurance Industry

Blockchain technology, known for its decentralized, secure, and transparent framework, is set to disrupt the insurance sector by streamlining processes, reducing costs, and building trust among stakeholders. Insurers and regulators are increasingly exploring blockchain’s transformative potential to reshape traditional insurance practices.

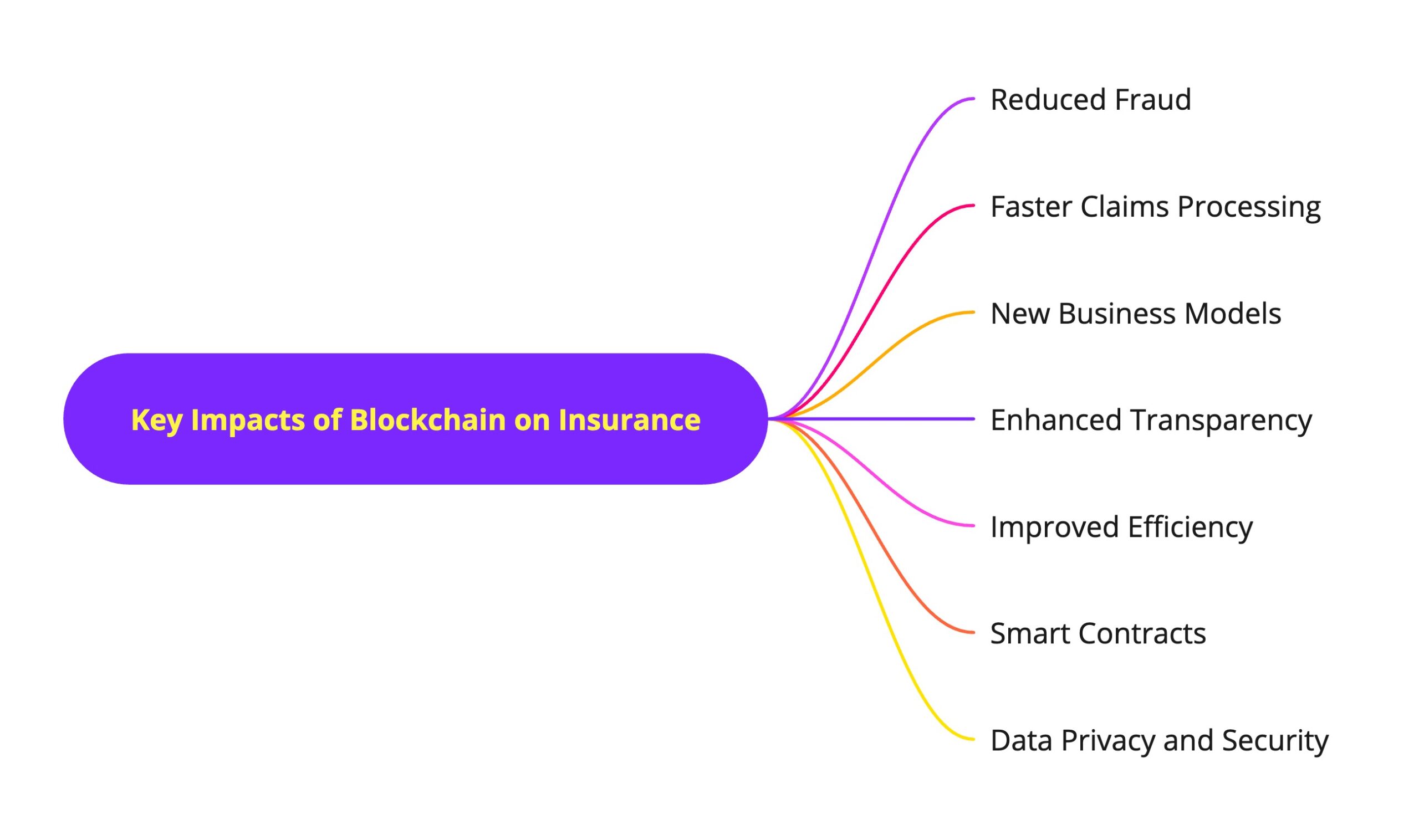

Key Impacts of Blockchain on Insurance

Enhanced Transparency and Trust

- Immutable Records: Blockchain’s immutable ledger ensures all transactions are permanently recorded and tamper-proof, fostering greater trust between insurers and policyholders.

- Full Traceability: Every transaction is traceable to its source, enhancing accountability and transparency throughout the insurance lifecycle.

Fraud Reduction and Lower Claims Costs

- Smart Contracts: These self-executing contracts automate claims processing, cutting administrative overhead and minimizing errors.

- Fraud Detection: Blockchain’s transparency makes it harder to manipulate data, aiding in the detection and prevention of fraudulent claims.

Advanced Risk Management

- Real-time Data Sharing: Blockchain enables seamless data sharing between insurers and stakeholders, enhancing risk assessment and underwriting processes.

- Smart Insurance Solutions: Integrating IoT devices with blockchain allows real-time monitoring of insured assets, offering precise risk assessments and personalized pricing.

Innovative Business Models

- Peer-to-Peer Insurance: Blockchain can power peer-to-peer insurance platforms, allowing individuals to insure one another, reducing costs and enhancing transparency directly.

- Microinsurance: Blockchain facilitates microinsurance, providing affordable and accessible coverage options for underserved markets, including low-income individuals and small businesses.

Greater Efficiency and Cost Reduction

- Process Automation: Blockchain automates many manual insurance processes, boosting efficiency and reducing operational costs.

- Lower Administrative Load: By cutting out intermediaries and simplifying workflows, blockchain reduces the administrative burdens faced by insurers.

Smart Contracts: Transforming Claims Management

Smart contracts, self-executing agreements with terms embedded directly in code, are set to transform the claims management landscape. It provides substantial benefits to insurers and policyholders by automating and optimising various claims processing tasks, enhancing efficiency, transparency, and cost-effectiveness.

Critical Advantages of Smart Contracts in Claims Management

Automation and Efficiency

- Streamlined Processes: Smart contracts automate numerous manual tasks in claims management, such as data collection, document validation, and initial evaluations, reducing the need for human intervention.

- Accelerated Turnaround: Smart contracts expedite the claims process by minimizing manual errors and removing bottlenecks, leading to quicker resolutions and increased customer satisfaction.

Transparency and Trust

- Immutable Ledger: Each claim transaction is recorded on the blockchain, creating a transparent and tamper-proof record that fosters accountability.

- Fraud Prevention: The transparency of smart contracts helps detect anomalies, reducing the occurrence of fraudulent claims.

Cost Reduction

- Lower Administrative Expenses: Automating claim processes significantly reduces administrative overhead, saving costs.

- Efficient Dispute Management: Smart contracts streamline dispute resolution, minimizing the need for costly legal proceedings.

Enhanced Customer Experience

- Prompt Claims Payouts: Smart contracts facilitate faster payments upon claim approval, enhancing customer satisfaction.

- Increased Visibility: Policyholders can track their claims in real-time, fostering trust through greater transparency.

Use Cases of Smart Contracts in Claims Management

- Automated Claim Submission: Policyholders can initiate claims through blockchain platforms, simplifying and accelerating the filing process.

- Instant Claim Evaluation: Smart contracts can automatically validate claims against pre-set rules, escalating complex cases to human assessors when necessary.

- Automated Payouts: Upon approval, smart contracts can trigger immediate payouts to policyholders, reducing waiting times.

- Efficient Dispute Resolution: Integrated arbitration mechanisms within smart contracts facilitate quick and cost-effective resolution of disputes.

- Automated Subrogation: Smart contracts streamline the subrogation process, enabling insurers to recover funds from responsible third parties efficiently.

Real-World Applications and Case Studies: AI and Blockchain in Insurance

AI and blockchain technologies are reshaping the insurance landscape, driving efficiency, transparency, and improved customer experiences. Here are some notable examples of how leading insurance companies harness these innovations.

Zurich Insurance Group

- Automated Claims Processing: Zurich leverages AI-driven solutions to automate critical steps in claims handling, such as document analysis, fraud detection, and preliminary assessments. This integration has led to faster claim resolutions and operational efficiency.

- Customer Impact: By streamlining the claims process, Zurich has enhanced customer satisfaction through quicker and more accurate settlements, fostering trust and loyalty.

Lemonade

- AI-Driven Chatbot: Lemonade’s AI-powered chatbot, “AI Jim,” handles customer queries and claims with impressive speed, offering instant payouts for straightforward claims. This automation significantly boosts the user experience by minimizing waiting times.

- Blockchain Integration: Utilizing blockchain, Lemonade maintains an immutable record of claims, enhancing transparency and reducing the risk of fraud, thereby ensuring a fairer claims process.

Allianz

- AI-Powered Fraud Detection: Allianz has deployed advanced AI models to identify fraudulent claims by analyzing data patterns and anomalies, significantly reducing the incidence of fraud and enhancing underwriting accuracy.

- Customer Impact: With fewer fraudulent claims, Allianz can offer more competitive premiums, enhancing value for honest policyholders and boosting overall customer satisfaction.

Future Trends in AI and Blockchain for Insurance

The convergence of AI and blockchain is set to transform the insurance industry by enhancing efficiency, transparency, and customer experience. AI will revolutionize underwriting and risk assessment by analyzing vast data for accurate profiles and predictive pricing. At the same time, blockchain will streamline claims processing with transparent records and smart contracts, reducing fraud and costs. Peer-to-peer insurance models will offer direct and cost-effective coverage. AI-driven fraud detection and IoT integration will enable real-time monitoring, personalized pricing, and preventive measures. Despite challenges in data privacy, regulatory compliance, and technological integration, these innovations promise significant benefits for insurers, driving efficiency and competitiveness.

Conclusion

AI and blockchain technologies are transforming the insurance industry by streamlining claims processing and enhancing efficiency. Automating tasks and improving fraud detection address long-standing inefficiencies, while smart contracts enable faster settlements and build trust between insurers and policyholders.Companies like Zurich, Lemonade, and Allianz showcase the benefits of these innovations, enhancing customer satisfaction and reducing costs. As AI advances risk assessment and blockchain improves transparency, insurers can navigate challenges like data privacy and regulatory compliance. Embracing these technologies positions insurers for a competitive future focused on efficiency and customer-centric solutions.

FAQs

How does blockchain technology help reduce the time for claim settlement?

Blockchain technology accelerates claim settlement by automating processes through smart contracts, enabling real-time data access, and eliminating manual paperwork. This leads to faster verification, reduced processing time, and quicker payouts to policyholders.

How can blockchain be used to reduce the settlement cycle?

Blockchain can shorten the settlement cycle by providing a transparent and immutable ledger for all transactions, enabling instant access to relevant data. Smart contracts can automatically execute payment conditions once claims are validated, significantly reducing the time needed for traditional settlement processes.

How does blockchain improve settlement processes in financial transactions?

In financial transactions, blockchain enhances settlement processes by enabling peer-to-peer transactions without intermediaries, reducing settlement times from days to minutes. Its decentralized nature ensures transparency and security, while immutable records prevent fraud and errors, further streamlining the process.

What is settlement blockchain?

Settlement blockchain refers to a blockchain system designed to facilitate the finalization of financial transactions, ensuring that all parties involved can agree on the transaction’s completion. It provides a secure, real-time ledger for recording transactions, significantly improving the efficiency and reliability of settlement processes in various financial markets.