Blockchain, with its decentralized and immutable ledger, ensures secure and transparent transaction recording, eliminating the need for intermediaries. Meanwhile, AI enhances decision-making by providing sophisticated risk assessments and personalized lending experiences. Together, these technologies are not only improving the efficiency of traditional lending systems but also democratizing access to credit for underserved populations.

This article explores how blockchain and AI are revolutionizing peer-to-peer (P2P) lending, addressing the shortcomings of conventional lending methods, and paving the way for a more inclusive financial future.

Blockchain and AI: Revolutionizing the Future of Lending

Blockchain is a decentralized and immutable ledger technology designed to securely record transactions across a network of computers. Its decentralized nature removes the need for intermediaries, making it a “trustless” system. Rather than relying on a central authority, blockchain uses consensus mechanisms to validate transactions, ensuring data integrity and transparency.

Artificial Intelligence (AI) refers to the development of machines capable of performing tasks that typically require human intelligence, such as learning, reasoning, and problem-solving. AI can be broadly categorized into:

- Narrow AI: Specialized systems designed to perform specific tasks like image recognition or predictive analytics.

- General AI: Hypothetical systems that possess human-level intelligence and the ability to perform any intellectual task across various domains.

Evolution of Peer-to-Peer (P2P) Lending

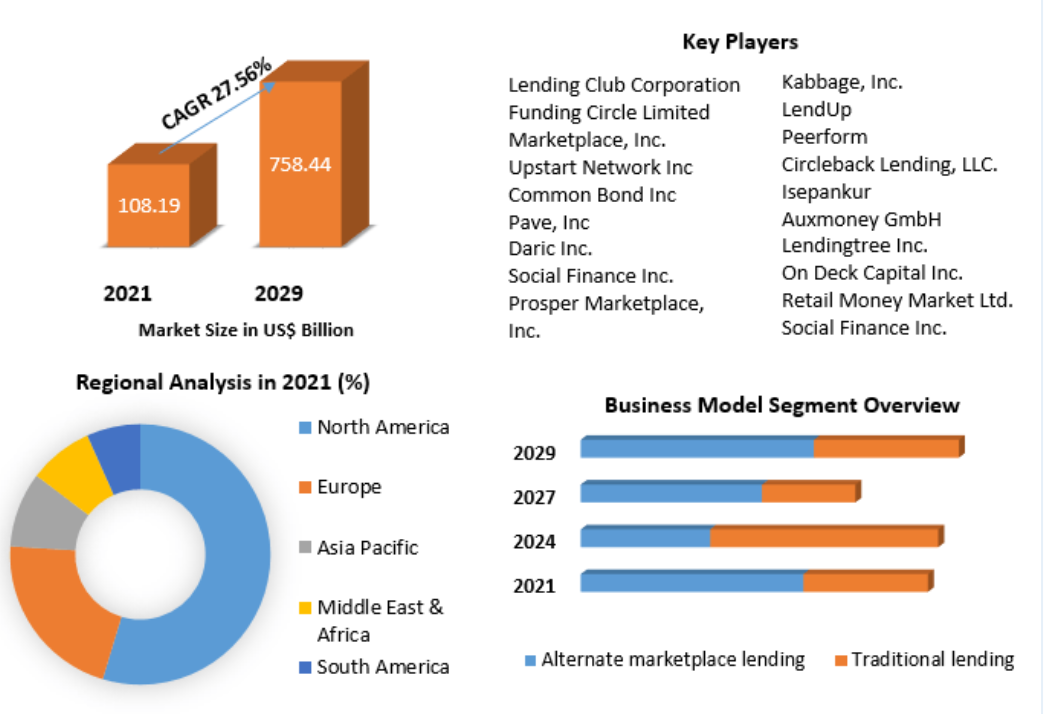

P2P lending has emerged as an innovative form of crowdfunding where individuals can lend directly to borrowers, bypassing traditional financial institutions. Global Peer to Peer Lending Market size was valued at USD 147.05 billion in 2022 and is poised to grow from USD 190.43 billion in 2023 to USD 1506.24 billion by 2031, growing at a CAGR of 29.5 % during the forecast period (2024-2031). This lending model has evolved rapidly due to the integration of cutting-edge technologies such as:

- Digital platforms: These platforms serve as online marketplaces connecting borrowers and lenders, simplifying the loan origination and repayment process.

- Blockchain technology: By ensuring transparency, security, and lower transaction fees, blockchain enhances trust and reduces overhead in P2P lending.

- AI integration: AI is applied to assess borrowers’ creditworthiness, detect fraudulent activities, and predict loan risks, making lending decisions more accurate and efficient.

Shortcomings of Traditional Lending Systems

Traditional lending institutions face several key inefficiencies:

- High interest rates: Exorbitant rates are often charged, particularly for those with low credit scores.

- Slow approval processes: Bureaucratic procedures lead to delays in loan approvals.

- Limited access: Stringent eligibility criteria hinder access for individuals and small businesses, especially in underserved areas.

- Centralized risk: Dependence on central authorities creates vulnerabilities and potential points of failure in the system.

How Peer-to-Peer Lending Works

Peer-to-peer (P2P) lending is a method that allows individuals or businesses to lend and borrow money directly, often bypassing traditional financial intermediaries. Here’s a streamlined overview of the process:

- Account Creation: Both lenders and borrowers sign up on a P2P lending platform.

- Loan Application: Borrowers submit loan requests, detailing the amount, purpose, and proposed repayment schedule.

- Credit Evaluation: The platform uses advanced algorithms to assess the borrower’s credit profile, considering factors like credit history, income, and debt ratio.

- Loan Listing: Approved loans are listed on the platform with an assigned risk level.

- Lender Investment: Lenders review loan listings and invest in those that fit their risk preferences and financial objectives.

- Disbursement: Once the loan is fully funded, the platform disburses the funds to the borrower.

- Repayment: Borrowers make regular repayments, which the platform distributes to the participating lenders.

Types of P2P Lending Models

P2P lending platforms typically use one of two models:

- Auction-Based: Lenders compete by offering interest rates, with the borrower securing the loan from the lender offering the lowest rate.

- Fixed-Rate: Loans are listed with set interest rates, and lenders choose whether to invest based on the terms offered.

The Role of Blockchain in Peer-to-Peer Lending

Blockchain technology has transformed the peer-to-peer (P2P) lending landscape, offering several key benefits that enhance the overall experience for both borrowers and lenders.

Decentralization and Enhanced Transparency

- Removal of Middlemen: Blockchain-based P2P lending platforms eliminate the need for traditional intermediaries like banks, reducing costs and risks associated with centralized control.

- Greater Transparency: Transactions are securely recorded on a decentralized, public ledger, ensuring all parties have access to accurate and verifiable information, fostering accountability and trust.

Smart Contracts: Streamlining the Lending Process

- Automation through Code: Smart contracts are programmable agreements that automatically execute loan terms, such as disbursing funds, calculating interest, and managing repayment schedules. This reduces the need for human oversight.

- Improved Efficiency: By automating various steps in the lending process, smart contracts minimize delays and administrative errors, making the entire system faster and more reliable.

Immutable Records for Trust and Security

- Permanent and Tamper-Proof Records: Blockchain ensures that once a transaction is recorded, it cannot be altered, providing a secure and unchangeable audit trail for every loan and repayment.

- Minimized Fraud Risks: The unchangeable nature of blockchain data significantly reduces the likelihood of fraudulent behavior, enhancing security for both lenders and borrowers.

AI-Driven Innovations in Peer-to-Peer Lending

Artificial Intelligence (AI) has reshaped the peer-to-peer (P2P) lending industry by introducing cutting-edge solutions that enhance efficiency, optimize risk management, and improve user experiences. Below are some key AI-powered applications:

AI for Enhanced Risk Assessment

- Sophisticated credit scoring: AI can evaluate vast datasets, including unconventional data sources such as online behavior and social media activity, to deliver more comprehensive and precise credit assessments.

- Real-time risk monitoring: AI models continuously track borrower behaviors and evolving market trends, allowing for dynamic adjustments to risk profiles based on real-time data.

Advanced Fraud Detection and Mitigation

- Pattern recognition: AI excels at detecting anomalies, spotting unusual behaviors like sudden transaction spikes or suspicious geographic activity that may signal fraud.

- Continuous surveillance: AI-driven systems offer round-the-clock monitoring of transactions, instantly flagging high-risk activities to enable timely responses to potential threats.

Streamlining Loan Approval with AI

- Automated approvals: AI algorithms streamline the loan approval process by analyzing applications in real-time, drastically reducing approval times and eliminating human error.

- Tailored loan offers: AI leverages borrower data to generate personalized loan offers with customized terms and interest rates, enhancing both satisfaction and loan suitability.

Smart Contracts in Blockchain-Powered AI Lending Systems

Smart contracts, coded directly into the blockchain, automate key processes in blockchain-powered AI lending systems. They provide efficiency, transparency, and trust by removing manual oversight and automating various aspects of the lending process.

Automated Loan Origination and Disbursement

Smart contracts instantly verify borrower credentials and disburse loans when conditions are met. This automation eliminates the need for intermediaries, speeding up the loan process while ensuring transparency since all terms are embedded in the contract.

Automated Repayment Schedules

Repayment schedules are automatically enforced by smart contracts. They calculate payments accurately and ensure they are made on time. Contracts can handle flexible terms, including early repayment options, making them adaptable to borrower needs.

Collateral Management

Collateral is securely held in the smart contract until the loan is repaid. In case of default, the contract automatically triggers liquidation, protecting lenders. This automated process provides security and reduces risk for both parties.

Dispute Resolution

Smart contracts can include built-in mechanisms for resolving disputes, like arbitration clauses. Since all actions are recorded on the blockchain, the resolution process is transparent, reducing the likelihood of disagreements.

Risk Assessment and Pricing

AI integrated into smart contracts assesses borrower risk and sets fair interest rates automatically. The pricing is transparent, and both parties can see how the risk level was determined, ensuring fairness in the lending process.

Improving Access to Finance Through Blockchain-Powered AI Systems

Blockchain and AI are reshaping global financial systems by improving access to credit and services for underbanked populations. Together, these technologies create more inclusive, transparent, and efficient financial ecosystems.

Financial Inclusion for the Unbanked and Underbanked

Blockchain-powered identity systems, combined with AI-driven credit scoring, make financial services more accessible to the unbanked and underbanked. These individuals, who often lack formal credit histories or government-issued identification, can now establish verifiable identities and access loans.

- Empowering the underserved: AI and blockchain reduce the barriers for those traditionally excluded from the financial system.

- Simplified onboarding: Blockchain-based ID verification simplifies the process of accessing services for populations without formal documentation.

- Expanding opportunities: Individuals in developing regions can access savings accounts, loans, and investments, improving financial stability.

Global Access to Peer-to-Peer Lending Markets

Blockchain facilitates peer-to-peer (P2P) lending across borders by creating a secure, decentralized platform for global transactions. This increases the pool of lenders and borrowers, reducing reliance on local financial institutions and promoting cross-border investments.

- Borderless transactions: Blockchain allows individuals to lend or borrow globally, overcoming geographical restrictions.

- Reduced dependency on banks: P2P lending platforms powered by blockchain give users direct access to funding without intermediaries.

- Wider market reach: Borrowers and lenders from different countries can connect easily, fostering global economic growth.

Cross-Border Lending and Reduced Barriers

Blockchain simplifies cross-border lending by automating and securing transactions. Its transparent and decentralized nature reduces the costs typically associated with international transfers, such as currency exchange fees and third-party transaction costs.

- Cost reduction: Blockchain minimizes cross-border transaction fees, making loans more affordable for borrowers and more profitable for lenders.

- Faster transactions: Automated smart contracts streamline cross-border loan agreements, enabling quicker fund transfers.

- Enhanced security: Blockchain ensures the transparency of cross-border transactions, protecting both parties from fraud and miscommunication.

Case Studies of Blockchain-Integrated AI Lending Platforms

Leading Platforms Combining Blockchain and AI

- SALT: This innovative platform allows users to secure loans using their cryptocurrency assets as collateral. SALT employs AI algorithms to evaluate the value of these digital assets and determine loan eligibility effectively.

- Cred: Operating in India, Cred is a P2P lending platform that utilizes blockchain for secure and transparent transactions. AI plays a vital role in assessing borrowers’ creditworthiness and pairing them with appropriate lenders.

- Aave: A decentralized lending protocol built on the Ethereum blockchain, Aave leverages AI-driven risk assessment models to set interest rates and define loan terms, enhancing decision-making efficiency.

Insights from Early Implementers

- Data quality matters: The effectiveness of AI models is heavily dependent on the quality of the training data, making data integrity a top priority.

- Regulatory adherence is critical: Blockchain-based P2P lending platforms must navigate and comply with relevant legal frameworks to operate successfully.

- User experience is paramount: A seamless, intuitive interface and clear processes are essential for attracting and retaining both borrowers and lenders.

- Scalability poses challenges: As these platforms grow, they need to address scalability issues to maintain efficient operations and prevent bottlenecks.

By taking these lessons into account, future blockchain-integrated AI lending platforms can build on the successes of early adopters to develop innovative and effective financial solutions.

Conclusion

The integration of blockchain and AI in the lending sector is ushering in a new era of financial services that prioritize transparency, security, and accessibility. By addressing the inefficiencies of traditional lending models, such as high interest rates and slow approval processes, these technologies create a more efficient and user-friendly experience for borrowers and lenders alike. Furthermore, they empower underbanked populations by simplifying access to financial services and fostering global participation in P2P lending markets. As the industry continues to evolve, the lessons learned from early adopters will be crucial in shaping the future of blockchain-integrated AI lending platforms, ultimately contributing to a more equitable and resilient financial ecosystem.

FAQS

What is an AI Lending Platform?

An AI lending platform is an online service that uses artificial intelligence to facilitate borrowing and lending. It assesses borrower creditworthiness and risks using advanced algorithms, allowing for quicker approvals and personalized loan offers, benefiting both lenders and borrowers.

What is Blockchain for Social Lending?

Blockchain for social lending involves using blockchain technology to create decentralized platforms that enable peer-to-peer lending. This approach enhances transparency and security while promoting financial inclusion for underserved communities, allowing easier access to credit at lower costs.

What is an Example of AI in Banking?

A key example of AI in banking is the use of chatbots for customer service. These AI-driven tools handle inquiries and provide account assistance in real time, improving customer satisfaction while reducing operational costs. AI is also employed in fraud detection systems to identify unusual transaction patterns, enhancing security.