Artificial Intelligence (AI) bots represent a transformative force across various sectors, particularly in the realm of Decentralized Finance (DeFi). These sophisticated software applications are engineered to operate autonomously, employing advanced technologies such as machine learning and natural language processing. By analyzing complex datasets and interacting with users, AI bots are revolutionizing how financial services are delivered, providing enhanced efficiency, security, and decision-making capabilities. As the DeFi landscape continues to evolve, the integration of AI bots is becoming increasingly essential for optimizing financial transactions and ensuring user engagement.

What Are AI Bots?

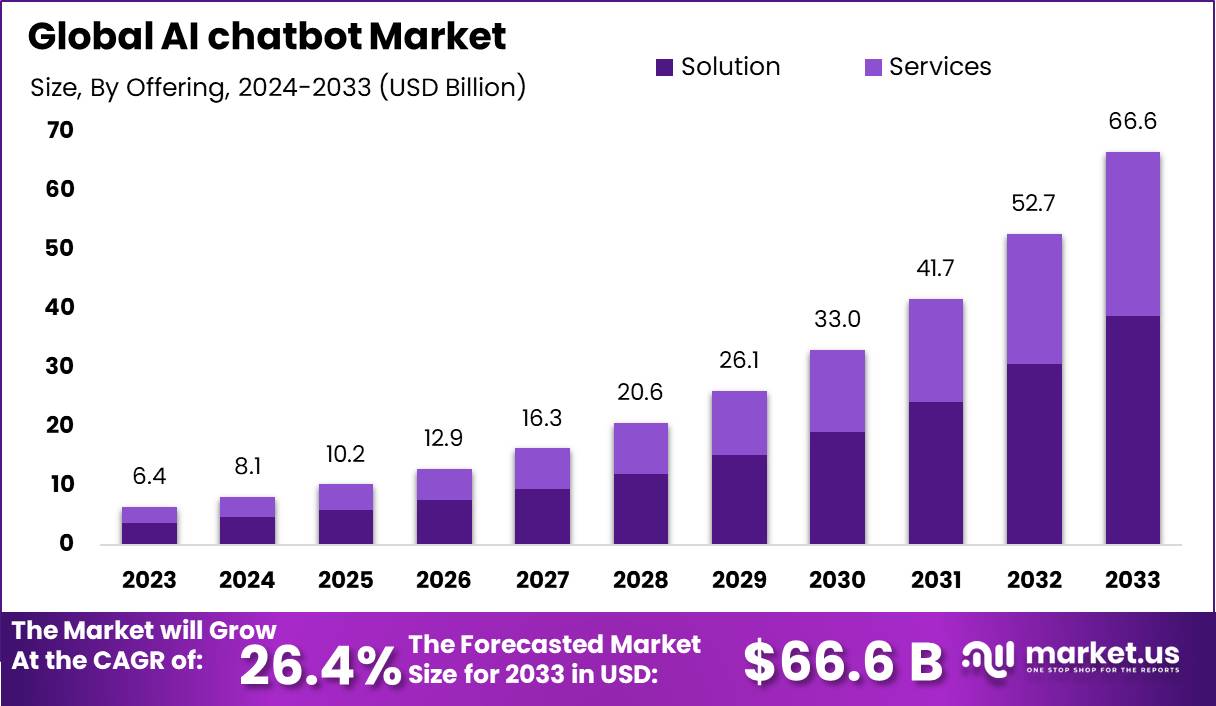

AI bots, or artificial intelligence bots, are sophisticated software applications designed to perform tasks autonomously. Utilizing technologies like machine learning and natural language processing, they can interact with users, analyze complex datasets, and make informed decisions. The Global AI chatbot Market size is expected to be worth around USD 66.6 Billion By 2033, from USD 6.4 Billion in 2023, growing at a CAGR of 26.4% during the forecast period from 2024 to 2033.

The Role of AI in Decentralized Finance

Decentralized Finance (DeFi) is an emerging sector that leverages blockchain technology to provide financial services without the need for intermediaries. AI bots are integral to this ecosystem, enhancing its functionality in several ways:

- Automation of Processes: AI bots streamline operations like trading, lending, and borrowing, making DeFi more user-friendly and efficient.

- Enhanced Decision-Making: By analyzing vast amounts of data, AI bots can identify trends and provide insights that drive informed decisions.

- Security Improvements: AI bots contribute to the security of DeFi platforms by detecting and preventing fraudulent activities.

Transforming DeFi with AI Bots

AI bots are reshaping the DeFi landscape through:

- Efficient Trading: These bots can execute trades at optimal prices and frequencies, maximizing user profits.

- Yield Optimization: AI bots help users discover the most profitable yield farming opportunities, enhancing their returns.

- Risk Management: By assessing market conditions, AI bots protect users’ assets from fluctuations and unexpected downturns.

Furthermore, AI bots keep users informed about the latest developments in the DeFi space and assist in identifying the best interest rates for loans and deposits.

Why DeFi Requires AI Bots

The complexities of DeFi can overwhelm new users. Here’s how AI bots address various challenges:

- Simplifying Complexity: AI bots provide user-friendly interfaces and automate complicated processes, making DeFi more accessible.

- Managing Volatility: The highly volatile nature of cryptocurrency markets necessitates AI bots that can quickly analyze data and identify risks.

- Enhancing Security: With DeFi’s vulnerabilities, AI bots monitor for unusual activities and enhance platform security.

- Increasing Efficiency: Automation allows for cost reductions and improved processing speed as DeFi scales.

Types of AI Bots in DeFi

AI bots play diverse roles within DeFi, including:

Trading Bots

-

- Market-Making Bots: Provide liquidity on decentralized exchanges (DEXs) by maintaining balanced order books.

- Arbitrage Bots: Exploit price differences across various DEXs for profit.

- Trend-Following Bots: Utilize historical price data to make informed trading decisions.

Yield Optimization Bots

-

- Yield Farming Bots: Automatically navigate different protocols to secure the highest yields.

- Liquidity Pool Optimization Bots: Analyze fees and token prices to enhance liquidity positions.

Risk Management Bots

-

- Liquidation Prevention Bots: Monitor positions to avert liquidations in volatile markets.

- Hedging Bots: Use derivatives to protect against portfolio losses.

Security Bots

-

- Anomaly Detection Bots: Monitor for suspicious activities that could indicate potential threats.

- Fraud Prevention Bots: Employ machine learning to detect and flag fraudulent transactions.

Additional Types

-

- Information Bots: Provide real-time market insights and updates.

- Customer Support Bots: Assist users with common inquiries and troubleshooting.

Key Components of AI Bots in DeFi

For effective operation, AI bots rely on several critical components:

Data Collection and Analysis

-

- Real-Time Data Feeds: Continuous access to market data, including prices and trading volumes, is essential for accurate decision-making.

- Oracles: Connect blockchain networks to real-world data, enabling bots to access vital external information.

Machine Learning Models

-

- Predictive Analytics: Leverage historical data to forecast trends and optimize strategies.

- Reinforcement Learning: Allow bots to learn from interactions and improve their performance over time.

Smart Contracts

-

- Automated Transactions: Smart contracts facilitate automated execution of various DeFi functions, with AI bots initiating transactions based on defined conditions.

Popular DeFi Platforms for AI Bot Integration

Several leading DeFi platforms are ideal for AI bot integration:

-

- Features: A decentralized exchange utilizing an automated market maker (AMM) model.

- Opportunities: Arbitrage, market-making, and yield farming bots.

-

- Features: A lending and borrowing protocol offering various interest rates and flash loans.

- Opportunities: Yield optimization, risk management, and liquidation prevention bots.

-

- Features: A lending protocol that allows users to earn interest on crypto assets.

- Opportunities: Similar to Aave, with added possibilities for governance bots.

Real-World Applications and Case Studies

AI-Powered Arbitrage Bots on Uniswap

-

- Description: Exploit price differences between Uniswap and other DEXs.

- Example: A bot may detect a token trading higher on one exchange and profit by buying low and selling high.

- Impact: Enhances liquidity and price stability across platforms.

Yield Optimization Bots in Compound

-

- Description: Automatically shift assets between lending pools to maximize interest.

- Example: A bot identifies a higher yield on a different protocol and reallocates assets accordingly.

- Impact: Increases user returns while minimizing risks.

Lessons from Successful AI Bots in DeFi

- Data Quality Matters: Access to high-quality, real-time data is crucial for effective decision-making.

- Machine Learning Power: Advanced algorithms can detect patterns that human analysts might overlook.

- Security Focus: Building AI bots with robust security features is essential to prevent exploits.

- Automation Value: AI bots can free users from mundane tasks, allowing them to concentrate on strategy and growth.

- Innovation Potential: AI bots drive new products and services within DeFi, fostering ongoing innovation.

Future Predictions for AI Bots in DeFi

- More Advanced Algorithms: Future bots will likely integrate sophisticated machine learning techniques like deep learning to enhance performance.

- Decentralized Oracles: Increased reliance on decentralized oracles for reliable off-chain data.

- Specialized Bots: Growth in bots tailored to specific niches within DeFi, such as derivatives or insurance.

- Ethical Considerations: As AI technology matures, addressing concerns around bias, privacy, and transparency will be critical.

Conclusion

AI bots are poised to play a pivotal role in the ongoing evolution of Decentralized Finance. By automating processes, enhancing decision-making, and ensuring security, these intelligent systems are not just improving efficiency—they are redefining the financial landscape. As the technology behind AI continues to advance, the potential for even more innovative and specialized AI bots will undoubtedly shape the future of DeFi, making it more accessible and effective for users around the globe.

FAQS

What are Automated Market Makers (AMMs) for DeFi?

AMMs are decentralized protocols that enable trading without order books, using smart contracts to create liquidity pools. Prices are determined algorithmically based on supply and demand, allowing users to trade directly from their wallets.

How to Build a DeFi Arbitrage Bot?

- Choose Language: Use Python or JavaScript.

- Select Protocols: Identify DeFi platforms for price monitoring.

- Monitor Prices: Write scripts to track price discrepancies.

- Implement Logic: Set conditions for executing trades.

- Execute Transactions: Use smart contracts for automated trades.

- Test Thoroughly: Backtest before deploying with real assets.

What is a DeFi Money-Making Bot?

A DeFi money-making bot automates strategies like arbitrage and yield farming to generate profits in decentralized finance, optimizing trades and managing assets efficiently.

How to Create a Crypto Bot?

- Define Strategy: Decide on your trading approach.

- Select Platform: Choose a crypto exchange with API access.

- Programming Language: Use Python or JavaScript.

- Set Up API: Create secure API keys on the exchange.

- Develop Bot: Code your trading strategy and risk management.

- Test Bot: Simulate trading to assess performance.

- Deploy: Launch and monitor the bot in the live market.

Developing AI Bots for Decentralized Finance (DeFi) Platforms with Codearies

At Codearies, we are at the forefront of innovation, developing AI bots tailored specifically for Decentralized Finance (DeFi) platforms. Our cutting-edge AI solutions enhance trading strategies, optimize liquidity management, and automate risk assessment processes, ensuring users can navigate the complex DeFi landscape with confidence. By leveraging advanced machine learning algorithms, we empower our clients to make data-driven decisions in real-time, maximizing their investment potential while minimizing risks. With our AI bots, businesses can not only streamline their operations but also stay ahead in the rapidly evolving world of DeFi.