In recent years, the financial scenario for retirees has transformed with the integration of artificial intelligence (AI) in financial planning. AI-powered financial planning apps are now reshaping how retirees approach their financial well-being by simplifying budgeting, investment management, and expense tracking. This technology addresses unique retirement challenges—such as fixed incomes and rising healthcare costs—by offering tools that are both accessible and incredibly insightful. For retirees, AI-driven financial planning apps provide peace of mind, supporting a secure, comfortable, and well-planned retirement.

The Rise of AI in Financial Planning

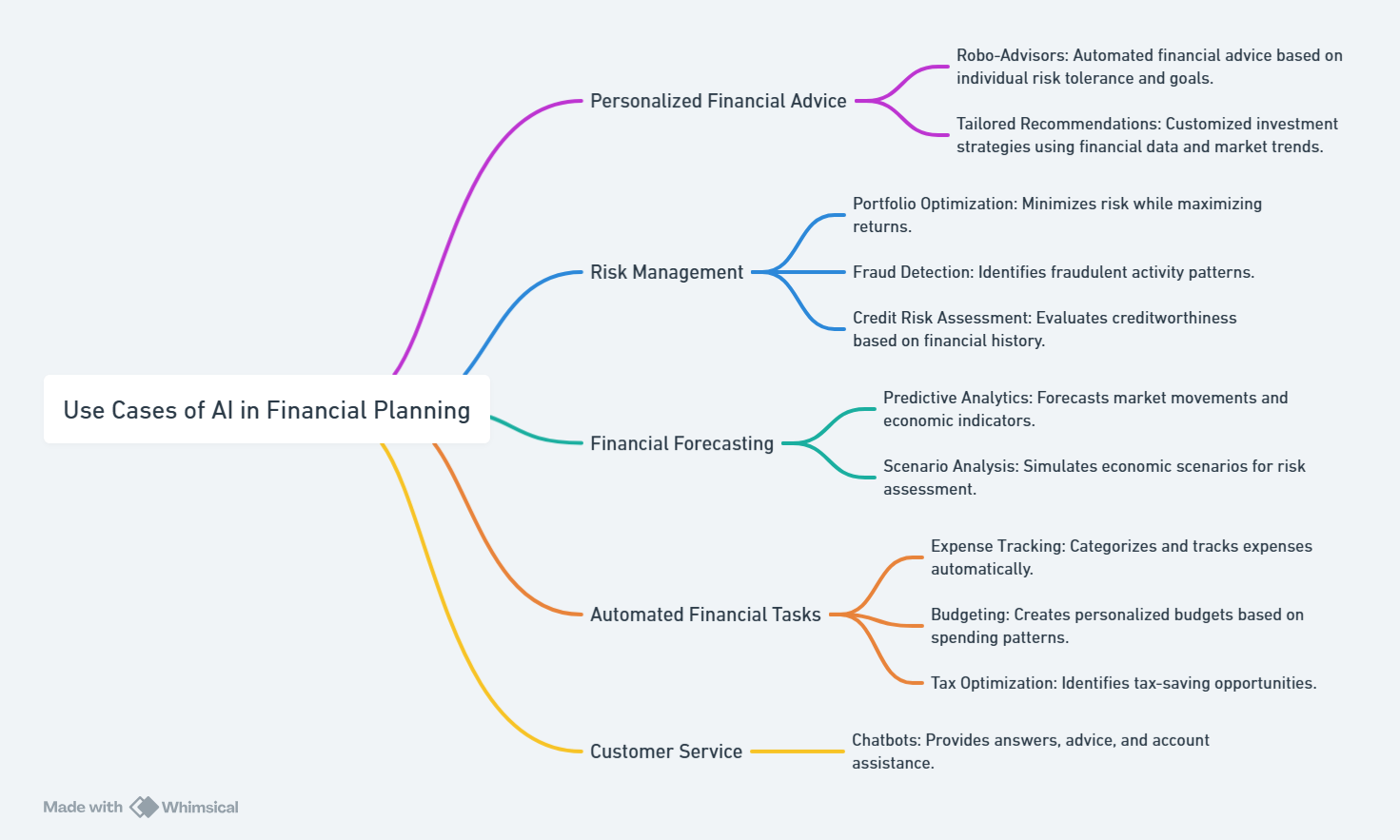

The application of AI in financial services has seen exponential growth, bringing sophisticated algorithms and automation into retirement planning. AI’s ability to quickly analyze large datasets and extract useful insights offers retirees a chance to make data-driven financial decisions. Gone are the days of manual tracking and reliance solely on financial advisors; today’s AI-driven tools provide real-time solutions. The AI in Financial Planning and Wealth Management Market Size is valued at USD 17.53 billion in 2023 and is predicted to reach USD 73.34 billion by the year 2031 at a 20.2% CAGR during the forecast period for 2024-2031. This rapid advancement in technology empowers retirees to navigate the complexities of their finances more easily and accurately.

Why Retirees Need AI-Powered Financial Planning

Managing finances after retirement can be challenging due to limited income streams, increased healthcare costs, and the need for budgeting precision. AI-powered financial planning apps simplify this complexity by delivering insights and tools that are uniquely suited to the financial realities of retirement. Whether it’s maximizing income from savings, maintaining a budget, or preparing for medical costs, these apps empower retirees to manage their money more efficiently.

Top Features to Look for in AI-Powered Financial Apps

When selecting a financial planning app, retirees should prioritize features that cater to their specific needs, such as:

- Personalized Budgeting: AI-driven budgeting tools help users create realistic, adaptable budgets that reflect their spending patterns.

- Investment Insights and Tracking: With real-time investment analysis, these apps provide tailored advice, helping retirees optimize portfolios for sustainable returns.

- Healthcare Planning: Some AI apps project healthcare costs, offering insights into future expenses to support financial readiness.

- Fraud Protection: Built-in AI security features can detect suspicious activity, offering additional protection against potential scams.

How AI Enhances Financial Security for Retirees

Artificial intelligence (AI) is transforming retirement planning, providing retirees with innovative ways to achieve financial security and peace of mind. Here’s how AI is enhancing financial resilience for today’s retirees:

- Tailored Financial Roadmaps: AI-driven planning tools take into account your unique financial profile, goals, and risk tolerance, generating a custom retirement plan that adapts as life changes. This ensures ongoing alignment between your retirement goals and your financial strategy, helping to provide a solid financial foundation.

- Dynamic Investment Management: AI-powered robo-advisors continuously monitor the markets, automatically rebalancing and optimizing your portfolio. By assessing risks and seeking growth opportunities in real time, they aim to protect and enhance your wealth over the years.

- Proactive Fraud Protection: Advanced AI algorithms scan for irregularities in real-time, flagging unusual activities to safeguard your assets from potential fraud or identity theft. This immediate alert system is crucial for keeping your savings secure.

- Healthcare Expense Optimization: AI tools identify affordable healthcare plans and help manage medical costs, essential for retirees with higher expenses.

- Social Security Strategy: AI analyzes your finances to determine the best time to claim Social Security benefits, boosting long-term income.

- Long-Term Care Planning Assistance: AI assesses care needs, estimates costs, and suggests funding strategies to prepare for future expenses.

- Comprehensive Estate Planning: AI estate planning tools help create tax-efficient plans to ensure your assets are distributed as desired.

- Financial Guidance Chatbots: AI-powered assistants offer tailored financial advice, guiding retirement decisions and providing real-time support for financial well-being.

How AI-Powered Apps Enhance Retirement Income Calculations

AI-powered retirement income planning apps are transforming the way people approach their financial future by providing smart, data-driven insights tailored to individual needs. These apps go beyond basic calculations, integrating real-time data, historical trends, and complex algorithms to deliver sustainable income plans, informed withdrawal strategies, and tailored annuity options. Here’s how these tools elevate retirement planning:

Sustainable Income Forecasting

- User Data Collection: Users enter key information such as savings balances, expected retirement income sources (e.g., pensions, Social Security), and anticipated expenses.

- Scenario Analysis: AI models various potential scenarios, factoring in inflation, market volatility, and life expectancy to provide a realistic income outlook.

- Risk Profiling: By assessing the user’s risk tolerance, the app adjusts income forecasts to match their comfort with market fluctuations.

- Projected Sustainable Withdrawals: AI projects an optimal annual withdrawal that balances income needs without exhausting the retirement fund prematurely.

Crafting Optimal Withdrawal Strategies

- Data-Driven Insights: The app examines decades of market data, allowing it to pinpoint withdrawal rates that historically maximize portfolio longevity.

- Personalized Recommendations: AI customizes withdrawal suggestions based on individual portfolios and risk tolerance.

- Stress Testing: Through sensitivity analysis, AI evaluates how different economic shifts might impact the sustainability of specific withdrawal rates, providing users with contingency options.

Evaluating Annuity Options with Precision

- Annuity Suitability Check: The app reviews the user’s retirement needs, and risk profile to determine if an annuity is suitable.

- Product Comparison: AI compares annuity products based on guaranteed income, growth potential, and fees.

- Strategic Optimization: AI identifies cost-effective options to maximize income, ensuring the selected annuity aligns with the user’s financial strategy.

Leading Types of AI-Powered Retirement Planning Apps

- Robo-Advisors: These platforms use AI to manage investment portfolios based on users’ goals and risk tolerance.

- Financial Planning Software: AI-powered platforms analyze data, project future needs, and offer strategic retirement recommendations.

- Advanced Retirement Calculators: These tools use AI to assess savings goals, predict benefits, and estimate retirement income precisely.

Future of AI in Retirement Planning

AI will transform retirement planning, enhancing financial security with hyper-personalized plans that adapt to individuals’ changing needs. Through predictive analytics, AI will simulate future scenarios, such as market shifts and healthcare expenses. This will allow retirees to make proactive, informed choices. Virtual advisors will offer real-time, ethical guidance. Unified platforms will bring financial tools together, automating tasks like account balancing and tax filing. However, ensuring data privacy, avoiding algorithmic biases, and maintaining human oversight will remain crucial. By blending AI’s capabilities with human expertise, we can create a more secure and fulfilling retirement future.

Conclusion

AI-powered financial planning apps have proven essential for retirees, providing tools that simplify budgeting, secure investments, and protect finances. As these technologies continue to evolve, retirees can look forward to even greater support, ensuring their financial well-being remains intact. With AI’s assistance, retirees can enjoy the freedom and peace of mind they deserve in their golden years.

FAQs

What is the best AI app for financial analysis?

Some leading AI-powered financial analysis apps include Alpaca, which automates trading strategies; Numerai, which uses AI to make data-driven stock predictions; and TrendSpider, known for its detailed technical analysis and charting tools. SigFig and Yewno also offer comprehensive portfolio management and investment insights. Your choice should depend on whether you need real-time trading, stock analysis, or general financial management.

Is Finance GPT free?

Finance GPT provides a free version with access to basic features, but most advanced tools, like in-depth analysis require a subscription. Check their website for the most up-to-date pricing options and feature details.

What is the best AI finance solver?

The best AI finance solvers include ChatGPT for general financial advice, BloombergGPT for in-depth market analysis, and Kabbage for business cash flow and financial solutions. Zest AI also provides credit scoring for financial services. The choice depends on whether you need individual financial advice or specialized tools for business needs.

How to use AI to save money?

AI-powered apps like Trim and Truebill help cut costs by managing subscriptions and negotiating bills. Albert and Cleo use AI to track spending and provide budgeting advice, while Acorns automates savings by investing spare change. These tools offer tailored insights to streamline spending and boost savings over time.