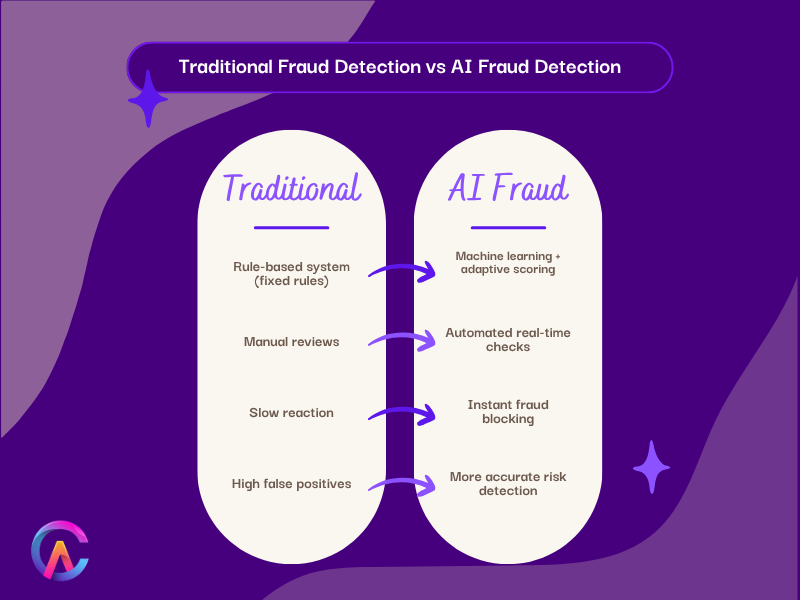

The fintech space keeps facing smarter scammers using fresh digital tools and platforms. With rapid growth pulling in huge user numbers plus massive transaction volumes, stopping fraud matters more than ever before. Old school rules and hands on checks just don’t cut it anymore. Today’s protection runs on AI, helping firms outsmart attackers through flexible, sharp, instant response systems

The Challenge of Fraud in the Digital FinTech Era

Fintech apps like online banks, e-wallets, crypto markets, or loan networks, draw scammers easily. Scams run from fake payments and stolen IDs to trick emails, hijacked accounts, bogus signups, card trials, made up profiles, dirty cash flows, or mind games. When tricks evolve quietly, old rule based checks miss red flags fast. On top of that, reviewing shady deals by hand drags time, plus it breaks under heavy load.

Ai closes this gap by spotting odd behavior automatically, shifting as scams change while picking up tips from each break in try or mistaken alert.

How AI Transforms Fraud Detection

Machine Learning Models for Pattern Recognition

AI driven tools handle massive amounts of activity and usage info. By looking at many clues like purchase amount, place, gadget used, sign in style, how often things happen, they learn what typical behavior looks like. Odd patterns set off warnings that fraud might be happening. Instead of sticking to preset conditions, these smart systems keep adjusting, spotting fresh sneaky tricks as soon as they pop up.

Real Time Risk Scoring

Every time someone makes a deal, smart systems give it a risk number using old records, current context, or live threat info. If a deal looks risky, alarms go off right away, either to check it later or stop it automatically. Scoring stuff as it happens helps financial apps stay safe while making things smoother for honest customers.

Deep Learning for Complex Fraud Schemes

Deep neural nets break things down step by step, spotting sneaky attacks that slip past basic checks. Take smart systems, they notice scam groups when devices look nearly identical or bots hide behind tons of tiny payments.

Natural Language Processing for Social Engineering

AI using natural language tricks checks messages, emails, or sign up info, spotting word choices tied to scams or manipulation attempts. So it catches sneaky fraud early, stopping cash from slipping out the door.

Graph Analytics for Network Discovery

AI spots sneaky crime groups by tracking how people, gadgets, places, yet payments connect, using smart maps that reveal fake accounts, middlemen, even dirty cash loops tied together, this helps bust big scams hiding behind layers of activity.

Benefits for FinTech Providers and Customers

- Faster ways to stop scams mean instant warnings or quick responses, cutting down money loss yet protecting confidence

- AI cuts down on errors, letting real users move through without random interruptions because accuracy means less hassle overall

- Keeping up with fresh threats helps systems stay secure over time

- AI helps set up smart defenses that act early, so fewer hands on tasks are needed. This way, security crews can spend time on serious risks instead

The end result? A more secure money world where confidence grows alongside smooth use, thanks to steady tech upgrades.

Key Business Cases and Real World Impact

- Upstart lenders use smart software to catch odd sign up trends slowing fake IDs from slipping through during enrollment scams

- Payment processors rely on smart systems that catch odd behavior blocking fake transactions or stolen accounts, even when clues are weak. These tools adapt fast, spotting red flags others miss while keeping things smooth for real users

- Crypto platforms use smart tech to track money flows across borders instantly, helping meet rules without delays while spotting shady deals before they spread. Systems stay alert 24/7, swapping old methods for faster checks that adapt on their own, keeping authorities informed but not overwhelmed

- Borrowing apps spot sneaky behavior by linking online traces through heaps of data points using smart tech that learns patterns. These tools flag copycat frauds not just by one signal but many clues working together. Instead of waiting, they act fast when odd matches pop up across user actions. No jargon needed the system checks moves people make online while avoiding false alarms

Some fintech examples show drops in fraud damage over 60% cut while getting users signed up faster without hassle.

Best Practices and Considerations

- Data quality matters a lot, mixing device signals with how people use cards helps AI learn better when you add outside threat data

- People still make the final call when tricky situations pop up. While tech helps out, it doesn’t take over. Decisions stay in human hands whenever alerts come through. Think of AI as a tool that boosts judgment, not swaps it

- Clear AI systems come first when it’s about rules or gaining people’s confidence through openness

- Fraud stays covered when people jump between phones, websites, or outside apps mixing safeguards keeps gaps small because protection shifts across each step without skipping spots

How Codearies Supercharges AI Powered Fraud Detection

Codearies mixes smart tech know how with practical finance skills, so you get live scam protection that fits your specific needs.

- From start to finish, check threats that match how users interact with your product while factoring in rules you must follow. Link fake activity patterns to actual customer behaviors seen across different regions

- Use ML with deep learning to pick models that learn from data. Then set them up to spot odd patterns over time. These systems score risks while they work nonstop. They adjust themselves as new info comes in

- NLP plus graph analytics bring smarter ways to catch fraud mules using upgraded signal tracking, while boosting shields against social tricks

- Seamless Platform Integration Connecting AI fraud detection with payments onboarding support channels and compliance stacks

- Explainable and Compliant AI Dashboarding for transparency audit trails and continuous improvement

- Keep tweaking the system, check models often, mix in fresh threat info, then adapt fast when weird attacks pop up

At Codearies, your fintech runs strong fewer scams get through, yet users still enjoy smooth interactions

Frequently Asked Questions

Q1 Does Codearies work with AI fraud tools on old systems or mixed clouds?

Yes, we adjust fixes to fit how your tech works, whether it’s mixed cloud setups, old school databases, or new API tools

Q2 How quickly can new fraud tactics be detected by Codearies AI?

Our tools keep learning on their own, so they adapt fast when fresh threats show up, no delay. As soon as new info flows in, updates kick in automatically. This means protection stays sharp without waiting around. Each change happens right away, not later. When attacks evolve, the system rolls with them smoothly

Q3 Does using AI to spot scams follow money rules and protect personal info?

Yes, every solution’s made with clear records plus follows local rules from the start

Q4 Will AI increase false positives and user friction?

Our machine learning systems get adjusted to boost precision, this cuts company losses while also preventing real users from getting wrongly flagged now and then

Q5 Do I need a team of data scientists?

No, Codearies handles AI plus keeps an eye on things, letting your crew spend time growing the business while helping customers

For business inquiries or further information, please contact us at