Real estate has traditionally been a complex and paper-heavy industry, often plagued by issues such as fraud, slow processes, and lack of transparency. By integrating artificial intelligence (AI) with blockchain technology, new solutions are emerging that promise to streamline property transactions, make them more secure, and reduce costs for all parties involved.

AI’s ability to analyze data patterns and make predictions, combined with blockchain’s decentralized, transparent, and immutable ledger, offers a powerful toolkit for real estate professionals. The future of real estate lies in how well these technologies can solve current problems while creating new efficiencies. Let’s dive into the ways this fusion is set to revolutionize the industry.

Transforming Real Estate with Blockchain Technology

Blockchain technology is reshaping the real estate landscape by introducing new levels of transparency, efficiency, and security in transactions. Here’s a look at the pivotal ways blockchain is impacting the industry. The Global AI in Real Estate Market size is expected to be worth around USD 41.5 Billion By 2033, from USD 2.9 Billion in 2023, growing at a CAGR of 30.5% during the forecast period from 2024 to 2033.

Smart Contracts for Seamless Transactions

- Automated Execution: Smart contracts facilitate the automatic execution of transaction terms, minimizing the reliance on intermediaries and reducing paperwork.

- Error Reduction: By automating processes, blockchain significantly lowers the chances of human error and helps prevent fraudulent activities.

Fractional Ownership through Tokenization

- Accessible Investments: Blockchain allows for the creation of digital tokens that represent fractional ownership of real estate, democratizing investment opportunities.

- Increased Liquidity: Tokenized real estate can be traded on decentralized platforms, enhancing liquidity and lowering transaction costs.

Building Trust with Transparency

- Immutable Ownership Records: Blockchain’s unchangeable ledger provides a transparent history of property ownership and transactions, fostering trust among stakeholders.

- Fraud Mitigation: The transparent nature of blockchain makes it challenging for fraudulent activities to take root.

Robust Security Measures

- Decentralized Data Storage: Blockchain’s architecture distributes information across a network of nodes, making it resistant to hacking attempts.

- Encryption for Protection: Cryptographic techniques safeguard data and transactions, ensuring that sensitive information remains secure.

Streamlined Title Transfers

- Efficient Processes: By automating title transfers, blockchain significantly reduces the time and costs associated with these transactions.

- Prevention of Title Fraud: The elimination of physical documents decreases the risk of fraudulent title claims.

Enhanced Property Management

- Automated Payment Systems: Smart contracts can handle rent payments automatically, ensuring timely collections and minimizing disputes.

- Maintenance Tracking: Blockchain can document property maintenance activities, providing a clear and accessible audit trail.

Innovative Business Models

- Crowdfunding Opportunities: Blockchain opens doors for real estate crowdfunding platforms, enabling investors to collaborate on larger projects.

- Token Trading Platforms: These platforms allow for the creation and trading of property tokens, creating new avenues for investment.

Tackling Challenges with AI-Driven Blockchain

Real estate transactions have long been hindered by inefficiencies, excessive paperwork, and security vulnerabilities. The integration of AI-driven blockchain technology presents an innovative approach to overcoming these obstacles. Here’s a closer look at the prevailing issues and how blockchain can effectively address them:

Current Challenges in Real Estate Transactions

- Extensive Paperwork: The process of buying or selling property typically involves cumbersome documentation and regulatory processes.

- Fraud Risks: The real estate sector is vulnerable to various types of fraud, including title fraud, wire transfer scams, and deceptive listings.

- Transparency Issues: A lack of visibility in the real estate market can lead to uninformed decisions by buyers and sellers alike.

- High Transaction Fees: Closing costs and various associated fees can significantly inflate the total cost of real estate transactions.

- Prolonged Processes: Traditional real estate dealings often slow down and become inefficient, especially when multiple stakeholders are involved.

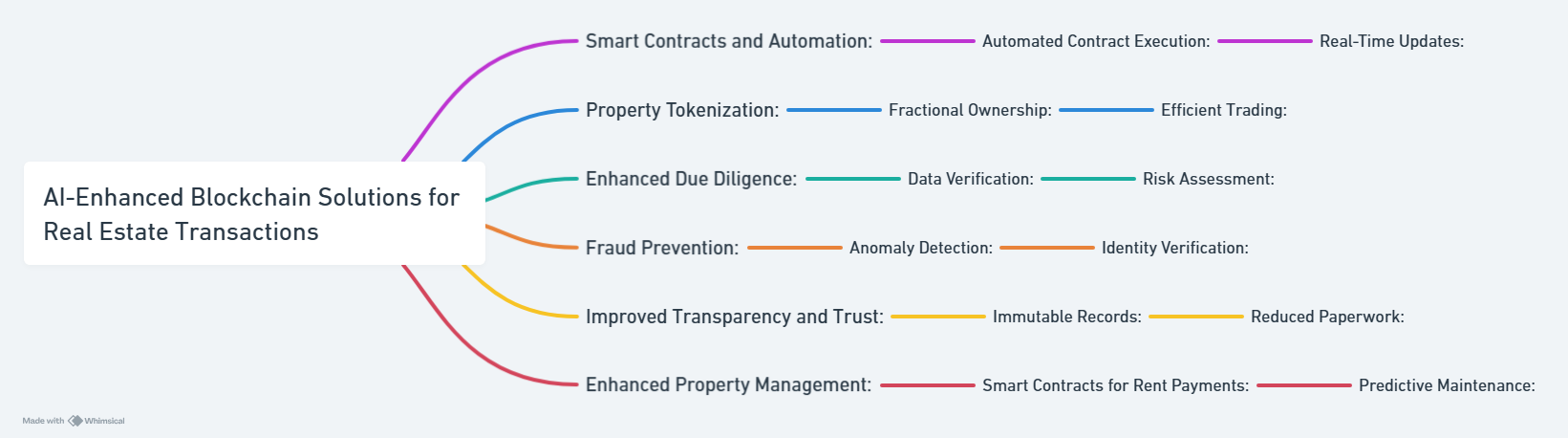

Notable Use Cases of AI-Driven Blockchain in Real Estate

- Property Tokenization: Digital tokens can represent fractional ownership of real estate, broadening access to investment opportunities.

- Automated Lease Management: Smart contracts can oversee lease agreements, automate rent payments, and handle maintenance requests efficiently.

- Fraud Prevention: AI algorithms can analyze transaction data for anomalies, helping to detect and prevent fraudulent activities.

- Secure Property Data Management: Property records can be securely stored and managed on a decentralized blockchain, ensuring integrity and accessibility.

- Streamlined Due Diligence: AI can automate processes such as title searches and document verification, enhancing risk assessment efforts.

Transforming Real Estate Transactions with Smart Contracts

Smart contracts, leveraging AI-powered blockchain technology, are revolutionizing real estate transactions. By automating contract execution and minimizing human error, these innovative agreements provide significant advantages for both buyers and sellers.

How Smart Contracts Function in Real Estate

- Digital Document Conversion: Legal documents related to real estate, such as purchase agreements, leases, and mortgages, are digitized for seamless integration into the blockchain.

- Contract Programming: The specific terms and conditions are encoded into a smart contract, ensuring clarity and mutual agreement among all parties involved.

- Automated Execution: Once the predetermined conditions are satisfied, the smart contract autonomously executes actions such as transferring ownership or disbursing funds.

The Role of AI in Smart Contracts for Real Estate

- Automated Due Diligence: AI can streamline due diligence processes, such as property title verifications and risk assessments, ensuring all essential checks are performed prior to contract execution.

- Predictive Analytics: Utilizing historical data, AI can identify potential risks or complications that may arise during a transaction, enabling proactive strategies to address them.

- Natural Language Processing: AI-driven natural language processing tools can simplify complex legal jargon, making contract terms more comprehensible for all parties involved.

Revolutionizing Property Valuation with AI and Blockchain

The integration of AI-driven property valuation with blockchain technology is transforming how properties are priced, ensuring accurate and real-time assessments. This innovative approach creates a more efficient, transparent, and trustworthy valuation system.

How AI-Driven Property Valuation Functions

- Data Gathering and Analysis: AI algorithms gather extensive data on properties, including sales history, geographic location, property characteristics, and prevailing market trends.

- Feature Identification: AI models extract key features from the collected data, such as square footage, nearby amenities, and recent changes in the market.

- Training the Model: Trainers use historical property data to develop these AI models, enabling them to recognize patterns and relationships between property attributes and their market values.

- Instant Valuation: Once trained, the AI models can deliver precise property valuations in real-time, reflecting the most current market conditions and property details

The Impact of Blockchain on Property Valuation

- Tamper-Proof Records: Blockchain offers a secure and immutable record of property valuations, ensuring that data remains unaltered.

- Increased Transparency: By making valuation data accessible on the blockchain, all relevant parties can verify information, fostering confidence in the process.

- Automated Processes with Smart Contracts: Smart contracts can streamline property valuation procedures, reducing the need for manual oversight and minimizing errors.

Practical Applications of AI-Driven Property Valuation

- Market Analysis: AI-powered valuation models analyze market trends, identify potentially undervalued properties, and highlight investment opportunities.

- Mortgage Processing: Lenders can utilize AI valuations to expedite the mortgage application process while managing risk more effectively.

- Property Tax Evaluations: Governments can leverage AI-driven valuations to conduct fair and accurate property tax assessments.

- Property Management Insights: Property managers can use these valuations to optimize rental pricing strategies and monitor property value changes over time.

Tokenization in Real Estate

Blockchain facilitates the creation of digital tokens that represent fractional ownership of properties. This innovation allows for greater accessibility, enabling more investors with limited budgets to participate in real estate. Additionally, it enhances liquidity; tokenized properties can be traded on decentralized exchanges, lowering transaction costs.AI further enhances this process by managing these tokenized assets. For instance, it can automate the distribution of rental income or profits to token holders and oversee smart contracts related to co-ownership responsibilities and voting rights.

Streamlined Mortgage Processing

AI improves mortgage processing by quickly analyzing borrower data and property details to automate risk assessments, leading to faster approvals. Coupled with blockchain, which creates a secure and tamper-proof record of ownership and financial information, this combination significantly reduces fraud risks. Furthermore, the transparency provided by blockchain ensures that all parties involved have access to an immutable record of the transaction.

Secure Land Registry and Property Records

The decentralized nature of blockchain enhances the security of land registries, making them tamper-proof and minimizing fraud and errors. With this technology, all relevant parties can access a clear and secure record of land ownership and property details. AI can also expedite the verification of documents and data analysis, speeding up property searches and ownership checks.

AI-Driven Property Financing

AI algorithms can analyze borrower information, property values, and market trends to assess potential loan risks effectively. Blockchain enhances this process by providing a transparent record of property ownership and any associated liens, improving loan security. Additionally, smart contracts can automate loan disbursements and title transfers, significantly reducing paperwork and accelerating the closing process.

Conclusion

The integration of AI-enhanced blockchain solutions for real estate transactions offers a groundbreaking shift in how the industry operates. By combining the security and transparency of blockchain with the intelligence and automation of AI, the real estate sector can become more efficient, secure, and accessible. The potential for faster transactions, reduced fraud, and lower costs could transform how properties are bought and sold globally. As the technology matures, we can expect to see even more innovative solutions that will continue to reshape the real estate landscape.

FAQs

Are There Any Technological or AI Advances in Real Estate Transactions?

Yes, technological and AI advances are transforming real estate transactions. Innovations include automated property valuations using machine learning algorithms, AI-driven chatbots for customer service, and virtual reality tours that enhance property viewing experiences. Additionally, data analytics helps identify market trends and investment opportunities, making transactions more efficient and informed.

What Form of AI is Most Commonly Used in Real Estate?

The most commonly used forms of AI in real estate include machine learning for predictive analytics, natural language processing (NLP) for chatbots and virtual assistants, and computer vision for property image analysis. These technologies streamline processes like property searches, customer engagement, and market analysis.

What Are Real Estate Transactions with Smart Contracts?

In real estate transactions, smart contracts act as self-executing agreements with terms written directly into code. They use blockchain technology to automatically execute transactions once conditions are met, which reduces the need for intermediaries and enhances transparency and security in property transfers.

How to Use AI to Make Money in Real Estate?

To make money in real estate using AI, consider the following strategies:

- Property Investment Analysis: Use AI-driven tools to analyze market trends and property values to identify lucrative investment opportunities.

- Predictive Analytics: Leverage AI to forecast rental income and property appreciation, helping you make informed investment decisions.

- Enhanced Marketing: Implement AI for targeted marketing campaigns based on customer behavior and preferences, attracting potential buyers or renters more effectively.

- Automated Valuation Models: Utilize AI models for accurate property valuations, enabling better pricing strategies when buying or selling.