Cybercriminals’ tactics also change as the digital environment does. Fraud has become more sophisticated, driving businesses to adopt advanced technologies to safeguard their assets. Artificial Intelligence (AI) and Blockchain are among the most promising technological synergies. While blockchain provides a decentralized and secure way to record transactions, AI enhances its capability by detecting fraudulent activities in real-time. This partnership reshapes how fraud is managed across various sectors, ensuring faster and more efficient fraud detection.

Understanding Real-Time Fraud Detection

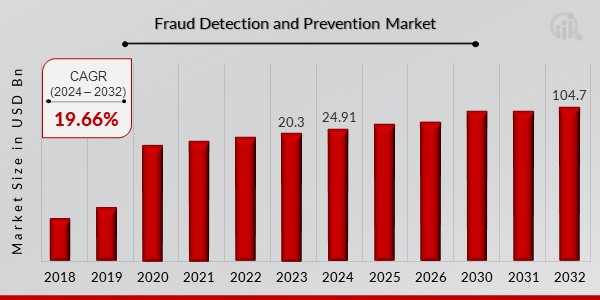

Real-time fraud detection refers to monitoring transactions as they occur, aiming to identify and stop fraud before it causes harm. Traditional fraud detection systems often rely on post-event analysis, where fraudulent activities are determined afterwards. This reactive approach is no longer sufficient in today’s high-speed digital economy.AI-powered systems offer a proactive alternative. Using deep learning and neural networks, AI can analyze real-time transaction data, identifying abnormal patterns or behaviours that signal fraud. This ability to intervene instantaneously helps businesses mitigate potential threats before they result in financial loss or damage to reputation. The Fraud Detection and Prevention Market size is projected to grow from USD 24.91 billion in 2024 to USD 104.7 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 19.66% during the forecast period (2024 – 2032).

The Urgency of Real-Time Fraud Detection in Today’s Digital World

As digital transactions become faster, traditional methods of detecting fraud—often relying on delayed analysis—are no longer adequate. In industries like finance and e-commerce, where transactions occur in seconds, real-time fraud detection is critical to prevent significant damage.

The Cost of Delayed Fraud Detection

- Financial Risks: Even a short delay in identifying fraudulent activities can result in significant economic losses. In e-commerce, unauthorized purchases can drain stock and erode customer confidence.

- Data Security Breaches: Fraudulent access to sensitive data, if not caught immediately, can lead to data breaches with severe legal and reputational consequences.

Why Real-Time Detection Matters

Real-time fraud detection is crucial for several reasons:

- More robust Security: Real-time fraud detection drastically reduces the risk of financial damage and data breaches.

- Customer Trust: Companies can protect customers and build trust by preventing unauthorized transactions.

- Regulatory Compliance: In industries with strict fraud prevention laws, real-time detection helps businesses more effectively meet legal requirements.

In summary, real-time fraud detection, powered by AI, is essential for businesses to protect themselves and their customers from rapidly evolving digital threats.

AI in Blockchain: A Powerful Alliance for Fraud Prevention

Integrating artificial intelligence (AI) with blockchain technology is a game changer in the battle against fraud. Each technology offers unique strengths, and their combination enhances security in the digital world. AI and blockchain create a more reliable and proactive system for detecting and preventing fraud in real-time transactions.

How AI and Blockchain Work Together

AI and blockchain complement each other in several key ways:

- Real-Time Monitoring and Detection: AI can analyze vast amounts of blockchain data in real time. It can identify irregularities or anomalies in transaction patterns that may suggest fraudulent behaviour.

- Pattern Recognition: Through machine learning, AI can learn from previous transaction data and recognize patterns typically associated with fraud. This allows it to detect and even anticipate fraudulent attempts before they escalate.

- Automated Smart Contracts: Blockchain’s immutable ledger ensures transparent record-keeping, while AI enhances the functionality of smart contracts by enforcing rules and automating verification processes. This reduces the risk of fraud and human error.

- Building Trust: Blockchain’s decentralized and transparent nature fosters trust between involved parties. Combined with AI’s advanced fraud detection capabilities, this makes it much harder for fraudsters to manipulate or falsify data.

Specific Applications of AI in Blockchain for Fraud Prevention

AI and blockchain work together in various ways to enhance fraud prevention:

- Identity Verification: AI-powered systems can verify digital identities, reducing instances of identity fraud and enhancing the integrity of user authentication processes.

- Supply Chain Oversight: Blockchain ensures transparent tracking of goods through the supply chain, and AI can monitor for any unusual activities or signs of counterfeiting, enhancing supply chain security.

- Monitoring Financial Transactions: AI can evaluate transaction patterns for irregularities that could signal fraud, such as unauthorized payments or money laundering schemes.

- Protection of Intellectual Property: Blockchain technology can serve as a tamper-proof record for intellectual property, while AI can help detect and prevent unauthorized access or duplication of proprietary information.

AI: A Fortified Shield for Blockchain Security

Blockchain technology, known for its decentralized structure and immutable ledger, has transformed security across various industries. Despite its inherent strengths, blockchain is not immune to evolving cyber threats. Malicious actors are constantly developing new techniques to exploit vulnerabilities in these networks. This is where artificial intelligence (AI) steps in, providing a robust and adaptive layer of defence.

Strengthening Blockchain Security with AI

- Detecting Anomalous Behavior: AI can process vast amounts of data on the blockchain in real-time, identifying irregularities that deviate from typical transaction patterns. These anomalies might indicate fraudulent actions such as unusual transaction volumes, address modifications, or discrepancies in data records.

- Immediate Threat Detection: AI systems can instantly flag suspicious activities and notify administrators to take swift action. This rapid response is especially crucial in finance and supply chains, where a single fraudulent transaction could lead to significant financial or operational damage.

- Predictive Threat Analytics: AI-powered predictive models use historical data and current trends to identify potential future threats. By recognizing patterns linked to fraud or security breaches, AI can proactively address weak points before attackers exploit them.

- Smart Contract Audits: AI can automatically verify smart contracts, ensuring they adhere to predefined conditions and do not contain exploitable loopholes. This reduces the risk of vulnerabilities within self-executing contracts being leveraged for fraud.

- Defending Against Distributed Denial of Service (DDoS) Attacks: AI can identify abnormal traffic patterns that signal a DDoS attack. This attack aims to flood a blockchain network with excessive traffic to cause disruptions. Early detection by AI helps mitigate such attacks, preserving the network’s stability and performance.

Machine Learning Algorithms for Fraud Detection

Machine learning (ML) has become a critical tool in detecting fraud by analyzing large datasets to identify patterns and anomalies. Here are key ML algorithms commonly used for fraud prevention:Decision Trees and Random Forests

- How they work: Decision trees classify data through if-else rules. Random forests improve accuracy by combining multiple decision trees.

- Use cases: Effective for detecting fraud based on transaction patterns and user behaviour.

Support Vector Machines (SVMs)

- How they work: SVMs classify data by finding the optimal boundary between categories.

- Use cases: Ideal for distinguishing legitimate transactions from fraudulent ones.

Neural Networks

- How they work: Neural networks process complex patterns through interconnected layers of nodes.

- Use cases: Useful for detecting sophisticated fraud schemes.

Anomaly Detection

- How it works: Identifies unusual data points that deviate from normal behaviour.

- Use cases: Flags suspicious transactions that could indicate fraud.

Choosing the Right Algorithm

The best ML algorithm depends on data type, fraud complexity, and available resources. Organizations can significantly improve their fraud detection capabilities by selecting a suitable model.

Predictive Analysis: A Proactive Defense Against Fraud

Predictive analysis, driven by artificial intelligence (AI), is a robust tool for preempting fraud. By examining historical data and identifying patterns, these models forecast potential future fraudulent activities, allowing businesses to take preventative actions and mitigate risks before they materialize.

How Predictive Analysis Operates

- Data Evaluation: Predictive models sift through extensive historical datasets, including transaction logs and customer behaviour, to uncover hidden patterns.

- Pattern Identification: The models detect correlations and anomalies, such as irregular spending patterns or unusual login locations, that may signal potential fraud.

- Forecasting: Based on identified patterns, these models estimate the likelihood of future fraudulent incidents, enabling proactive measures.

Combining Predictive Analysis with Blockchain

Integrating predictive analysis with blockchain technology enhances its effectiveness:

- Data Integrity: Blockchain’s immutable ledger ensures the data used in predictive analysis is accurate and unalterable, enhancing the reliability of predictions.

- Real-Time Monitoring: Blockchain’s decentralized system allows for the continuous monitoring of transactions, facilitating the timely detection of anomalies.

- Proactive Measures: By anticipating potential fraud risks, businesses can implement preventative strategies, such as adjusting security protocols or setting transaction limits.

Conclusion: AI and Blockchain – The Future of Fraud Detection

Integrating AI and blockchain represents a significant leap forward in fraud prevention technology. Together, they offer a robust, real-time solution to combating fraud in a digital world where cyber threats are becoming more sophisticated daily. With AI’s ability to learn and improve and blockchain’s secure and immutable infrastructure, businesses can create fraud detection systems that are both intelligent and impenetrable.As these technologies evolve, their combined potential will become indispensable in protecting industries ranging from finance to healthcare. The future of fraud prevention lies in this powerful synergy, ensuring that businesses can stay one step ahead of fraudsters and confidently safeguard their digital assets.

FAQS

What Are the Machine Learning Algorithms for Fraud Detection in Blockchain?

Several machine learning algorithms are utilized to detect fraud in the blockchain. Decision Trees and Random Forests classify transactions based on various factors, improving accuracy with multiple trees. Support Vector Machines (SVMs) distinguish between fraudulent and legitimate transactions by finding optimal data separation. Neural Networks detect complex patterns and sophisticated fraud schemes. Anomaly Detection Algorithms identify deviations from standard transaction patterns, while Clustering Algorithms group similar data to uncover clusters of fraudulent activity.

What Is Proof of Fraud in Blockchain?

Proof of Fraud in blockchain involves demonstrating that fraudulent activity has occurred by presenting evidence or anomalies. This evidence shows that a transaction or action within the blockchain violates its rules or integrity, helping to challenge and rectify fraudulent entries.

What Is the Difference Between Fraud Proof and ZK Proof?

Fraud Proof shows that a transaction or action on the blockchain is invalid, providing evidence of fraud. In contrast, ZK Proof (Zero-Knowledge Proof) allows for the validity of a transaction or knowledge to be proven without revealing specific details, thus maintaining privacy.

Which Database Is Used for Fraud Detection?

Relational Databases (e.g., MySQL) handle structured data and traditional fraud detection. NoSQL Databases (e.g., MongoDB) support real-time fraud detection with large-scale, unstructured data. Graph Databases (e.g., Neo4j) effectively identify complex fraud patterns by analyzing transaction relationships.

How can Codearies help you?

At Codearies, we excel in harnessing AI solutions to transform your business operations and drive growth. By integrating advanced AI technologies, we empower businesses to automate processes, gain actionable insights, and enhance decision-making. Our expertise spans across AI-driven data analytics, machine learning algorithms, and intelligent automation, enabling you to leverage data for strategic advantage. Whether it’s through optimizing your customer experience, improving operational efficiency, or developing innovative products, Codearies provides tailored AI solutions that align with your business goals and future-proof your digital strategy. Let us help you unlock the full potential of AI and stay ahead in the competitive landscape. Book your free consultation now!

Source

Source