Blockchain and artificial intelligence (AI) have been hailed as transformative technologies. Combined, these two powerful innovations can offer groundbreaking solutions in various industries. In risk management, blockchain-powered AI models provide unparalleled benefits by delivering secure, transparent, and efficient systems that improve decision-making processes. This article explores the development and applications of blockchain-powered AI models for risk management, delving into how they shape this critical field’s future.

Risk Management: Key Concepts

What Is Risk Management?

Risk management includes identifying, assessing, and prioritizing risks, then coordinating efforts to minimize and control their impact. Traditional methods, though somewhat effective, struggle with modern threats like cyberattacks, financial fraud, or supply chain disruptions. These challenges require real-time and predictive solutions.

The Need for Advanced Risk Models

The complexity of today’s digital economy necessitates advanced risk models that go beyond traditional methods. With blockchain and AI, risk managers can develop models that predict potential risks and proactively address them before they escalate.

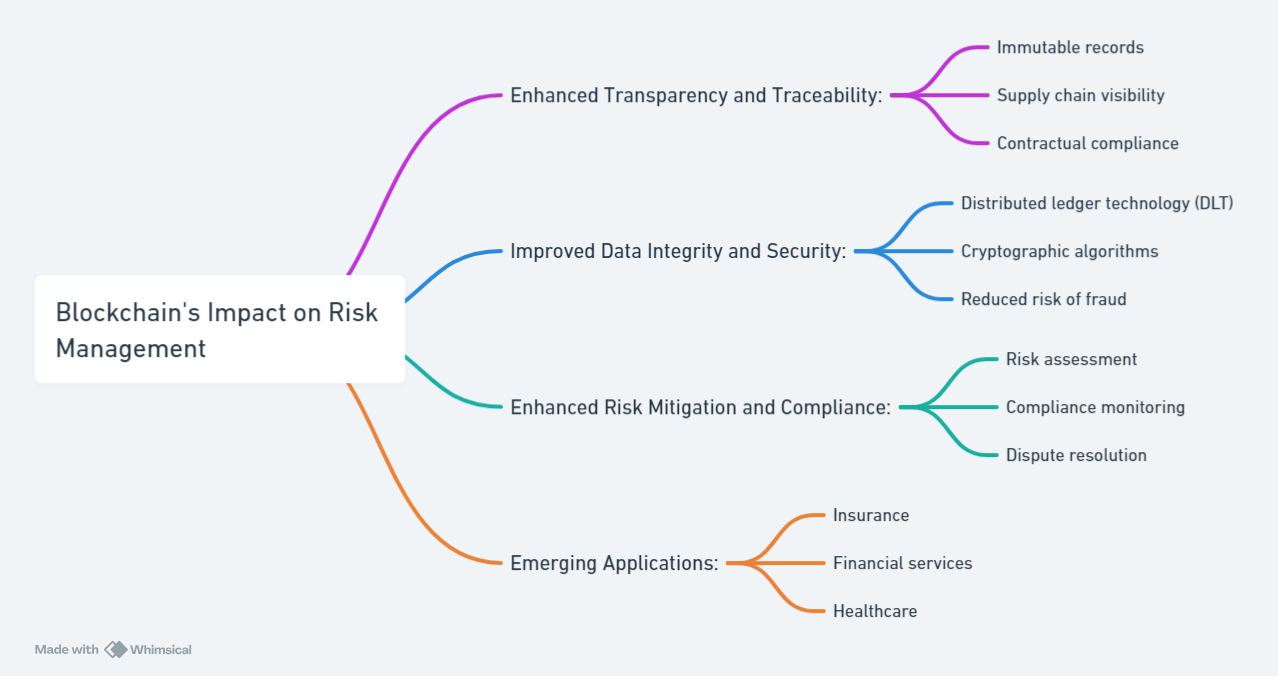

Blockchain’s Impact on Risk Management

Blockchain technology brings transformative potential to risk management, offering decentralised, transparent solutions, and resistant to tampering. Here are key ways blockchain enhances risk management across industries:

Increased Transparency and Immutable Audit Trails

- Permanent Records: Blockchain’s immutable ledger ensures that it cannot be altered once a transaction is recorded. This creates a reliable audit trail, making detecting and addressing discrepancies or fraudulent activities easier.

- Supply Chain Integrity: By tracking products through every stage, blockchain ensures authenticity and combats issues like counterfeiting and unethical sourcing practices.

Automated Compliance through Smart Contracts

- Self-Enforcing Agreements: Smart contracts are programmable contracts that automatically execute terms based on predefined conditions. These reduce human error, ensure agreement adherence, and streamline dispute resolution.

- Regulatory Assurance: Blockchain’s transparent transaction records simplify compliance with regulatory frameworks, offering a real-time, unalterable ledger of activities that can be audited anytime.

Heightened Data Protection and Security

- Robust Encryption: Blockchain utilizes advanced cryptographic methods to secure sensitive information, minimizing the likelihood of data breaches or unauthorized access.

- Privacy-Preserving Mechanisms: Technologies like zero-knowledge proofs enable blockchain platforms to verify information without revealing underlying data, thus protecting privacy while ensuring integrity.

Mitigating Counterparty Risks

- Decentralized Systems: By eliminating reliance on intermediaries, blockchain significantly reduces the risks of counterparty failure, fraud, and manipulation.

- Automated Execution with Smart Contracts: Smart contracts enforce transactions automatically once conditions are met, eliminating the risks of delayed payments or breached agreements.

Revolutionizing Risk Management in Financial Services

- AML and KYC Compliance: Blockchain’s ability to create a transparent yet secure transaction history simplifies Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures, automating compliance with financial regulations.

- Efficient Securities Trading: Blockchain reduces settlement times in securities trading by replacing traditional clearing processes with a decentralized, real-time ledger, which mitigates systemic risks.

Streamlining Insurance and Claims Management

- Fraud Detection: By providing a transparent and immutable record of events, blockchain can identify inconsistencies in insurance claims, making it easier to detect fraud.

- Faster Claims Settlement: Smart contracts can expedite claims processing by automating claim verification and settlement, reducing processing times and enhancing customer satisfaction.

While blockchain holds tremendous potential in mitigating risks, successful implementation depends on addressing challenges like scalability, regulatory compliance, and system interoperability. When integrated thoughtfully, blockchain can provide a solid foundation for more secure, transparent, and efficient industry risk management practices.

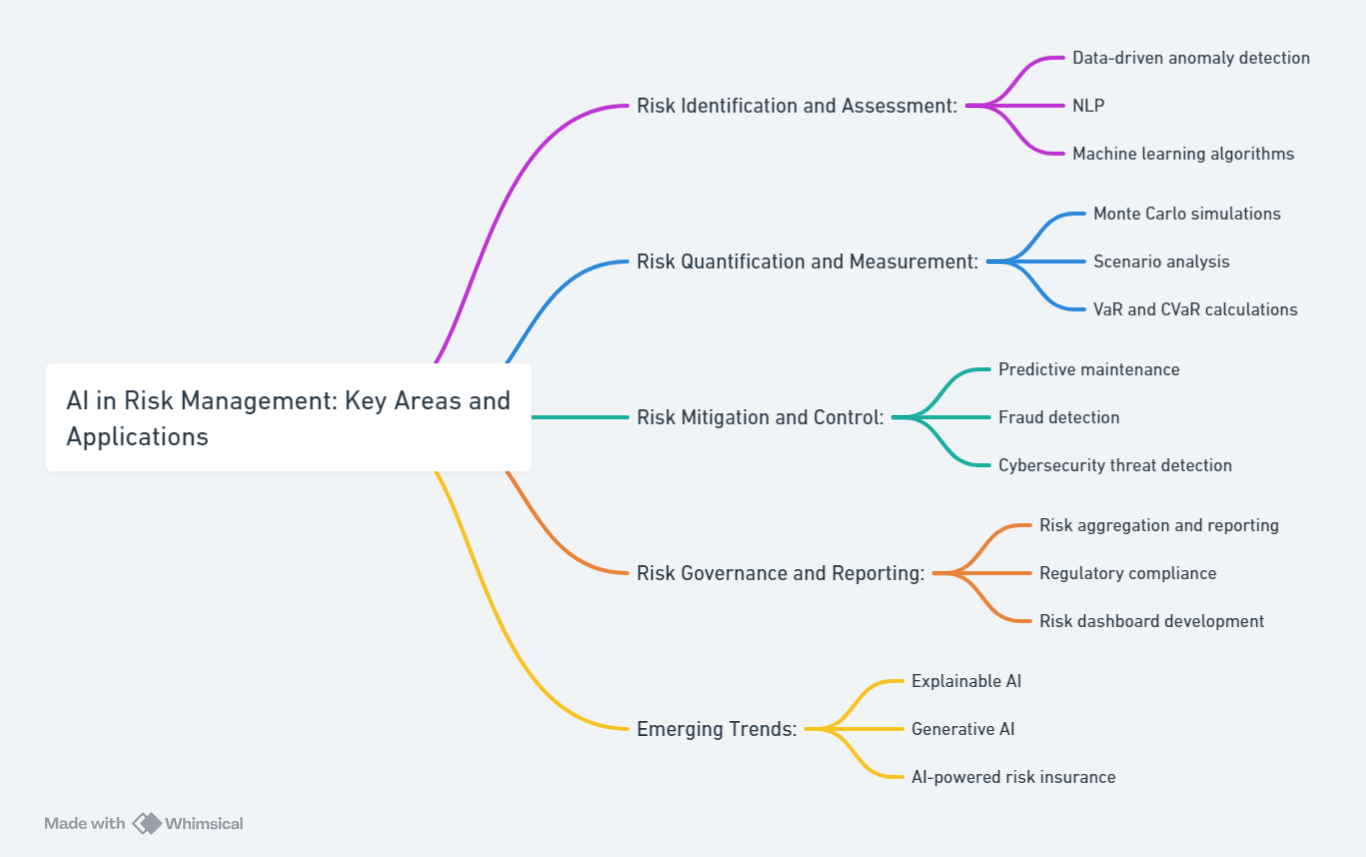

AI in Risk Management: Transforming the Landscape

Artificial Intelligence (AI) is reshaping risk management with its ability to process vast amounts of data, detect patterns, and offer predictive insights. By leveraging machine learning and advanced analytics, AI enhances every stage of risk identification, assessment, and mitigation, making it a critical tool for modern organizations. The global AI model risk management market size was estimated at USD 5.48 billion in 2023 and is projected to grow at a CAGR of 12.8% from 2024 to 2030.  Here are the key ways AI is revolutionizing risk management:

Here are the key ways AI is revolutionizing risk management:

Advanced Risk Identification and Analysis

- Big Data Processing: AI can analyze extensive datasets rapidly, uncovering patterns, trends, and hidden risks that may be difficult for human analysts to detect. This proactive approach helps organizations stay ahead of potential risks.

- Predictive Analytics: AI can use machine learning algorithms to forecast potential risks by building predictive models based on past data and real-time trends. This allows for early risk detection and proactive planning.

- Scenario Simulations: AI can simulate various risk scenarios, allowing organizations to evaluate the impact of potential events and prepare mitigation strategies for different possible outcomes.

Real-Time Risk Monitoring and Alerts

- Continuous Surveillance: AI systems can continuously monitor data streams from various sources, such as IoT sensors, social media platforms, and real-time market data. This 24/7 monitoring helps detect emerging threats as they develop.

- Anomaly Detection: AI algorithms can identify deviations from standard behaviour or processes, flagging unusual activity that might indicate security breaches, operational failures, or market disruptions.

Efficient Risk Mitigation and Response

- Decision-Making Support: AI offers decision-makers actionable insights by analyzing risk data and providing strategic recommendations. This allows leaders to make informed decisions quickly, reducing the exposure window.

- Automated Risk Response: AI can automate risk mitigation by triggering security protocols or executing preset responses to cyber threats.

- Crisis Management: AI tools support real-time crisis management by analyzing data and recommending the best strategies during emergencies.

Regulatory Compliance and Reporting

- Automated Compliance Monitoring: AI can help businesses stay compliant with evolving regulations by automatically scanning and verifying legal and regulatory requirements adherence.

- Regulatory Risk Identification: AI systems can evaluate complex regulatory frameworks and identify areas where an organization might face legal or compliance risks, guiding proactive adjustments.

Enhanced Fraud Detection and Prevention

- Behavioral Pattern Analysis: AI can detect fraudulent behaviour by analyzing large datasets to identify unusual transactions or deviations from typical patterns. Machine learning algorithms continuously adapt to new forms of fraud, making detection more effective over time.

- Instant Alerts: When suspicious activities are detected, AI can send real-time alerts, enabling businesses to respond quickly and prevent potential losses.

Examples of AI in Risk Management Applications:

- Cybersecurity: AI algorithms detect, analyze, and respond to cyber threats in real time, improving the protection of digital assets from hacking attempts or data breaches.

- Financial Risk Management: AI helps financial institutions manage credit, operational, and market risks by analyzing client profiles, market conditions, and transactional data to predict risk levels and inform investment strategies.

- Insurance: AI assists insurance companies by automating risk assessments, detecting fraudulent claims, and optimizing premium pricing based on risk factors.

- Healthcare: AI predicts and mitigates health risks by analyzing data to identify potential disease outbreaks, optimizing resource allocation, and improving patient care outcomes.

AI’s powerful capabilities enhance risk management, but it’s important to emphasize that AI complements human expertise rather than replacing it. Effective risk management uses AI to support human judgment, improve decision-making, and foster a more resilient organizational framework.

Key Components of Blockchain-Powered AI Models for Risk Management

Smart Contracts

Smart contracts are self-executing contracts with terms written directly into the code. These are key features of blockchain technology, enabling automated, secure transactions. In risk management, smart contracts can automatically enforce compliance with regulations or trigger actions when certain risk thresholds are met. AI enhances this by ensuring that the conditions of these contracts are based on real-time data and predictive analytics.

Decentralized Data Storage

Traditional data storage methods pose significant risks, such as unauthorized access or data loss. With its decentralized data storage approach, Blockchain mitigates these risks by distributing data across multiple nodes. This makes it nearly impossible for any single party to alter or corrupt the data. AI further enhances this by ensuring that the data stored and used in risk management is accurate and relevant.

Consensus Algorithms

Consensus algorithms are the backbone of blockchain technology, ensuring that all network nodes agree on a transaction’s validity. In risk management, this ensures that decisions are based on a consensus, reducing the likelihood of errors or fraudulent activities. AI can help optimize these algorithms, making them more efficient and adaptable to changing risk environments.

Future Trends in Blockchain AI for Risk Management

Decentralized AI Models

One exciting development is the emergence of decentralized AI models. These models leverage the decentralised blockchain to distribute AI processing across multiple nodes. This reduces the reliance on centralized AI systems, which can be more vulnerable to attacks or failures. Decentralized AI models also promote transparency, as decisions are made collectively by the network.

AI-Powered Predictive Risk Models

Predictive analytics powered by AI is already revolutionizing risk management. As they become more sophisticated, AI models can predict risks with even greater accuracy. Combined with blockchain’s immutable data storage, these predictive models will provide organizations with actionable insights into potential risks before they become significant issues.

Integration with IoT and Big Data

The Internet of Things (IoT) and Big Data are other technologies significantly impacting risk management. When integrated with blockchain-powered AI models, IoT devices can provide real-time data that AI algorithms can analyze to predict risks. Blockchain ensures this data is secure and cannot be tampered with, making it ideal for high-stakes industries like healthcare, finance, and logistics.

Conclusion

Combining blockchain and AI transforms risk management by enhancing transparency, security, and efficiency. Blockchain provides secure, decentralized data storage and smart contracts, while AI offers predictive analytics and real-time risk monitoring. They enable organizations to identify, mitigate, and manage risks more effectively proactively. As these technologies continue to evolve, their integration with IoT and Big Data will further revolutionize risk management, offering more resilient and transparent solutions for the future.

FAQs

What is an AI-Powered Blockchain Builder?

An AI-powered blockchain builder integrates AI with blockchain to create and manage blockchain networks more efficiently. It automates tasks like smart contract creation, optimizes network performance, and enhances data processing, making the system smarter and more adaptive.

Is Blockchain Technology a Risk Mitigation Tool in the Supply Chain?

Blockchain mitigates supply chain risks by providing transparency, traceability, and security. It offers real-time tracking, prevents fraud, and ensures product authenticity, reducing risks related to counterfeiting, theft, and inefficiencies.

What Type of Risk is Supply Chain Risk?

Supply chain risk includes potential disruptions in the flow of goods and services. It encompasses operational, financial, cyber, and reputational risks, such as production delays, cyberattacks, or regulatory challenges.

What is an AI Risk Management Framework?

An AI risk management framework identifies and mitigates risks related to AI use. It includes steps like risk assessment, implementing safety measures, and continuous monitoring to ensure AI systems are ethical.