In an era where industries are under increasing regulatory scrutiny, ensuring compliance with legal standards has never been more crucial. From finance to healthcare, adhering to regulations is not just about avoiding fines; it’s about maintaining trust and security. Integrating blockchain with AI offers an innovative solution to streamline regulatory compliance, bringing a new level of transparency, accuracy, and efficiency. These two technologies, when combined, create an automated system capable of verifying, monitoring, and reporting compliance activities in real-time.

Blockchain’s decentralized, immutable ledger ensures data integrity, while AI brings intelligent automation, identifying patterns, and predicting risks. Together, they create a synergy that can revolutionize compliance processes across industries. Whether you are managing sensitive financial transactions or safeguarding patient data in healthcare, the fusion of blockchain and AI may offer the key to overcoming traditional compliance challenges.

Why Regulatory Compliance is Challenging

Regulatory compliance is fraught with complexities. Companies face ever-evolving regulations, differing rules across jurisdictions, and the constant threat of non-compliance penalties. The cost of regulatory failure is significant—both financially and reputationally. Traditional methods of managing compliance rely heavily on manual processes, which are prone to errors and time-consuming delays.For industries like finance, healthcare, and manufacturing, compliance isn’t just about ticking boxes; it’s about adhering to stringent rules that change frequently. In finance, regulations like Anti-Money Laundering (AML) and Know Your Customer (KYC) are crucial, while healthcare must navigate privacy laws such as HIPAA. The difficulty lies in accurately tracking and recording vast amounts of data, ensuring that every transaction, operation, or process aligns with these laws.

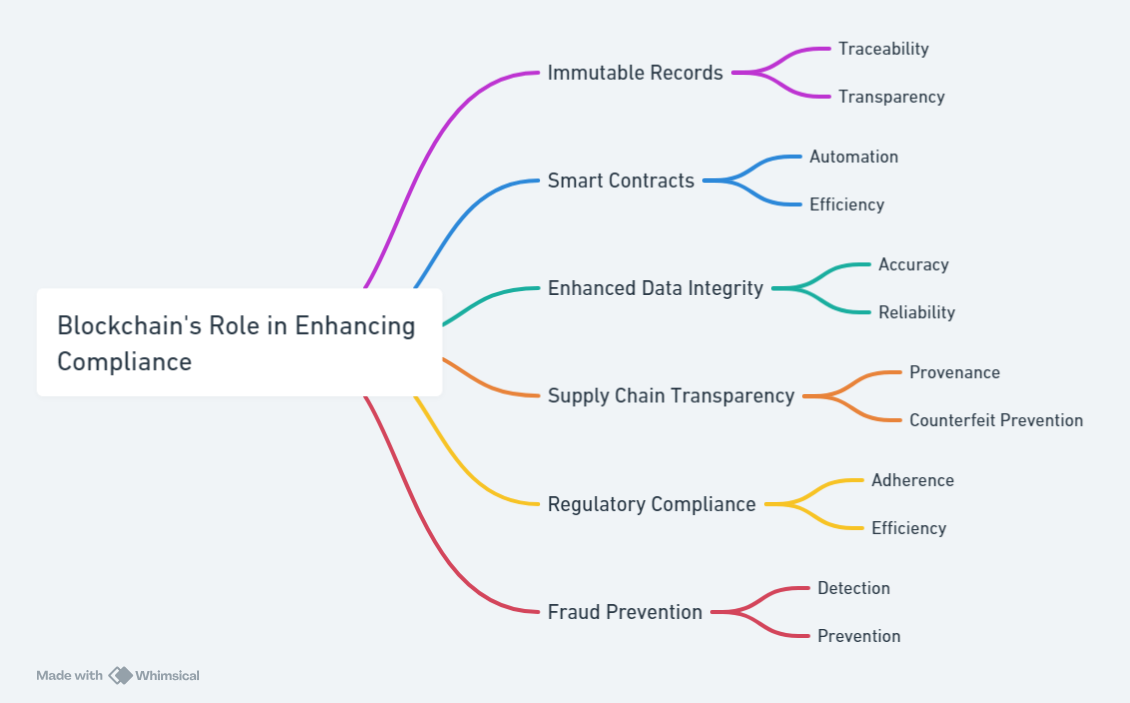

Blockchain’s Role in Enhancing Compliance

Blockchain’s decentralized and immutable ledger offers a revolutionary approach to regulatory compliance. It ensures data integrity by creating permanent, tamper-proof records of transactions and decisions. In finance, for example, blockchain can provide a transparent audit trail for each transaction, simplifying compliance with AML regulations. Its decentralized nature also reduces the risk of centralized failures, distributing control across a secure network. The global Regulatory Compliance market size was valued at USD 17135.97 million in 2023 and is expected to expand at a CAGR of 6.03% during the forecast period, reaching USD 24348.16 million by 2031. Smart contracts further enhance blockchain’s capabilities by automating compliance tasks. These self-executing contracts ensure that regulatory obligations are met automatically, reducing the need for manual intervention and lowering the risk of non-compliance.

Smart contracts further enhance blockchain’s capabilities by automating compliance tasks. These self-executing contracts ensure that regulatory obligations are met automatically, reducing the need for manual intervention and lowering the risk of non-compliance.

AI’s Capabilities for Automating Compliance

AI brings automation and intelligence to the compliance equation. By analyzing vast amounts of data in real-time, AI can identify patterns, flag anomalies, and predict potential compliance risks. In the financial sector, AI can monitor transactions for signs of fraud or money laundering, while in healthcare, it can track data access to detect potential HIPAA violations. The ability to anticipate risks before they escalate is invaluable for organizations striving to stay ahead of regulatory challenges.By integrating AI, companies can streamline their compliance workflows, reducing human error and enhancing the overall accuracy of their regulatory adherence.

Blockchain and AI in Financial Compliance

Chainalysis – Tracers: Tracers uses blockchain and AI to monitor cryptocurrency transactions, identifying suspicious patterns linked to money laundering. This enables real-time AML compliance by analyzing billions of transactions and flagging potential risks.CoinFabrik: CoinFabrik automates KYC and AML processes using blockchain for secure data storage and AI for rapid analysis. This integration reduces compliance costs and speeds up identity verification while ensuring regulatory adherence.

Healthcare Compliance with Blockchain and AI

Patient Data Management: Blockchain creates an immutable record of patient data, while AI monitors access and flags suspicious activity. This ensures data security and compliance with regulations like HIPAA.Consent Management: Blockchain records patient consent, and smart contracts enforce it automatically. This guarantees privacy compliance by giving patients control over their data while meeting regulatory requirements.

Blockchain and AI in Data Privacy Compliance

Data Breach Detection: AI analyzes blockchain records to detect unusual activities, allowing organizations to respond quickly to potential breaches and comply with regulations like GDPR.Consent Management: Blockchain stores immutable consent records, while AI automates their management, ensuring that companies respect user data preferences in real-time.Data Minimization: AI helps organizations identify and delete unnecessary data, ensuring compliance with GDPR’s data minimization principle. Blockchain securely stores only essential information.

Blockchain and AI for Real-Time Compliance Monitoring

The integration of Blockchain and Artificial Intelligence (AI) creates a robust framework for real-time compliance monitoring. This powerful combination harnesses the strengths of blockchain’s transparency and immutability alongside AI’s analytical prowess, facilitating continuous oversight of operations and ensuring adherence to regulations.

How It Works

- Data Capture on Blockchain:

Compliance-related transactions, events, and relevant data are securely recorded on a blockchain. This establishes a tamper-resistant and transparent ledger that provides an auditable trail of all activities. - AI-Driven Analytics:

AI algorithms are employed to perform continuous, real-time analysis of the data stored on the blockchain. These algorithms can swiftly detect patterns, identify anomalies, and flag deviations from established compliance rules and regulations. - Real-Time Alerts:

Upon identifying potential compliance issues, the AI system generates immediate alerts to designated stakeholders. This prompt notification enables timely investigation and corrective actions, mitigating risks before they escalate. - Continuous Improvement:

The AI model learns from historical data and the outcomes of previous compliance checks, refining its analytical capabilities over time. This iterative learning process enhances its accuracy and efficiency in detecting compliance risks.

Smart Contracts: A Solution for Regulatory Automation

Smart contracts, implemented on blockchain platforms, serve as a powerful mechanism for automating regulatory compliance. These self-executing agreements automatically enforce specified terms and conditions when predefined criteria are met, eliminating the need for manual oversight and ensuring adherence to regulations.

How Smart Contracts Facilitate Regulatory Automation

- Establish Compliance Criteria: The first step involves clearly defining the compliance rules within the smart contract, reflecting the relevant regulatory requirements. These rules can be intricate and involve multiple variables.

- Encode on Blockchain: The defined rules are then encoded into the smart contract and deployed on a blockchain, ensuring the contract’s immutability and resistance to tampering.

- Automated Execution: When specific conditions arise—such as a transaction or the passage of time—the smart contract autonomously executes the necessary actions, thereby ensuring compliance with the established regulations.

Regulatory Sandboxes for Blockchain-AI Testing

Regulatory sandboxes serve as experimental frameworks that allow emerging technologies, such as blockchain and Artificial Intelligence (AI), to be tested and refined without the immediate constraints of full regulatory compliance. This environment promotes innovation while safeguarding consumers and the integrity of the financial system.

How Regulatory Sandboxes Function

- Controlled Environment: Regulatory sandboxes create a secure setting in which companies can deploy their blockchain-AI solutions under the oversight of regulatory authorities. This ensures that innovations are monitored while minimizing risk.

- Limited Scope: The testing parameters are typically confined to specific applications or geographic locations, which allows for focused experimentation without overwhelming regulatory systems.

- Supervision: Regulators actively oversee the testing phases, ensuring that participating companies adhere to existing laws and regulations while fostering innovation.

- Feedback Loop: These sandboxes facilitate an ongoing dialogue between regulators and industry players, enabling both parties to gather insights and adapt their approaches based on real-world testing results.

Notable Examples of Blockchain-AI Regulatory Sandboxes

- Singapore: The Monetary Authority of Singapore (MAS) has implemented a regulatory sandbox for fintech innovations, which includes blockchain and AI applications, to spur economic growth while ensuring financial stability.

- United Kingdom: The Financial Conduct Authority (FCA) in the UK has established a regulatory sandbox to support fintech firms that are developing solutions utilizing blockchain and AI, fostering a culture of innovation while maintaining regulatory oversight.

- United States: Various states in the U.S. have initiated regulatory sandboxes targeting fintech innovations, encompassing blockchain and AI, to provide a framework for testing new technologies within a compliant structure.

The Future of Blockchain and AI in Regulatory Compliance

The integration of blockchain and AI is poised to significantly enhance regulatory compliance across industries through key emerging trends. Enhanced transparency and traceability in supply chains, supported by blockchain’s immutable records and AI’s risk analysis, are crucial. Automated compliance monitoring is evolving with AI enabling real-time audits and smart contracts that enforce compliance terms. Additionally, AI’s predictive analytics facilitate risk assessment and adaptation to regulatory changes. Blockchain strengthens data privacy through its encryption and AI-driven governance policies, while automated reporting enhances accuracy and efficiency. Blockchain also streamlines cross-border compliance by supporting global standards, and its integration with IoT improves real-time compliance monitoring.

Conclusion

The integration of blockchain and AI is set to revolutionize regulatory compliance across various industries. By leveraging blockchain’s decentralized and immutable ledger alongside AI’s analytical capabilities, organizations can enhance transparency, accuracy, and efficiency in compliance processes. Smart contracts automate compliance enforcement, reducing human error and manual oversight, while regulatory sandboxes foster innovation by allowing safe testing of these technologies.As regulatory landscapes continue to evolve, the synergy of blockchain and AI will be vital for organizations to navigate complexities, protect data, and maintain stakeholder trust. Embracing these solutions will not only mitigate compliance risks but also position businesses for future success and innovation.

FAQs

What is a known regulatory issue for blockchain adoption?

A well-known regulatory issue with blockchain adoption is the lack of clear legal frameworks across jurisdictions. Because blockchain operates on a decentralized, global scale, there is often confusion about which laws apply to transactions, especially in industries like finance, healthcare, and supply chain. This regulatory uncertainty makes it difficult for companies to fully embrace blockchain, as they must navigate differing national regulations and compliance requirements. Additionally, concerns about data privacy, such as compliance with the General Data Protection Regulation (GDPR) in the EU, pose challenges since blockchain’s immutability may conflict with rights like data deletion.

Will GRC be replaced by AI?

While AI can significantly enhance Governance, Risk, and Compliance (GRC) processes by automating monitoring, risk assessment, and decision-making, it is unlikely to fully replace GRC. Instead, AI will act as a powerful tool within GRC frameworks, augmenting human oversight rather than eliminating it. AI excels at processing large datasets in real time, detecting patterns, and providing predictive analytics, but human judgment remains essential for ethical decision-making, interpreting complex regulations, and addressing context-specific challenges. Therefore, AI will transform GRC by making it more efficient and responsive, but it won’t entirely replace the need for human-driven governance.

How can banks use AI for regulatory change management?

Banks can leverage AI for regulatory change management by automating the tracking and interpretation of new and evolving regulations. AI-powered systems can monitor regulatory bodies, analyze legislative updates, and assess how these changes impact a bank’s compliance requirements. By utilizing natural language processing (NLP) and machine learning, banks can leverage AI to classify, interpret, and prioritize regulatory changes, ensuring that they take necessary actions promptly.Additionally, AI can streamline workflows by automating compliance reporting, document management, and risk assessments, allowing banks to adapt quickly to regulatory shifts without overwhelming their compliance teams.

What is a high-risk AI system?

A high-risk AI system is one that poses significant potential for harm to individuals, society, or the environment due to its decisions or actions. Such systems are commonly employed in areas where incorrect outcomes or biased decisions can result in serious consequences. For example, in healthcare, they assist with diagnosis and treatment recommendations; in finance, they aid in credit scoring and loan approvals; in law enforcement, they support predictive policing; and in autonomous vehicles, they enhance decision-making processes. High-risk AI systems are subject to stricter regulatory scrutiny because of the potential for violation of rights, discrimination, or safety risks, and must meet higher standards of transparency, accuracy, and fairness.