Microfinance plays a crucial role in providing financial services individuals and small businesses in underserved regions, especially in emerging economies. However, credit scoring—the system by which lenders evaluate a borrower’s creditworthiness—has traditionally been biased, inaccessible, and reliant on limited data.

Financial inclusion is vital for economic growth, and the latest advancements in artificial intelligence (AI) and blockchain are reshaping the landscape of microfinance and credit scoring. By combining AI with blockchain technology, organizations are developing platforms that provide secure, transparent, and efficient financial services, making it easier for underserved communities to access capital. As these technologies merge, their ability to transform financial systems, especially in the realms of microfinance and credit evaluation, becomes increasingly evident. This convergence promises to unlock new opportunities and drive inclusive economic development.

The Importance of Microfinance in Emerging Economies

Microfinance is a game-changer in emerging economies, offering small loans and financial services to those often overlooked by traditional banks. Here’s why it’s vital:

- Financial Inclusion: Microfinance empowers the unbanked by providing access to credit, enabling marginalized communities to engage in economic activities.

- Economic Growth: By fueling small businesses and creating jobs, microfinance drives local economies and helps reduce poverty.

- Entrepreneurship: It fosters innovation by supporting startups and encouraging entrepreneurial spirit.

- Financial Literacy: Many MFIs provide training, helping borrowers make informed financial decisions and build resilience.

- Social Impact: Microfinance especially benefits women, enhancing their economic opportunities and supporting community development.

- Risk Management: Community-based lending approaches and diversified portfolios help manage risks and ensure sustainability.

In essence, microfinance is crucial for empowering individuals, driving growth, and promoting a more equitable society.

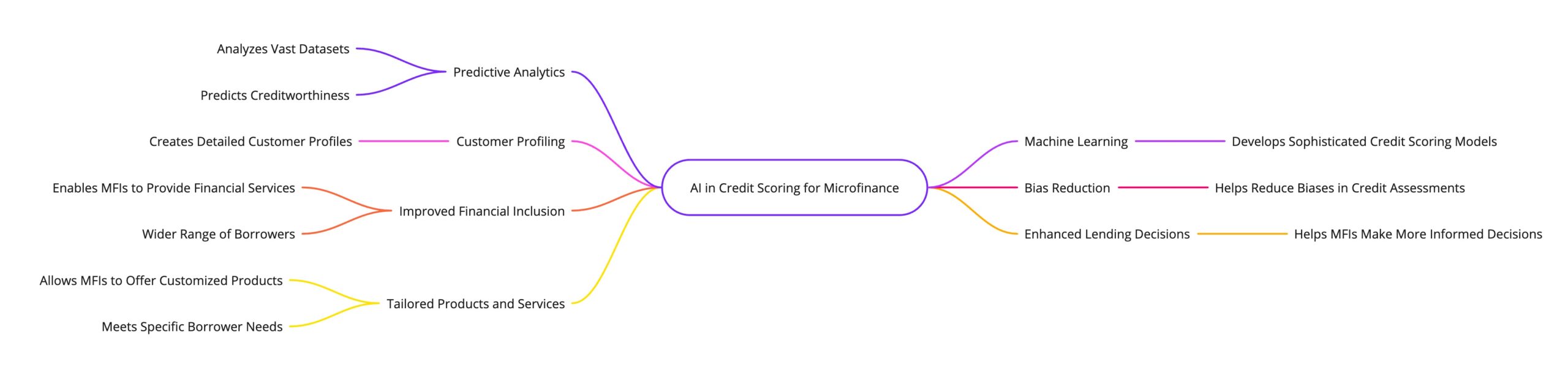

The Role of AI in Credit Scoring for Microfinance

Artificial Intelligence (AI) is transforming credit scoring in microfinance, addressing the limitations of traditional methods that often overlook key aspects of borrowers’ financial situations. The global AI in credit scoring market is expected to exhibit a CAGR of 26.5% from 2024 to 2029. Here’s how AI is making a significant difference:

Predictive Analytics for Credit Risk Assessment

AI algorithms can sift through vast amounts of borrower data—financial histories, demographic details, and behavioral patterns—to discern trends and predict creditworthiness with enhanced precision. This allows microfinance institutions (MFIs) to make more informed lending decisions and minimize loan default risks.

Machine Learning for Enhanced Credit Scoring

By employing machine learning, MFIs can create advanced credit scoring models that incorporate alternative data sources, such as mobile usage and social media activity. This innovation helps improve credit scores for individuals with limited or no credit history, broadening their access to microfinance loans.

Customer Profiling and Behavior Insights

AI can generate comprehensive customer profiles by analyzing various data points—demographics, financial behaviors, and social interactions. This information enables MFIs to customize products and services to meet borrowers’ specific needs, enhancing customer satisfaction and fostering loyalty.

Reducing Bias in Credit Assessments

Traditional credit scoring methods can inadvertently discriminate against certain groups, such as women and rural borrowers. AI addresses this challenge by developing inclusive scoring models that account for a broader range of factors, promoting fairness in credit assessments.

Blockchain’s Impact on Microfinance Systems

Blockchain technology is set to revolutionize microfinance, tackling key challenges and enhancing the efficiency and accessibility of financial services. Here’s how it’s making a difference:

Decentralized Lending Platforms

Blockchain enables the creation of decentralized lending platforms that cut out intermediaries, lowering transaction costs and expanding access for underserved communities. These platforms facilitate peer-to-peer lending, driving financial inclusion.

Transparent Credit Scoring

With blockchain, borrowers’ financial histories can be recorded transparently and immutably, leading to more accurate and unbiased credit scoring. This eliminates intermediary risks and protects the integrity of credit information.

Enhanced Trust and Fraud Reduction

The inherent transparency and immutability of blockchain help reduce fraud and bolster trust in financial services. By providing verifiable transaction records, it deters fraudulent activity and increases user confidence.

Tamper-Proof Financial Records

Blockchain creates permanent, tamper-proof records of financial transactions, ensuring data accuracy and reliability—especially beneficial for microfinance borrowers with limited documentation or credit history.

The Use of Smart Contracts in Microfinance

Smart contracts—self-executing agreements with coded terms—can significantly enhance microfinance systems. Here’s how:

- Automated Loan Disbursements: Smart contracts release funds automatically when specific conditions are met, ensuring prompt transactions.

- Efficient Repayment Processes: They automate repayment schedules, reducing administrative burdens and lowering default risks.

- Cost Reduction: Automation cuts operational costs for microfinance institutions (MFIs), allowing better resource allocation.

- Increased Transparency and Trust: Smart contracts provide an auditable record of transactions, fostering trust and minimizing fraud.

- Conditional Lending Models: They enable loans to be granted based on achieving specific milestones, promoting socially responsible lending.

- Peer-to-Peer Lending: Smart contracts facilitate direct connections between borrowers and lenders, broadening access to financial services and reducing costs.

In essence, smart contracts improve the efficiency and inclusivity of microfinance, making financial services more accessible and beneficial for borrowers.

Impact on Borrowers: Empowering Low Income Individuals

AI and blockchain technology are transforming microfinance by empowering low-income borrowers and enhancing their financial well-being. With AI-driven credit scoring models, even individuals with little or no credit history can gain access to loans, opening doors for those traditionally excluded from the financial system. Imagine needing urgent funds and having a streamlined process that allows for quick approvals and disbursements—this is now a reality thanks to the automation of loan applications. Moreover, the transparency of blockchain creates a trustworthy environment where borrowers feel secure in their transactions with lenders. Coupled with AI tools that offer financial literacy training, borrowers are equipped to make informed decisions and manage their finances effectively. Together, these innovations are not just providing financial resources; they are fostering a sense of empowerment and stability for low-income individuals, paving the way for a brighter financial future.

Case Studies: AI and Blockchain in Microfinance

Successful Blockchain-Based Microfinance Platforms

- Celsius Network: This innovative platform harnesses blockchain to offer decentralized lending and borrowing services. Users can earn interest on their cryptocurrency assets while accessing credit, making it a valuable resource for individuals and businesses seeking loans.

- Aave: A decentralized finance (DeFi) protocol that enables users to lend, borrow, and earn interest on various crypto assets. Aave has successfully provided microloans to individuals and small enterprises in developing regions, promoting financial inclusion.

- OmniLedger: This blockchain-based platform focuses on delivering microfinance services to underserved communities. By utilizing smart contracts, OmniLedger automates loan processes, ensuring transparency and building trust among users.

AI-Driven Credit Scoring Systems in Action

- LendTech: This microfinance platform employs AI-powered credit scoring models to evaluate borrower creditworthiness. By analyzing diverse data points, LendTech successfully extends loans to individuals who might otherwise be excluded from traditional financing options.

- Mosaic: Operating in Kenya, Mosaic utilizes AI to streamline loan application assessments. Its AI-driven credit scoring system enhances the accuracy of approvals and significantly lowers the risk of defaults.

Innovations in Decentralized Finance (DeFi) for Microloans

- Tokenized Assets: DeFi platforms are innovating by tokenizing assets like real estate or agricultural products, allowing them to serve as collateral for loans. This approach opens credit access for individuals and businesses lacking traditional collateral.

- Stablecoins: By utilizing stablecoins—cryptocurrencies pegged to stable assets like the US dollar—DeFi platforms offer more predictable and stable loan options, enhancing borrower confidence.

- Undercollateralized Loans: DeFi platforms are exploring undercollateralized loans, allowing borrowers to secure loans without having to provide full collateral value. This innovation helps expand credit access for underserved populations.

These case studies highlight the transformative potential of AI and blockchain in microfinance, showcasing how these technologies can improve financial inclusion, enhance lending processes, and create innovative solutions for underserved communities.

Conclusion

In summary, the fusion of AI and blockchain technology in microfinance is revolutionizing access to financial services, especially in emerging economies. By improving credit scoring, automating processes, and enhancing transparency, these innovations empower low-income borrowers historically excluded from traditional finance. Platforms like Celsius Network, Aave, and Mosaic illustrate the potential for these technologies to tackle challenges faced by underserved communities. As AI and blockchain advance, they promise not only to increase financial inclusion but also to foster sustainable economic growth, creating a more equitable society.

FAQs

1. What are the applications of artificial intelligence in financial services?

AI is transforming financial services through applications such as fraud detection, risk management, customer support via chatbots, algorithmic trading, and personalized financial advice. By analyzing data patterns, AI enhances decision-making and improves credit scoring accuracy, leading to greater financial inclusivity.

2. Does AI-based credit scoring improve financial inclusion? Evidence from online payday lending?

Yes, AI-based credit scoring improves financial inclusion by assessing a wider range of data, such as social media activity and transaction history. This allows lenders to offer loans to individuals with limited credit histories, thus bridging the gap for underserved populations and promoting fairer lending practices.

3. How is AI used in loan applications?

AI streamlines loan applications through automated underwriting, which speeds up approval processes. It utilizes technologies like optical character recognition (OCR) for document verification and predictive analytics to assess repayment risks, making the lending process faster and more accurate.

4. What is the role of AI in digital lending?

AI enhances digital lending by personalizing loan offerings based on customer data and automating credit scoring. It improves approval times and customer support with chatbots, while continuously analyzing data to mitigate risks and adapt lending criteria to market changes.