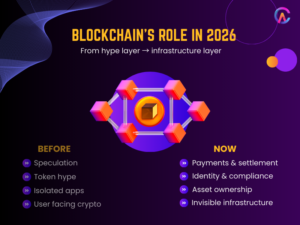

Blockchain in 2026 is evolving from just a trendy buzzword into a seamless infrastructure that quietly supports payments, identity verification, markets, and asset ownership behind the scenes. It’s starting to be seen in the same light as cloud technology and the internet, essential components that products depend on, even if they don’t always label themselves as crypto companies.

Here are the key blockchain trends that will define 2026, along with how Codearies is helping businesses leverage them.

1 Real world asset tokenization goes mainstream

Tokenization of real world assets is moving from experimental stages to full scale production, with billions of dollars in bonds, credit, real estate, and funds now represented on blockchain networks. This shift is creating new liquidity models and around the clock global markets that look quite different from traditional finance.

Key points

- By late 2025, the value of on chain real world assets surpassed thirty six billion dollars and is expected to grow at a much faster rate than the overall crypto market as we head into 2026.

- Tokenization now includes treasuries, corporate bonds, private credit, commodities, and carbon credits, moving beyond just early real estate projects.

- Regulators are increasingly rolling out compliance first frameworks, allowing banks, asset managers, and fintech companies to issue and trade real world assets with the necessary KYC, AML, and investor protections in place.

For everyday users, this means they can own fractions of assets that were once only available to institutions, and they can move or use them as collateral just as easily as they would with stablecoins.

2 Modular blockchains and data availability layers

Monolithic chains have a tough time scaling everything simultaneously, which is why modular architectures are stepping into the spotlight starting in 2026. In these modular designs, execution consensus and data availability are divided into specialized layers that can be mixed and matched like Lego blocks.

Key points

- Data availability networks like Celestia and modular frameworks such as Polygon 2.0 and EigenLayer’s restaking model are set to be key infrastructure innovations for the years 2026 to 2030.

- App chains and rollups can choose the DA layer that best meets their throughput and cost requirements, rather than forcing everything through a single Layer 1.

- This modular approach allows founders to create chains tailored for specific sectors like gaming, DeFi, or real world assets, instead of competing for space on a single crowded network.

For builders, modular stacks offer greater control over performance and fees, but they also introduce more design choices that demand expert architecture.

3 Zero knowledge proofs at scale

Zero knowledge proof technology is finally stepping out of the lab and becoming a practical foundation for privacy and scalability, especially on Ethereum and Layer 2 solutions. ZK allows systems to verify statements about data without actually revealing the data itself.

Key points

- ZK rollups like zkSync Era and Starknet are handling real world usage, while Polygon zkEVM provides EVM compatibility with ZK security.

- Trials from major companies, including Visa, around ZK based autopayments highlight the potential for private recurring payments on public blockchains

- ZK is also being utilized for identity and compliance, enabling privacy preserving KYC and proof of personhood while keeping personal data under wraps.

This combination tackles two long standing challenges, scalability and privacy, all without completely sacrificing decentralization.

4 Stablecoins and on chain payments beat traditional rails

Analysts are predicting that by 2026, stablecoins and on chain settlement will not only compete with traditional payment systems but may even outshine them in certain areas. These digital currencies allow for instant, borderless transactions in familiar denominations like dollars and euros.

Key points

- Research highlights stablecoins as the most promising fit in the crypto market, with payment startups integrating them into bank transfers, QR networks, and cards.

- Outlook reports suggest that stablecoins are set to surpass legacy systems in key markets as merchants and fintech companies embrace them for their speed and lower transaction fees.

- Both corporate and consumer wallets are increasingly merging stablecoins with local fiat currencies, giving users the flexibility to choose their preferred settlement method within the same applications.

For many users, stablecoins represent their first encounter with blockchain technology, often without them even realizing they’re engaging with crypto infrastructure.

5 DeFi 2.0 institutional friendly and integrated

Decentralized finance (DeFi) is evolving from experimental yield farming into robust platforms that institutions and corporations can actually utilize.

Key points

- Analysts anticipate that decentralized exchanges will account for over twenty five percent of spot trading volume by the end of 2026, thanks to improved user experience and growing on chain liquidity.

- Crypto backed loans in both DeFi and centralized finance (CeFi) are expected to surpass ninety billion dollars in outstanding loans, with a larger portion originating on chain.

- Institutional DeFi products featuring KYC pools, permissioned access, and real world asset (RWA) collateral are expanding as compliance frameworks become more established.

DeFi is gradually transforming into a programmable financial backbone for both crypto native and traditional businesses.

6 Interoperability and cross chain liquidity

The multi chain reality has arrived, and users now expect their assets and applications to function seamlessly across different chains, just like sending an email. Interoperability standards and cross chain messaging are designed to make the choice of blockchain almost invisible for most users.

Key points

- Interoperability layers and bridges that facilitate cross chain liquidity and messaging are becoming essential for token projects gearing up for launch in 2026.

- Predictions suggest that corporate and institutional Layer 1s will start to interoperate with public networks for settlement and liquidity as they transition from pilot programs to real world applications.

- App specific chains that connect through interoperable protocols help reduce fragmentation, allowing teams to create custom logic while still accessing shared liquidity.

Projects that overlook cross chain design may find themselves limiting their potential reach even before they officially launch.

7 Green and energy efficient blockchains

Sustainability is no longer just an afterthought, designing green blockchains is turning into a competitive edge and, in some cases, a necessity.

Key points

- Energy efficient proof of stake networks and carbon negative initiatives like Algorand and Energy Web are leading the charge in green blockchain efforts.

- Tokenized carbon credits and renewable energy certificates enable companies to monitor and offset their emissions on chains with verifiable records.

- Some forecasts indicate that regulators and major enterprises will favor or even require greener chains for compliance and ESG reporting.

This trend is prompting more projects to think about their energy profiles, consensus choices, and sustainability narratives right from the start.

8 Privacy and quantum resilience debates

As more value shifts onto the blockchain, the importance of privacy and long term cryptographic security is becoming increasingly urgent.

Key points

- Galaxy Research predicts that the combined market caps of privacy tokens will surpass one hundred billion dollars by the end of 2026, fueled by a growing demand for on chain privacy in light of stricter regulations.

- There’s a rising conversation about the potential threats posed by quantum computing to our current public key cryptography, with early experiments exploring quantum resistant solutions on Bitcoin and other networks.

- Zero knowledge (ZK) based privacy layers and selective disclosure identity solutions are working to balance the need for auditability with the necessity of user privacy.

Organizations that are planning infrastructure for the long haul are beginning to consider how to safeguard their cryptography and data privacy choices for the future.

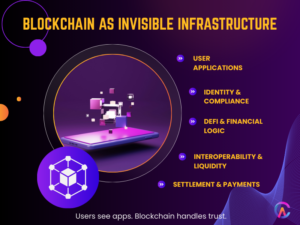

9 Blockchain as invisible financial and identity infrastructure

Several forecasts highlight a significant shift in perspective, suggesting that blockchain will evolve into a backend layer for settlement, identity, and registries, rather than just a trendy term for consumers.

Key points

- Predictions indicate that settlement layers, identity systems, ownership registries, and compliance aware ledgers will emerge as essential blockchain functions that users might not directly interact with.

- On chain identity credentials and verifiable credentials are set to streamline KYC processes across DeFi, CeFi, and fintech, enabling users to reuse trusted attestations.

- Governments and businesses are increasingly experimenting with or implementing registries for land titles, intellectual property, shares, and certifications, utilizing blockchain for its immutability and audit trails.

In this evolving landscape, the real winners are likely to be the applications and ecosystems that simplify complexity while harnessing the robust guarantees of blockchain technology behind the scenes.

10 Convergence of AI and blockchain

Finally, we’re seeing AI and blockchain come together in exciting ways, like tokenization, analytics, fraud detection, and AI driven payments.

Key points

- AI is stepping up to score tokenized assets, optimize collateral, and keep an eye on risks in both real world asset (RWA) and decentralized finance (DeFi) ecosystems.

- Experts predict that AI will lead the way in payments and on chain agents that can manage wallets, execute strategies, and engage with DeFi protocols, all without needing constant human oversight.

- By merging zero knowledge (ZK) proofs with AI models, we can achieve verifiable computation and privacy preserving AI applications, ensuring that results are trustworthy without revealing raw data or the inner workings of the models.

This intersection is set to give rise to new product categories that will require a blend of top notch AI engineering and deep blockchain knowledge.

How Codearies helps you build on 2026 blockchain trends

Codearies collaborates with founders, enterprises, and funds eager to turn the blockchain trends of 2026 into tangible products and business models, moving beyond mere presentations. With expertise in tokenization, DeFi, Web3 applications, and AI integration, Codearies serves as your comprehensive technical and product partner.

How Codearies supports future ready blockchain projects

-

RWA tokenization and DeFi design

Codearies assists in structuring and implementing tokenization models for various assets, including treasuries, real estate, credit, and funds. They design smart contracts, access controls, and integration pathways into DeFi protocols, all while prioritizing compliance first architectures.

-

Modular and interoperable chain architectures

The team is skilled at crafting solutions on existing L1s, L2s, or app chain frameworks, ensuring that cross chain messaging and liquidity routes are established. This way, your token or app is ready for multi chain operation right from the start.

-

ZK and privacy aware development

For projects that require privacy or compliance friendly proofs, Codearies incorporates ZK proof systems, identity credentials, and selective disclosure mechanisms into your product workflows.

-

Stablecoin and payment integrations

Codearies develops wallets, rails, and business logic that leverage stablecoins and on chain settlement for real world payments, payouts, loyalty programs, and B2B transactions.

-

AI plus blockchain convergence

When applicable, Codearies links AI models or agents to on chain assets and protocols, facilitating use cases such as AI managed portfolios, risk analytics, or autonomous treasury operations built on secure smart contracts.

By merging solid engineering with a forward looking perspective on the blockchain trends of 2026, Codearies ensures your project stays ahead of the curve rather than trailing behind.

FAQs

Q1: Which blockchain trend will have the biggest real world impact in 2026?

RWA tokenization and stablecoin based payments are anticipated to make the most significant real world impact, as they directly influence capital markets and everyday transactions while utilizing blockchains as an unseen backbone.

Q2: Is DeFi still relevant, or are institutions replacing it with private chains?

Analysts believe that DeFi will continue to capture an increasing share of spot trading and lending volumes, while institutions will leverage both public DeFi and permissioned or hybrid chains to meet various needs. This means public DeFi is here to stay and remains central to the ecosystem.

Q3: How does Codearies choose the right chain and stack for a new project?

Codearies evaluates your use case, user base, regulatory environment, and performance requirements before selecting the most suitable Layer 1s, Layer 2s, modular stacks, and interoperability layers. For instance, they might recommend Ethereum with rollups for DeFi, Solana, or modular Layer 2s for high throughput applications, or even specialized app chains for specific sectors.

Q4: Can Codearies help with both AI and blockchain in the same product?

Absolutely, Codearies can design and build systems where AI models or agents interact seamlessly with smart contracts, RWAs, and DeFi. This includes creating AI risk engines, AI trading agents, or analytics layers for platforms dealing with tokenized assets.

Q5 What is a realistic timeline to launch a blockchain product with Codearies?

Simple dApps or tokenization pilots can often move from design to mainnet in a few months while complex multi chain RWA or DeFi platforms typically launch in staged phases starting with a controlled MVP then expanding features assets and chain coverage as security and compliance milestones are met.

For business inquiries or further information, please contact us at