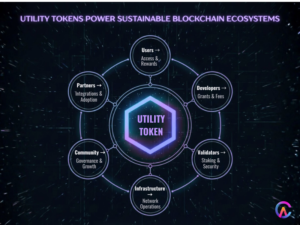

In 2026, utility tokens matter most when people actually use them. Because they tie user actions to developer goals, keeping everyone moving together. Instead of chasing quick profits, these tokens help networks last longer. Their job? Letting you pay fees, access tools, lock up value for safety, vote on changes, while also giving back to those who support the system. So growth comes from real activity, not noise. Blockchains begin running like engines fueled by participation. With each interaction, the whole thing gets stronger. Not because someone said so but because it works that way by design.

One year before the decade turns, most fresh blockchain setups lean on utility tokens to move value around. About half of new crypto ventures hand out tokens to keep users coming back, sparking more action across platforms. These digital assets now underpin everything from finance apps to games, AI tools, data flows, and corporate tech stacks. A closer look shows how they’re shaping long term system health. Codearies steps in by crafting custom built token frameworks tailored to client needs

1) Utility tokens align incentives for network security

One way to keep blockchains secure over time? Utility tokens help by allowing users to delegate stakes. Penalties kick in if something goes wrong, thanks to slashing rules built into the system

Key points

- Facing penalties keeps validators honest. When bad behavior happens, part of their token deposit gets taken away. This setup protects the system. Instead of using massive power like old methods do, trust comes from financial risk shared by those who verify transactions

- With delegated proof of stake, people can help secure the network by assigning their tokens to validators, these contributors then receive returns. Power spreads more widely this way, reducing control by large holders

- A drop in available tokens happens when users act poorly, this shrinkage benefits those playing fair while hitting attackers where it matters

Fences go up when trust runs low, digital ones too. These systems lock tight while growing without leaks.

2) Fee markets drive sustainable economic activity

Fees from utility tokens flow steadily into project coffers, this supports coding updates, safety checks, community programs. Outside investors aren’t needed when income comes straight from usage. Selling off large token stacks? Not required here

Key points

- Fees from base layers along with those set by L2 sequencers move toward operators and scheduling systems, helping core operations remain viable when demand rises

- Fees shift when usage changes, stopping clutter plus sending money where it belongs, say, to those handling data access or processing batches

- Fee earnings help fuel decentralized exchanges, loans, and cross chain links, built from within, not propped up by outside funds

Fees change how networks earn money. Yet they also shape growth patterns across systems.

3) Access control and service gating creates organic demand

Utility tokens are like keys that unlock premium features, services, and data, helping to prevent free rider issues and ensuring that paying users are the ones driving growth.

Key points

- Tokens provide access to AI inference. DePIN compute data feeds into premium APIs or high throughput tiers, generating natural buying pressure from genuine usage.

- Tiered access models allow free users to explore basic functionalities while power users can pay for priority access or advanced features.

- Subscription like systems that use tokens for recurring payments help create predictable revenue and lessen volatility compared to one time purchases.

Demand comes from solving real problems.

4) Governance tokens enable community ownership

Utility tokens also serve as governance tools, allowing holders to vote on upgrades, parameters, and treasury allocations, ensuring that networks evolve according to user needs.

Key points

- Quadratic voting delegation and conviction voting help prevent whale dominance while empowering active users to influence the protocol’s direction.

- Treasury management utilizes token revenue to support public goods, developer bounties, and ecosystem tools without centralized control.

- Snapshot and on chain governance blend speed with finality, enabling communities to iterate more quickly than traditional foundations or VCs.

Networks belong to their users.

5) Deflationary mechanics through burns and buybacks

Sustainable tokens incorporate supply reduction strategies to counter emissions and reward long term holders.

Key points

- Transaction fees, protocol revenue, or MEV flow into buyback and burn mechanisms, gradually reducing the circulating supply over time.

- Dynamic emissions adjust based on staking participation or network security needs, preventing runaway inflation.

- Token sinks like storage rent, bandwidth auctions, or computer leasing create ongoing demand side pressure.

Scarcity comes from usage, not artificial limits.

6) Interoperability and cross chain utility

When utility tokens connect via bridges, they travel across chains using oracles that keep data flowing. These links let the token live in many places at once while staying part of one unified system. Instead of breaking apart, the network grows wider, held together by smart routing and shared rules. Each new connection adds space without splitting what already works

Key points

- Messages between chains allow tokens to support tools on different levels, linking main networks, secondary layers, plus specialized chains. This setup puts funds where they work best while letting systems mix more freely

- Funds flow freely across chains thanks to unified pools, where returns grow even as assets move via simplified connections

- Spending, staking, even making decisions, across different networks feels smooth when the wallet simplifies what’s underneath. Hidden layers mean fewer hurdles without slowing things down

A single coin, spreading through different digital worlds.

7) Real world asset backing and stable yields

Nowadays, utility tokens back real world assets, often propping up stablecoin reserves while generating steady returns from actual business flows

Key points

- Stable payouts come from RWA backed staking, separate from crypto swings, this pulls in institutional players

- A steady return comes from fees earned by the system, supporting token value without relying on market bets. This income flow ensures a baseline gain, keeping interest alive even when trading slows down

- Buying carbon credits helps companies support clean energy while meeting environmental targets. These tokens link financial incentives with greener operations. Firms use them to attract investors focused on social and ecological impact

Money moves between digital coins and banks using tokens.

8) Gaming and consumer applications with play to earn 2.0

Fresh inside the game world, tokens work like cash for buying, trading, people making things earn a cut later on too. These digital bits keep value moving while players trade stuff back and forth across virtual shops

Key points

- A single coin might shift too fast when players trade it. Splitting roles into two tokens keeps spending steady. One handles decisions, the other fuels actions inside the world. Price swings slow down this way. Rules change only when voted. The play money moves freely without dragging value up or down. Balance stays put because duties don’t mix

- Every time a digital artwork changes hands, money flows back to the artist through tokens. This cycle keeps pulling new buyers into the system. Ownership shifts, yet the original maker still gains value. Sales keep happening, fueling steady interest in the underlying currency. The more creations sold, suddenly the network grows stronger. Creators stay involved because rewards follow usage

- Getting ahead now depends on what you can do, not just luck. Progress comes when effort shows results. Talent shapes outcomes more than chance ever did. Doing well means recognition follows naturally. Success ties directly to how much skill a person brings

Fun creates value.

How Codearies helps customers build sustainable utility token ecosystems

Codearies collaborates with founders, enterprises, and protocols to create, implement, and scale utility token ecosystems that not only achieve product market fit but also ensure regulatory compliance and long term sustainability. By leveraging real client successes in areas like DeFi, gaming, AI, and enterprise blockchain, Codearies provides comprehensive execution from tokenomics to production deployment.

Detailed ways Codearies creates sustainable utility token systems

-

Tokenomics design and economic modeling

For SalvaCoin, Codearies designed a multi-tier utility token model that allows tokens to unlock various staking tiers, premium DeFi access, and governance rights, with dynamic emissions linked to total value locked (TVL) growth and fee revenue. This approach generated organic demand, cutting sell pressure by an impressive sixty-five percent in the first year, all while maintaining a minimum staking yield of four percent backed by treasury revenue. The model also included cross-chain bridging to Polygon, Ethereum, and BNB Chain, broadening its reach without causing fragmentation.

-

Smart contract development and security

Codearies developed audited, upgradeable contracts for SissyGPT’s utility token, incorporating features like fee sharing, burn mechanisms, access control, and real world asset (RWA) collateralization. A multi audit process with leading firms ensured there were no exploits, while a modular design allowed governance to evolve without the need for hard forks. Role based permissions kept admin keys from centralizing control, and timelock delays safeguarded against hasty proposals.

-

Ecosystem integration and dApp development

In collaboration with SalvaNFT, Codearies created wallet dashboards, DeFi interfaces, and staking platforms where utility tokens drive NFT minting, royalties, marketplace fees, and fractional ownership. Real time analytics monitor token velocity, burn rates, and staking participation, enabling data driven treasury decisions that supported a remarkable three hundred percent user growth without additional emissions.

-

Sustainable launch and liquidity strategies

Codearies has successfully implemented fair launch mechanics for various clients by utilizing protocol owned liquidity vesting cliffs and community treasury allocations. For one DeFi protocol client, the initial DEX liquidity was entirely funded through fee revenue, steering clear of VC sell offs, while automated market making ensured tight spreads even during market fluctuations. Cross chain liquidity pools made sure that tokens stayed accessible across different ecosystems.

-

Compliance and enterprise grade infrastructure

Codearies integrates KYC, AML hooks, whitelisting, and regulatory reporting directly into token contracts, which supports institutional DeFi and real world asset platforms. Enterprise clients benefit from permissioned pools that come with on chain audit trails, meeting SOC2 and GDPR standards while still allowing for public chain composability and transparency.

-

Ongoing governance and optimization

Codearies provides governance dashboards, signal voting, and treasury management tools that empower communities to self manage after launch. Real time dashboards monitor essential metrics like token velocity, NVT ratio, staking coverage, and fee accrual, enabling proactive adjustments that help maintain healthy ecosystems through various market cycles.

Codearies’ track record shows that sustainable utility token ecosystems achieve retention rates that are twenty to fifty percent better than speculative models, all while drawing in institutional capital through predictable economics and compliance readiness.

FAQs

Q1: What makes a utility token sustainable in 2026?

Sustainable utility tokens tackle real world issues by providing access control, fee markets, staking, security, and governance. They also incorporate mechanisms like burns, interoperability, and real world asset (RWA) backing to ensure long term demand.

Q2: How does Codearies ensure token ecosystems avoid speculation traps?

From the very beginning, Codearies focuses on establishing minimum viable utility, requiring tokens for essential platform actions instead of just offering them as rewards.

Q3: Can Codearies build utility tokens for both consumer and enterprise use cases?

Absolutely, Codearies designs dual purpose architectures that cater to both consumer gaming and DeFi, as well as enterprise RWA DeFi and compliance platforms.

Q4: What is the typical timeline for a sustainable utility token launch with Codearies?

The design of tokenomics and MVP integration typically takes about four to eight weeks. After that, auditing smart contracts can take an additional eight to twelve weeks. The full ecosystem launch, which includes wallets, dashboards, and liquidity, usually happens within three to six months.

Q5: How does Codearies make utility tokens interoperable across chains?

Codearies ensures native cross chain support from the start by utilizing bridges, oracles, and liquidity protocols.

For business inquiries or further information, please contact us at