AI is shaking up the world of DeFi by transforming smart contracts from rigid rule based systems into flexible, self sufficient entities that can gauge market conditions, learn from data, and adjust their actions with minimal human oversight. Gone are the days of fixed interest rates, strict collateral requirements, and manual strategy crafting. Now, DeFi protocols are beginning to harness AI agents to enhance liquidity yields, manage risk, and execute trades in real time, making decentralized finance not only more efficient but also a bit more intricate and risky. This evolution paves the way for exciting new applications like self optimizing lending pools, autonomous market makers, and dynamic liquidation systems, but it also brings up important concerns about transparency, trust, and governance, especially when the code can adapt through learning.

From static smart contracts to autonomous agents

Traditional DeFi smart contracts operate on set logic, if the collateral ratio dips below a certain point, liquidate, if the price feed indicates X, then adjust the rate to Y. While these contracts are powerful, they lack the ability to adapt to context. Enter AI driven autonomous smart contracts, which introduce three key enhancements. They can gather more data from on chain activities, cross chain movements, and off chain signals. They learn from this data using techniques like reinforcement learning or predictive analytics. And they take action by tweaking parameters, choosing strategies, or initiating flows without waiting for manual governance decisions.

In practical terms, this means that the behavior of protocols can evolve over time. Lending platforms can identify the best collateral factors for various assets by monitoring volatility and user actions. Automated market makers can adjust their fee structures based on changing volumes and volatility. Liquidation bots can determine which positions to liquidate when gas prices surge or liquidity is low. The outcome is a more agile DeFi ecosystem that functions less like a static spreadsheet and more like a constantly evolving trading desk, all built on chain.

Where AI plugs into the DeFi stack

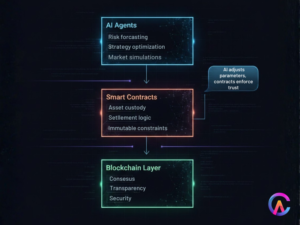

AI isn’t here to take over smart contracts at their core. Instead, smart contracts continue to serve as the reliable foundation for managing asset custody and settlement. Typically, AI finds its place in agents that interact with or adjust these contracts. A few interesting patterns are starting to emerge.

One of these patterns involves AI governed parameters. In this setup, governance determines which metrics an AI agent can manage, like interest rate curves, fee multipliers, or reward schedules. The agent operates off chain but regularly updates on chain contracts with new values through secure configuration calls. Another pattern is AI powered executors. These agents monitor the markets and carry out transactions such as arbitrage rebalancing or liquidations, all while adhering to predefined cap rules and safety checks stored on chain.

A third pattern features AI enhanced oracles and risk engines. Oracles can use anomaly detection to weed out unreliable price data, while risk engines can predict overall protocol risk through simulations and machine learning. These components don’t directly hold assets, but they significantly influence how smart contracts respond to real world events.

AI optimized lending and liquidity

Lending protocols are among the biggest winners when it comes to AI. Currently, most lending markets depend on static risk parameters like loan to value ratios, liquidation thresholds, and reserve factors, which governance updates periodically based on human analysis. This method is often slow and can lead to overreactions.

With AI, protocols can continuously assess risk for each asset, user cohort, and market condition. For instance, the system can learn that a specific token tends to become highly volatile during major events and can automatically tighten collateral requirements in advance. It can also identify concentration risk when one borrower dominates a pool and adjust incentives to encourage a more diverse mix of lenders or borrowers, reducing that risk.

When it comes to liquidity, AI can really help determine how much of the reserves should be lent out versus what should be kept as a safety net. It can also create dynamic interest curves that adjust based on usage and volatility in a nonlinear fashion, enhancing capital efficiency without compromising safety as much as traditional static curves tend to do.

Smarter automated market makers

Automated market makers (AMMs) initially relied on straightforward bonding curves that don’t need a centralized order book, but they often face issues like impermanent loss and can be less effective in volatile or thin markets. With AI driven liquidity management, these AMMs can become significantly smarter.

An AI agent can continuously track volume fluctuations and order flow, making real time decisions about where to allocate liquidity along a curve or across various pools. It might shift liquidity closer to the current price during stable market conditions and spread it out more when volatility increases. Additionally, it can adjust fees on the fly, raising them during turbulent times to better reward liquidity providers and lowering them during quieter periods to draw in more traders.

Over time, an AI powered AMM can learn the microstructure patterns of the market on each chain and trading pair, uncovering optimal configurations that would be nearly impossible to fine tune manually. For liquidity providers, this means potentially higher net returns and reduced uncompensated risk. For traders, it can lead to less slippage, especially with long tail assets.

AI driven liquidations and risk mitigation

Liquidations are one of the most delicate functions in DeFi. If they’re too aggressive, users face unnecessary liquidations, if they’re too slow, protocols can end up with bad debt. Traditional liquidation bots operate on basic rules, often competing against each other and wasting gas in the process.

With autonomous smart contract ecosystems, AI agents can plan liquidations in a more strategic manner. They can simulate future price movements and gas conditions to determine the best timing and order for liquidating positions. They can also route liquidations across multiple decentralized exchanges (DEXs) to minimize slippage and even coordinate partial liquidations to protect user health and reduce systemic shock.

AI isn’t just about liquidations, it can also spot flash loan attacks and oracle manipulations by analyzing typical transaction patterns and flagging anything that seems off. Smart contracts can then kick into safe mode, adjusting settings or pausing critical functions based on pre established rules whenever they detect suspicious activity.

Composable AI agents across DeFi

One of the standout features of DeFi is its composability. Protocols can stack on top of each other like Lego bricks. When you add AI into the mix, you get something called agent composability. For example, an AI yield optimizer can spread user deposits across various lending platforms and AMMs, using strategies that evolve over time. Another AI agent might focus on cross chain routing, figuring out the best places to deposit for optimal risk adjusted returns on each chain.

These agents could be owned by DAOs, share fees with token holders, and be governed on chain, while their models operate off chain within open frameworks. Over time, we could see a marketplace for AI DeFi agents emerge, where protocols integrate third party intelligence modules, similar to how they currently work with oracles and indexers.

New risks transparency and governance challenges

The benefits of DeFi come with some serious risks. It has always promoted itself as a transparent system where code is law, but AI, on the other hand, can often feel like a mystery. Those black box models can act in surprising ways or even be manipulated under certain conditions. When a model gets updated frequently, it can leave token holders and users scratching their heads, wondering what changes were made and why.

Then there’s the issue of accountability. If an AI driven change in parameters triggers a wave of liquidations or messes with a peg, who takes the blame? Is it the DAO that gave the green light? The developers who trained the model? Or the operators who rolled it out? Governance systems will need to set up clear guidelines, like limits on daily parameter changes, circuit breakers, and mandatory audits or stress tests for any new AI policies.

Bias and data quality are also big concerns. AI systems rely heavily on data, and if they’re trained on biased samples or tampered data, they can end up making poor or unfair decisions. To tackle this, DeFi will need to ensure that datasets are transparent, backtests are reproducible, and there’s community oversight on how models are trained and validated.

Design patterns for safer autonomous smart contracts

To enhance the safety of AI powered DeFi, several key design principles are coming to light. First, it’s crucial to keep custody and fundamental rules on chains that have immutable constraints, while allowing AI to adjust only secondary parameters within tightly defined limits. Second, we should implement multi layer kill switches, enabling governance or designated guardians to override or freeze AI decisions in emergency situations.

Third, we should prioritize interpretable models whenever possible, so stakeholders can understand the reasoning behind specific decisions. Even when we rely on complex models, we can add layers of explanation, dashboards, and scenario reports to ensure the system remains comprehensible. Fourth, it’s important to maintain robust simulation sandboxes where new AI strategies can be tested on historical and synthetic data before going live, with only a limited amount of capital at risk.

Lastly, we need to separate agent roles. It’s not wise to let a single AI control everything. Instead, we should use specialized agents with focused responsibilities, like pricing a specific set of parameters or managing a particular pool. This segmentation helps to minimize the impact if one agent encounters a failure.

How Codearies helps you build AI powered DeFi

Codearies is here to help DeFi projects transition from rigid smart contracts to smart, autonomous systems, all while prioritizing transparency, security, and governance. For teams working on AI driven DeFi platforms, Codearies kicks things off with an in depth discovery process. This involves mapping out your protocol design, tokenomics, and risk profile to identify clear automation opportunities, think dynamic interest rates, adaptive liquidity management, or AI monitors that keep an eye on security events.

The technical team then crafts layered architectures where core smart contracts manage assets and guarantees, while AI agents operate in controlled off chain environments, communicating through thoroughly audited interfaces. Codearies can also develop and integrate oracles, data pipelines, and analytics dashboards, ensuring that models receive clean, reliable signals and governance can effectively monitor outcomes. Machine learning specialists are on hand to help select the right models, ranging from simple statistical predictors to more complex reinforcement learning policies, depending on the intricacies of your protocol and your risk appetite.

When it comes to security, there’s no room for compromise. Codearies emphasizes rigorous testing of AI policies using simulation frameworks that replay historical DeFi events and adversarial scenarios, allowing you to see how autonomous decisions would perform under stress. Smart contract development adheres to best practices, complete with formal reviews and external audits when necessary, ensuring that AI stays within safe parameters. Governance tools like time locked changes, multi signature approvals, and on chain reporting of AI decisions keep your DAO and community informed and engaged.

Given that DeFi is all about composability, Codearies also assists in integrating your AI enhanced protocol into larger ecosystems, from aggregators and wallets to cross chain bridges, making sure that new autonomous behaviors harmonize with existing infrastructure. Whether you’re looking to upgrade an existing lending market, add AI layers to an AMM, or create a brand new fully autonomous DeFi primitive, Codearies is ready to provide comprehensive support, from architecture and development to analytics and long term optimization.

FAQs

Q1: What’s an autonomous smart contract in DeFi?

An autonomous smart contract in DeFi is a type of contract that automatically adjusts its key parameters or behaviors through AI agents, using real time data instead of just sticking to fixed rules or waiting for manual governance votes.

Q2: Why should a DeFi protocol even consider using AI?

AI enables DeFi protocols to respond more swiftly to market fluctuations, enhance capital efficiency, and manage risks in a dynamic way. This leads to improved yields and stability compared to relying on static parameter settings, all while ensuring that the final logic is executed on chain.

Q3: How does Codearies ensure the safety of AI driven DeFi systems?

Codearies creates strict on chain guardrails, employs sandbox simulations for testing new strategies, and puts in place overrides like time locks, change limits, and emergency controls. This way, AI can’t push protocols into risky situations.

Q4: Can Codearies collaborate with existing DeFi protocols instead of starting from scratch?

Absolutely, Codearies can integrate AI agents into existing contracts by adding configuration modules or auxiliary vaults. This allows protocols to enjoy adaptive behavior without the need to rewrite their entire codebase.

Q5: What’s the usual timeline for an AI powered DeFi project with Codearies?

Timelines can vary based on the project’s scope, but a focused pilot like AI optimized interest rates or liquidity rebalancing, can often be designed, tested, and integrated within a few months. Later phases can then expand to include more autonomous features and broader protocol coverage.

For business inquiries or further information, please contact us at