Blockchain technology is driving revolutionary changes across various industries, but few are as promising as real estate. As an industry traditionally reliant on face-to-face meetings, paper trails, and intermediaries, real estate is now seeing a digital transformation led by blockchain-based platforms. These platforms offer the potential to reduce inefficiencies, enhance transparency, and streamline property transactions, thereby democratizing real estate investments. With blockchain, real estate ownership is evolving into a more accessible and efficient process, making property transactions faster, more secure, and traceable.

What Are Blockchain-Based Real Estate Ownership Platforms?

Blockchain-based real estate ownership platforms are digital systems leveraging blockchain technology to manage, track, and facilitate property transactions. By utilizing decentralized ledgers, these platforms enable property transfers without the need for intermediaries, such as brokers or banks, ensuring transparency and reducing costs. Blockchain’s immutable nature creates a trustworthy environment where each transaction, ownership record, and contract is securely recorded. From tokenizing property assets to enabling fractional ownership, these platforms open new avenues for global investment and simplify the traditionally complex world of real estate.

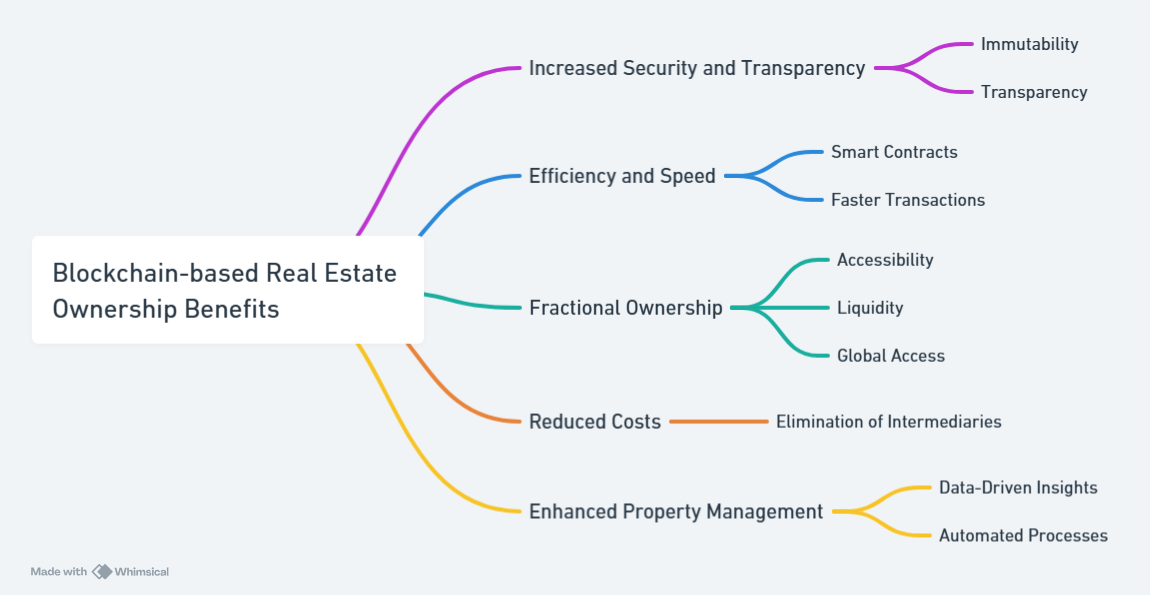

Key Benefits of Blockchain in Real Estate

Enhanced Transparency and Security

- Tamper-Proof Records: Blockchain’s immutable ledger ensures all property transactions remain unalterable, delivering highly reliable and verified information.

- Fraud Reduction: Blockchain’s transparent and secure framework minimizes the risk of fraudulent actions, protecting all parties involved in property transactions.

- Data Accuracy and Consistency: Through blockchain, property data remains consistent and accurate across the transaction lifecycle, preserving its integrity.

Improved Speed and Efficiency

- Smart Contracts: These self-executing contracts automate transaction processes, minimizing paperwork and speeding up real estate deals.

- Streamlined Transactions: Blockchain removes intermediaries, simplifying steps like title transfers and rental payments.

- Quicker Settlements: Secure blockchain systems facilitate faster property settlements, cutting delays and reducing costs.

Expanded Accessibility and Liquidity

- Real Estate Tokenization: Blockchain enables fractional ownership through tokenization, making real estate investments accessible to a broader audience.

- Higher Asset Liquidity: Tokenized assets can be bought, sold, and traded more easily, providing liquidity that’s traditionally rare in real estate.

- Cross-Border Transactions: Blockchain supports global real estate transactions, broadening market access for investors and owners.

Optimized Property Management

- Automated Payments: Smart contracts can streamline rent collection, ensuring timely, reliable payment flows.

- Tenant Verification: Blockchain can securely verify tenant identity and creditworthiness, lowering fraud risk.

- Clear Property Records: Property maintenance and repair records on the blockchain enhance transparency and foster stronger landlord-tenant relationships.

Applications of Smart Contracts in Real Estate

Property Sales

- Ownership Transfers: Automates ownership transfer upon receiving the agreed payment, reducing the need for manual verification.

- Timely Payments: Ensures payment deadlines are met, triggering title transfer accordingly.

- Fractional Ownership: Facilitates fractional property ownership, allowing investors to own portions of properties easily.

Property Rentals

- Automated Rent Collection: Rent payments are collected automatically, improving accuracy and ensuring timely cash flow.

- Lease Enforcement: Ensures that lease terms and conditions are met, reducing disputes and ensuring accountability.

- Lease Renewals and Terminations: Automates lease renewals or terminations as per pre-set conditions, simplifying tenant management.

Real Estate Management

- Maintenance Management: Automates the management of maintenance requests and work orders, improving response times and organization.

- Tenant Verification: Streamlines tenant screening and verification, reducing the risk of leasing to unqualified tenants.

- Fee Distribution: Distributes property management fees automatically, easing financial processes.

Real Estate Financing

- Automated Loan Processing: Disburses loan funds and manages repayment schedules autonomously.

- Enforced Loan Conditions: Ensures that loan terms are met, supporting both lenders and borrowers.

- Foreclosure Management: In cases of default, smart contracts can initiate foreclosure proceedings without the need for additional intervention.

Types of Blockchain Real Estate Ownership Platforms

Blockchain real estate platforms vary widely, from public blockchains accessible to anyone to private blockchains limited to authorized participants. Public blockchain platforms like Ethereum offer transparency, while private blockchains offer more control and privacy, often appealing to traditional real estate firms.The Real Estate Tokenization Market Size was valued at USD 2.81 Bn in 2023 and is predicted to reach USD 11.80 Bn by 2031 at a 19.9% CAGR during the forecast period for 2024-2031. Emerging blockchain real estate ownership platforms bring diverse approaches and benefits for investors. Here’s a look at some key types:

- Tokenization Platforms

Fractional Ownership: These platforms tokenize real estate assets, allowing investors to purchase fractional shares in a property, making real estate investment more accessible.

Improved Liquidity: Tokenization boosts asset liquidity, enabling investors to trade property shares more easily.

Examples: PropertyBlockChain, Harbor, RealT - Smart Contract Platforms

Automated Transactions: Smart contracts handle tasks like property transfers, rent payments, and lease renewals automatically.

Paperless Process: By digitizing paperwork, these platforms make transactions faster and more efficient.

Enhanced Efficiency: Smart contracts reduce transaction time and cut costs.

Examples: Propy, Ubitquity - Decentralized Land Title Registries

Immutable Ownership Records: These platforms record ownership on a blockchain, preventing tampering and fraud.

Secure Transactions: Blockchain’s cryptographic security ensures that property transactions are safe and transparent.

Example: Land Registry of Georgia - Real Estate Investment Platforms

Direct Investment Opportunities: These platforms let investors directly fund real estate projects, bypassing traditional middlemen.

Portfolio Diversification: Investors can spread investments across various properties.

Examples: RealBlocks, Pacaso - Metaverse Real Estate Platforms

Virtual Property Ownership: These platforms support buying, selling, and managing digital real estate in virtual worlds.

New Investment Horizons: Virtual property ownership opens doors to novel investment possibilities for individuals and businesses.

Examples: Decentraland, The Sandbox

Key Factors When Selecting a Blockchain Real Estate Platform

Security: Look for platforms with robust security measures to protect investments.

Transparency: The platform should provide clear insights into all investment stages.

Regulatory Compliance: Ensure the platform adheres to relevant legal standards.

User Experience: A straightforward, user-friendly interface is essential.

Reasonable Fees: Check for competitive fee structures.By evaluating these factors, investors can identify the best blockchain platform that aligns with their investment goals and requirements.

How to Invest in Blockchain-Based Real Estate Platforms

Blockchain technology is transforming real estate investment, offering new avenues through digital platforms. To invest in blockchain-based real estate, start with thorough research: understand the platform’s technology, team, and history, assess the real estate asset’s potential, and ensure regulatory compliance. Set up a secure cryptocurrency wallet—like MetaMask, Coinbase Wallet, or Trust Wallet—and fund it with cryptocurrency, often Bitcoin or Ethereum. Explore platforms like Propy or Atlant for tokenized real estate, and evaluate token offerings, including their utility and potential appreciation. Follow platform instructions to purchase tokens, noting any minimum investment requirements and associated fees. Finally, monitor your investment’s performance, staying informed about the underlying asset, token value, and relevant market or regulatory updates.

FAQs

How is Blockchain Used in Property Management?

Blockchain streamlines property management by automating rent collection, enforcing lease terms, and managing tenant data securely. Smart contracts handle tasks like maintenance requests and payments, reducing paperwork and errors while enhancing transparency and efficiency.

What is Real Estate Tokenization?

Tokenization converts real estate value into digital tokens on a blockchain, allowing fractional ownership. Investors can buy and trade property shares more easily, increasing liquidity and making real estate accessible to a wider audience.

What is REITs in Real Estate?

REITs (Real Estate Investment Trusts) are companies that own or finance income-producing properties. Investors buy shares, gaining exposure to real estate without buying property. REITs pay dividends from rental income, offering a simple way to invest in real estate.

What is NFT in Real Estate?

NFTs in real estate represent unique ownership or rights to a specific property on a blockchain. They make it easier to buy, sell, or transfer property ownership digitally, providing a secure and transparent ownership record.