Institutional adoption is set to revolutionize crypto, shifting it from a speculative asset class to a regulated financial infrastructure by 2026. Major players like banks, asset managers, pension funds, and corporations are ready to invest significant capital through ETFs, custody solutions, tokenization, and on chain settlement. In fact, over 76% of global institutional investors are planning to boost their digital asset exposure, with nearly 60% aiming for more than a 5% allocation in their portfolios. This shift is driven by clearer regulations, a more mature infrastructure, and tokenized real world assets that connect traditional finance with blockchain technology.

In this analysis, we’ll explore how institutional adoption is reshaping crypto markets, infrastructure, products, and opportunities in 2026. We’ll also take a closer look at how Codearies is helping enterprise founders and protocols navigate this evolving landscape successfully.

1) ETFs unlock regulated mass market access

Spot ETFs for Bitcoin, Ethereum, Solana, and other emerging altcoins are giving institutions a compliant way to invest, removing the hassles of direct custody and compliance.

Key points

- Spot Bitcoin and Ethereum ETFs now represent over $115 billion in professionally managed assets, attracting pension plans, family offices, and asset managers looking for regulated entry points.

- Big names like Morgan Stanley, Fidelity, and BlackRock are expanding their ETF offerings to include Solana, XRP, and various basket products, indicating a growing institutional comfort with crypto as a portfolio diversifier.

- ETFs are absorbing more than 100% of the new supply of Bitcoin, Ethereum, and Solana, providing ongoing price support while derivatives enhance liquidity for more sophisticated trading strategies.

ETFs are transforming crypto into a viable tradable asset class.

2) Regulatory frameworks enable institutional participation

The Clarity Act, MiCA, and the GENIUS Act, along with regional stablecoin frameworks, are paving the way for a more structured environment where institutions can confidently invest their capital.

Key points

- The US Clarity Act establishes a clear market structure, providing the crypto industry with a formal regulatory framework that’s crucial for compliance teams in institutions.

- In Europe, MiCA and Asia’s MAS stablecoin regime are creating scalable, compliant environments for tokenized assets and payments.

- As accounting standards evolve, companies can now hold crypto on their balance sheets with fair value treatment, which helps to minimize tax complications.

Regulation is becoming a facilitator rather than an obstacle.

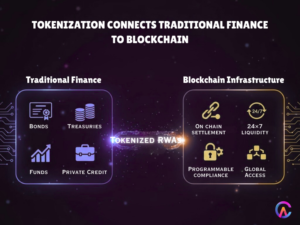

3) Tokenization of real world assets scales rapidly

Tokenized treasuries, bonds, private credit, and funds are unlocking billions of dollars, enabling liquidity with 24/7 settlement and programmable compliance.

Key points

- Platforms like BlackRock BUIDL, JPMorgan Onyx, and Goldman Sachs GS DAP are leading the way in institutional tokenization for regulated issuance and settlement.

- On chain treasury products are creating compliant yield instruments that attract conservative investors looking for blockchain efficiency without the speculative risks.

- The growth of tokenized real world assets (RWAs) is expected to outpace the broader crypto market, enhancing distribution, compliance, and secondary markets on chain.

Tokenization is bridging the gap between traditional finance and crypto.

4) Corporate treasury and balance sheet adoption

Public companies, corporations, and family offices are now viewing Bitcoin as a digital treasury reserve, with Strategy leading the pack at over 640,000 BTC.

Key points

- MicroStrategy’s rebranding and its substantial Bitcoin holdings signal the viability of digital asset treasury strategies.

- Corporations are increasingly using stablecoins for cross border payments, working capital, and yield generation, effectively sidestepping the friction of traditional banking.

- On chain settlement is lowering counterparty risk and capital requirements for B2B transactions.

Crypto is becoming a standard in the corporate world..

5) Institutional grade infrastructure matures

With qualified custody, prime brokerage, compliance tools, and API connectivity, crypto is becoming a practical reality for businesses.

Key points

- Coinbase Institutional, Fidelity Digital Assets, and various banks provide qualified custody with insurance and SOC2 compliance, catering to institutional needs.

- Prime brokerage services offer lending, margin execution, and portfolio management, seamlessly connecting centralized and decentralized finance.

- API connectivity allows for the integration of crypto into essential enterprise systems like ERPs, CRMs, and treasury management software.

This infrastructure aligns with the standards of traditional finance.

6) Stablecoins become institutional settlement layer

Regulated stablecoins are starting to replace outdated systems in crucial areas, enabling instant, borderless transactions.

Key points

- Stablecoins have surpassed a market cap of one trillion dollars, becoming the go to digital currency for payments, treasury management, and collateral.

- Banks, fintech companies, and corporations are utilizing stablecoins for redemptions, subscriptions, and B2B transactions under the MiCA GENIUS frameworks.

- JPM Coin and other enterprise stablecoins facilitate intraday settlements among institutional clients.

Stablecoins are driving global commerce.

7) DeFi becomes institutional compliant

Permissioned DeFi pools, KYC compliant lending, and real world asset collateral are attracting more conservative investors.

Key points

- Institutional DeFi is capturing an increasing share of lending and trading volumes through whitelisted pools and compliance measures.

- On chain vaults are packaging DeFi strategies into ETF like wrappers for wider distribution.

- Decentralized exchanges are managing over twenty five percent of spot volume with execution quality that meets institutional standards.

DeFi is catering to professionals.

How Codearies helps customers capitalize on institutional crypto adoption

CodeAries is your go to partner for comprehensive blockchain solutions, helping startups, enterprises, and funds embrace crypto like never before.

- Our expertise includes real world asset (RWA) tokenization platforms, utilizing Chainlink oracles, fractional ownership vaults, and Fireblocks custody to ensure compliance with the MiCA GENIUS Act.

- We create ETF compliant yield products, tokenized treasuries, and DeFi pools, all backed by audited smart contracts from Quantstamp and PeckShield, achieving an impressive 100k TPS scalability.

- Our vertical integration services streamline trading, custody, and compliance into cohesive stacks, cutting operational risks by 50% and speeding up mainnet launches.

- AI agents are on hand to monitor portfolios and execute hedges, all while ensuring privacy with ZK proofs across multi chain environments.

- Our development lifecycle encompasses everything from whitepapers and tokenomics to MVP audits, regulatory filings, and liquidity bootstrapping.

- We offer fixed price packages ranging from $100k to $500k, with milestone payments, enterprise retainers, and revenue share models tailored to meet institutional needs.

Reach out to CodeAries for compliant dApps, RWA platforms, and AI crypto agents. We provide full stack vertical integration to position your business at the forefront of the 2026 institutional wave. Our production ready deployments, along with CI/CD pipeline monitoring, ensure scalability, security, and regulatory alignment. Let us help you transform your projects into institutional grade assets that drive sustained growth and optimize your treasury revenue.

FAQs

Q1 What drives institutional crypto adoption in 2026?

In 2026, institutional crypto adoption is fueled by clear regulations like the Clarity Act, access to ETFs, tokenized real world assets (RWAs), and a robust custody infrastructure that allows institutions to invest with confidence. Clients of Codearies are tapping into these trends via compliance ready DeFi platforms, achieving an impressive one hundred million dollars in total value locked (TVL) from institutional sources in just their first year.

Q2 Which institutions lead crypto adoption?

The leaders in crypto adoption include BlackRock, Fidelity, JPMorgan, MicroStrategy, and Goldman Sachs, who are all making strides with ETFs, custody solutions, and tokenization platforms. Codearies is working hand in hand with these ecosystems to create Onyx compatible infrastructure that facilitates smooth institutional transactions.

Q3 How does Codearies make protocols institutional ready?

Codearies ensures that protocols are ready for institutional use by incorporating KYC, AML, whitelisting, audit trails, and enterprise APIs right from the start. This approach is exemplified by SalvaCoin’s institutional pools, which support SOC2 compliance, have zero exploits, and provide real time risk monitoring for family offices and hedge funds.

Q4 What is the timeline for an institutional ready crypto product with Codearies?

The compliance audited minimum viable product (MVP) is set to launch within eight to twelve weeks, while the complete institutional platform with custody API integrations will be ready in three to six months. SalvaCoin successfully reached its mainnet with institutional pools managing ten million dollars in assets under management (AUM) in just fourteen weeks.

Q5 Can Codearies serve both institutions and retail simultaneously?

Absolutely, Codearies has designed a dual access architecture that features permissionless public pools alongside whitelisted institutional access. SalvaCoin caters to retail DeFi users while its institutional pools support accredited investors, all benefiting from the same liquidity, composability, and governance.

For business inquiries or further information, please contact us at