In an era where financial crimes are becoming increasingly sophisticated, traditional fraud detection systems are struggling to keep up. The introduction of Quantum Computing-based AI models for fraud detection presents a game-changing solution. With the ability to process vast amounts of data faster and more accurately than classical methods, quantum computing is setting new standards in combating fraud.

As financial institutions deal with complex global transactions, integrating quantum computing with artificial intelligence provides a robust system that not only predicts fraud but also helps prevent it in real-time. This advanced technology promises to outpace traditional systems in detecting anomalies, learning from massive datasets, and refining algorithms to stay ahead of emerging fraud techniques.

Quantum Computing-Based AI Models: An Overview

Quantum computing is not merely an incremental improvement over classical computing; it represents a leap forward. Unlike classical systems, which use bits as the smallest unit of information (limited to 0s and 1s), quantum computers operate using qubits. These qubits can exist in multiple states simultaneously, thanks to the principles of superposition and entanglement. This allows quantum computers to process exponentially more data than classical systems.In fraud detection, this ability to analyze vast datasets and detect patterns across multiple dimensions in real-time is transformative. When AI models are integrated into quantum systems, they become even more powerful. These models can learn from vast amounts of data at unprecedented speeds, allowing them to identify fraud patterns that would be invisible to traditional methods.

How AI and Quantum Computing Revolutionize Fraud Detection

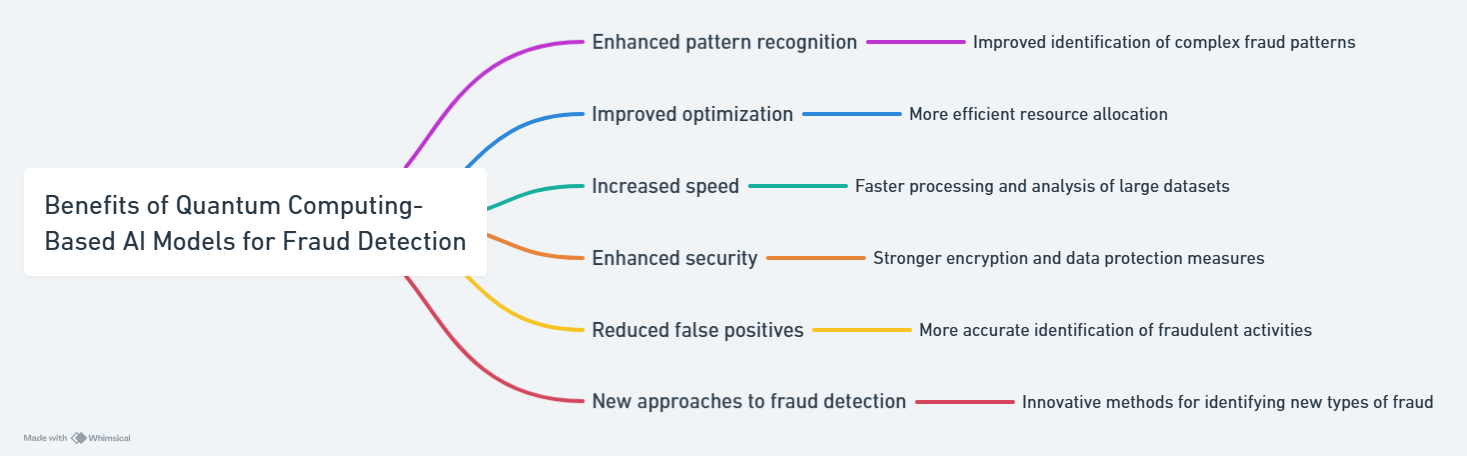

Traditional fraud detection relies heavily on rules-based systems and static algorithms. While effective in many cases, these systems can be rigid, slow, and prone to false positives. As fraudsters adopt more sophisticated techniques, these conventional systems often fall behind, unable to keep up with new patterns or methods. Quantum AI, however, changes the game entirely. By leveraging the power of quantum computing, AI models can analyze large, complex datasets faster and more efficiently. This not only enables more accurate fraud detection but also allows for real-time prevention. Financial institutions can now detect anomalies as they happen, preventing fraudulent transactions before they occur.Furthermore, quantum AI models improve over time. With every new piece of data they process, these models refine their algorithms, making them more effective at predicting and preventing fraud. The result is a dynamic, adaptive fraud detection system that evolves alongside the threats it is designed to counter.

Quantum AI, however, changes the game entirely. By leveraging the power of quantum computing, AI models can analyze large, complex datasets faster and more efficiently. This not only enables more accurate fraud detection but also allows for real-time prevention. Financial institutions can now detect anomalies as they happen, preventing fraudulent transactions before they occur.Furthermore, quantum AI models improve over time. With every new piece of data they process, these models refine their algorithms, making them more effective at predicting and preventing fraud. The result is a dynamic, adaptive fraud detection system that evolves alongside the threats it is designed to counter.

Why Traditional Fraud Detection Systems Fall Short

Traditional fraud detection relies on rule-based systems and classical machine learning, but these methods struggle with the complexities of today’s fraud landscape. Here are key challenges:

- Data Overload: Conventional systems often can’t manage the vast amounts of data from millions of daily transactions across various formats. As data volume grows, maintaining accuracy becomes difficult, and updating rules is time-consuming.

- Slow Processing Speeds: Fraud detection needs real-time analysis. Traditional systems are limited by linear processing, leading to delays that can allow fraud to occur before detection.

- Evolving Fraud Techniques: Cybercriminals continuously develop new methods, making it hard for rule-based systems to keep up. These models often rely on historical data, making them reactive rather than proactive.

- High False Positives: Rigid rules can lead to many legitimate transactions being incorrectly flagged as fraudulent, causing customer frustration and increased operational costs.

How Quantum Computing Addresses These Issues

Quantum computing presents a powerful solution to these challenges:

- Handling Massive Datasets: Quantum computers utilize qubits to process vast amounts of data simultaneously, allowing for efficient analysis of large datasets without compromising accuracy.

- Real-Time Processing Power: With their superior speed, quantum systems can analyze numerous potential fraud patterns in seconds, enabling immediate detection and intervention.

- Adapting to New Techniques: Quantum AI can quickly learn from new fraud patterns, allowing for proactive adjustments to detection methods, keeping pace with evolving criminal strategies.

- Reducing False Positives: By analyzing multiple factors simultaneously, quantum systems offer a more nuanced understanding of transactions, significantly lowering the rate of false positives.

Applications of AI and Quantum Computing in Fraud Detection

The combination of AI and quantum computing unlocks a range of powerful applications for fraud detection. Here’s a closer look at key areas:

Financial Fraud

- Credit Card Fraud: AI analyzes transaction patterns to flag anomalies. Quantum computing enhances this by processing vast datasets quickly, uncovering complex patterns that might be overlooked by classical methods.

- Money Laundering: Quantum algorithms can dissect large financial networks to expose hidden transactions, while AI builds predictive models to prevent future laundering.

- Insider Trading: By examining market data, social media, and employee behavior, AI can pinpoint potential insider trading. Quantum computing speeds up the analysis of extensive datasets for quicker detection.

Insurance Fraud

- Claim Fraud: AI detects suspicious patterns in claims by analyzing data from various sources. Quantum computing helps uncover complex correlations that indicate fraud.

- Policy Fraud: Quantum algorithms scrutinize policy applications to identify misrepresentations, while AI enhances underwriting processes to minimize fraudulent applications.

Cybersecurity

- Phishing Attacks: AI assesses email content and sender behavior to identify phishing attempts. Quantum computing boosts this by efficiently processing large volumes of data, catching more sophisticated scams.

- Malware Detection: Quantum algorithms analyze malware code to reveal new threats, enabling AI to create stronger antivirus solutions.

- Data Breaches: AI monitors network traffic for signs of breaches, and quantum computing accelerates this detection, identifying subtle indicators of compromise.

Supply Chain Fraud

- Counterfeit Products: AI evaluates product and supplier data to identify counterfeits. Quantum computing aids in recognizing complex patterns within supply chain networks.

- Supply Chain Disruptions: Quantum algorithms analyze data to detect anomalies, while AI utilizes this insight to mitigate risks and maintain operational continuity.

These examples illustrate how AI and quantum computing can significantly enhance fraud detection. As these technologies evolve, we can expect even more innovative solutions in the future.

Case Study: JPMorgan Chase’s Use of Quantum Computing in Fraud Detection

JPMorgan Chase, a leading global financial institution, has been actively exploring quantum computing to enhance its fraud detection capabilities.

The Challenge

With a landscape of increasingly sophisticated fraudulent activities—including credit card fraud, money laundering, and cyberattacks—traditional detection methods often fall short, struggling to keep pace with evolving threats.

The Quantum Solution

Recognizing the promise of quantum computing, JPMorgan Chase aims to:

- Enhance Pattern Recognition: Quantum computers can process vast datasets rapidly, revealing subtle anomalies that indicate fraud.

- Optimize Machine Learning Models: Quantum optimization can refine machine learning algorithms, boosting their accuracy and efficiency.

- Simulate Complex Scenarios: Quantum simulations help identify vulnerabilities in financial systems, allowing for better countermeasures.

Key Achievements

- Improved Fraud Detection: The bank has reported notable advancements in detecting fraudulent activities through quantum-inspired algorithms that uncover previously elusive patterns.

- Reduced False Positives: These systems lower the incidence of false positives, ensuring smoother transactions for legitimate users.

- Faster Response Times: Enhanced data analysis speeds facilitate real-time responses to potential fraud, minimizing losses.

Integrating Quantum AI with Current Systems: A Seamless Transition

Integrating quantum AI into existing fraud detection frameworks demands careful planning. Here are key strategies for a smooth transition:

Data Preparation and Quality

- Data Cleaning and Standardization: Ensure that training and testing datasets are accurate, consistent, and error-free.

- Feature Engineering: Identify or develop features that effectively highlight the nuances of fraudulent behavior.

Model Development and Training

- Hybrid Approach: Utilize both classical and quantum algorithms—classical methods for preprocessing and feature extraction, and quantum algorithms for advanced pattern recognition and optimization.

- Transfer Learning: Start with pre-trained models, either quantum or classical, and fine-tune them for specific fraud detection tasks.

Integration with Existing Systems

- API Integration: Create APIs or middleware to link the quantum AI model with current fraud detection systems.

- Data Pipelines: Set up efficient data flows to facilitate communication between the quantum model and other system components.

- Orchestration: Use orchestration tools to coordinate workflows across various elements of the system.

Testing and Validation

- Rigorous Testing: Conduct comprehensive tests to assess the quantum AI model’s fraud detection capabilities.

- Benchmarking: Compare its performance against traditional fraud detection methods.

- Continuous Monitoring: Establish monitoring systems to track performance and identify areas for enhancement.

Conclusion

The integration of quantum computing and AI in fraud detection represents a transformative shift in how financial institutions combat increasingly sophisticated fraud. By harnessing the unparalleled processing power of quantum systems, organizations like JPMorgan Chase are enhancing their ability to identify and prevent fraudulent activities in real-time. As these technologies continue to evolve, they offer promising solutions to the limitations of traditional methods, ensuring a more robust and adaptive approach to safeguarding against financial crimes. Embracing this innovation will not only improve detection accuracy but also foster greater trust and security in financial transactions.

FAQs

What AI algorithm is used for fraud detection?

Several AI algorithms are used in fraud detection. Decision Trees classify transactions based on features, while Random Forests improve accuracy by combining multiple trees. Neural Networks excel at recognizing complex patterns, and Support Vector Machines (SVM) find optimal classification boundaries. Anomaly Detection Algorithms, like Isolation Forests, identify outliers that may indicate fraud.

What banks use AI for fraud detection?

Many banks utilize AI for fraud detection. JPMorgan Chase enhances its detection capabilities, while Bank of America monitors transactions for anomalies using AI-driven systems. Wells Fargo employs machine learning for real-time fraud identification, and HSBC analyzes transaction patterns to improve fraud prevention.

What is Generative AI for fraud detection?

Generative AI creates new data based on existing datasets. In fraud detection, it simulates fraudulent scenarios, helping train models to recognize various fraud types. It also enhances limited datasets with realistic examples, improving model performance.

How is AI used in quantum computing?

AI and quantum computing intersect in optimizing quantum algorithms for tasks like fraud detection. Hybrid models combine classical AI with quantum computing for better pattern recognition. AI also aids in interpreting quantum results, facilitating efficient decision-making in fraud detection applications.