The crypto landscape in 2026 is stepping into a fresh chapter where institutional investment, real world applications, and clearer regulations take center stage, overshadowing the usual hype and memecoins, even though retail trends still influence prices. Analysts are calling this the beginning of an institutional era for digital assets, with Bitcoin and stablecoins providing stability in a maturing market, while the tokenization of DeFi and AI driven infrastructure quietly transform the financial framework behind the scenes.

Let’s dive into the current state of crypto in 2026 and explore how Codearies is empowering businesses to thrive in this evolving environment.

1) From speculative cycles to institutional era

Crypto in 2026 remains unpredictable, but the factors driving it are shifting. Instead of relying solely on the traditional four year halving cycles, research from Grayscale and 21Shares suggests that structural demand from ETFs, institutions, and real world assets will disrupt the old patterns and prolong this cycle.

Key points

- Grayscale anticipates that crypto will continue to experience a sustained bull market, with Bitcoin possibly surpassing previous highs, as the old four year cycle theory diminishes due to the stabilizing influence of institutional capital.

- 21Shares predicts increasing valuations across six major crypto sectors in 2026, emphasizing that on chain activity and institutional investments will play a more significant role than just retail speculation.

- CNBC interviews and forecasts consistently portray 2026 as the dawn of the institutional era, where digital assets are integrated into professional portfolios alongside equities and bonds, rather than being seen as niche investments.

While price fluctuations will persist, the fundamental drivers are gradually maturing.

2) Regulatory clarity and policy shifts

Regulation in 2026 has evolved from being just a looming concern to a vital enabler, especially following the policy changes that took place in 2025. Many jurisdictions have shifted from a punitive approach to a more proactive framework, allowing larger pools of capital to get involved.

Key points

- In the US, conversations around pro crypto legislation, including proposals like CLARITY and various stablecoin bills, have boosted confidence that crypto will be woven into the financial system instead of facing outright bans.

- Both the US and Europe are making strides in rulemaking for spot Bitcoin and Ethereum ETFs, along with clearer guidelines on custody, stablecoins, and tokenized deposits, paving the way for institutions to comply.

- According to Coinbase’s 2025 State of Crypto and institutional surveys referenced by the media, over eighty percent of institutional investors are looking to up their crypto investments, and more than seventy five percent plan to dive into tokenized assets by 2026, once the frameworks are established.

While regulatory risks still exist, the focus has shifted more towards the finer details rather than the existential threats in many key markets.

3) Institutional adoption ETFs and tokenization

Institutional adoption is shaping up to be the most significant structural narrative of 2026. With advancements in ETFs, custody solutions, and tokenization, crypto is now being recognized as a serious asset class by banks, funds, and corporations.

Key points

- The introduction of Bitcoin and Ethereum spot ETFs, along with emerging products like Solana and basket ETFs, provides pension funds, RIAs, and corporations with a regulated way to gain exposure. Predictions from Bitwise suggest that ETFs and their derivatives will purchase more than one hundred percent of the new BTC, ETH, and SOL supply in 2026.

- Reports indicate that traditional powerhouses like JPMorgan and Vanguard are rolling out tokenized money market funds and exploring tokenized deposits and stablecoin settlements through platforms like Kinexys.

- The growth of tokenized real world assets (RWAs), including treasuries, funds, private credit, and real estate, is expected to be a major driver, with some estimates suggesting that tokenized asset markets could soar into the trillions over the next decade, starting with 2026 as a pivotal year.

Crypto is gradually becoming part of mainstream financial infrastructure from balance sheets to back office settlement.

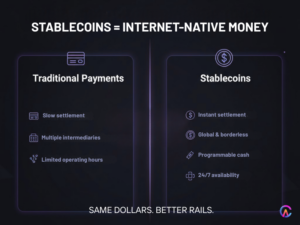

4) Stablecoins becoming the internet’s money

Stablecoins are quickly becoming the go to crypto solution for everyday transactions and treasury management in 2026. They offer digital dollars that can move at lightning speed while seamlessly connecting with both decentralized finance (DeFi) and traditional financial systems.

Key points

- According to 21Shares’ crypto outlook, stablecoins are projected to exceed a trillion dollars in market cap as they establish themselves as a fundamental part of global payment infrastructure.

- Silicon Valley Bank believes stablecoins will evolve into the internet’s dollar, especially as regulated fiat backed models gain momentum under frameworks like MiCA in Europe and US legislation such as the GENIUS Act.

- Reports on institutional adoption highlight that businesses are increasingly interested in stablecoins and tokenized cash due to benefits like quicker settlements, fewer intermediaries, and programmable cash flows for B2B and cross border transactions.

However, some analysts caution that stablecoins might destabilize weaker currencies in emerging markets, leading to new macroeconomic risks and increased regulatory scrutiny.

5) DeFi 2.0 UX compliance and yield

Decentralized finance has moved beyond its experimental yield farming phase. By 2026, serious DeFi projects are honing in on user experience, compliance, and sustainable yields, often backed by real world assets (RWA).

Key points

- 21Shares anticipates that DeFi will see rapid growth, driven by improved user experiences, clearer product market fit, and more professional liquidity provisioning.

- Institutional DeFi segments featuring KYC pools, permissioned participants, and tokenized treasuries or credit are expanding quickly, as institutions favor on chain transparency while requiring compliance tools.

- Predictions suggest that on chain vaults, sometimes referred to as ETFs 2.0, will double their assets under management by packaging DeFi strategies into user friendly tokenized wrappers for both retail and institutional investors.

DeFi is evolving into a programmable financial backend, with interfaces that resemble familiar fintech applications.

6) Token models and utility over pure speculation

Token design in 2026 is facing a lot more scrutiny. After experiencing several boom and bust cycles and airdrop crazes, both investors and regulators are now paying closer attention to real utility and sustainable economics.

Key points

- The token trend analyses for 2026 show a strong shift towards utility tokens, real world assets (RWAs), and governance tokens that have clear purposes. While pure meme cycles still exist, they’re becoming less important for serious builders.

- Projects that are launching now are more inclined to create tokens based on actual usage fees, access rights, and staking for security or governance, rather than just using them as fundraising tools.

- Regulatory frameworks that distinguish between utility tokens, security tokens, stablecoins, and RWAs are pushing teams to be clearer about their designs and disclosures.

This environment favors teams that view tokenomics as a part of product design rather than just a marketing strategy.

7) Convergence of AI and crypto

AI was the big story from 2023 to 2025, and by 2026, it’s becoming increasingly intertwined with crypto, influencing trading infrastructure, on chain analytics, and digital commerce.

Key points

- Predictions from Bitwise and Galaxy highlight the combination of AI and crypto as a key driver for new use cases, including AI agents that manage wallets, execute DeFi strategies, and handle on chain transactions.

- The outlook suggests that AI driven compliance, risk scoring, and RWA analytics are essential for safely scaling tokenization and institutional DeFi.

- Silicon Valley Bank anticipates that AI and crypto will work together to redefine digital commerce, with AI systems managing subscriptions, micropayments, and licensing through programmable money.

Teams that can blend strong AI engineering with a deep understanding of Web3 are in a great position during this phase.

8) Market structure consolidation and M and A

The crypto market landscape in 2026 is shaping up to be much more consolidated compared to just a few years back, with major players snapping up smaller firms in areas like exchanges, custody, and infrastructure.

Key points

- SVB is forecasting yet another record breaking year for mergers and acquisitions, as exchanges, custodians, wallets, and infrastructure providers combine their capabilities into more comprehensive offerings, all driven by institutional demand for complete solutions.

- Venture capital and late stage funding are likely to lean towards projects that demonstrate real revenue, have institutional clients, and maintain a strong compliance stance, rather than those speculative token launches that have been so common.

- Some reports indicate that the demand for investable companies might actually outpace supply, as institutional investors and large tech firms look to gain exposure to crypto infrastructure while steering clear of the risks associated with early stage ventures.

For founders, this means that standing out and delivering high quality execution is more crucial than ever.

9) Regional divergence and emerging market dynamics

The crypto scene in 2026 isn’t a one size fits all situation globally. Different policy attitudes and market conditions create a mix of opportunities and challenges.

Key points

- The US, EU, UK, Singapore, and UAE are generally moving towards a consensus on regulated digital assets, stablecoins, and tokenization, although they still have their own unique details to iron out.

- In emerging markets, there’s a notable rise in retail adoption of stablecoins and crypto solutions for remittances and as a hedge against inflation, but local regulators are often cautious, sometimes pushing activities offshore.

- Analysts point out that the strongest organic growth in crypto tends to occur where local currencies and banking systems are the weakest, making regulatory responses a politically sensitive issue.

Builders need to keep geo specific compliance and user experience in mind, rather than assuming a one size fits all approach will work.

10) Risks still present in 2026

Even as we look ahead to 2026, the crypto landscape still comes with its fair share of risks.

Key points

- The market remains highly volatile, especially during major macro events, regulatory news, and technical failures. Analysis suggests that Bitcoin could see both bullish and corrective trends as we approach late 2026.

- Issues like smart contract exploits, bridge hacks, and governance attacks are still prevalent, although the quality of infrastructure and security practices is gradually getting better.

- Regulatory overreach or misalignment, particularly concerning stablecoins, privacy, or DeFi, could disrupt certain business models or drive activity into less transparent areas.

Participants should focus on solid risk management instead of assuming that maturity guarantees safety.

How Codearies helps customers win in the 2026 crypto landscape

Codearies is here to help startups, enterprises, and funds navigate the evolving crypto landscape of 2026, turning those shifts into tangible products and real business results. Rather than just zeroing in on token launches, Codearies takes a comprehensive approach, managing everything from architecture to development and integration, all while keeping regulations in mind.

How Codearies supports clients in 2026

-

RWA tokenization and DeFi products

Codearies crafts and executes tokenization processes for treasuries, funds, real estate, and private credit. This includes everything from smart contracts and whitelisting logic to KYC compliant access controls and DeFi integrations that enhance yield and liquidity.

-

Stablecoin and payment solutions

The team develops wallets, merchant systems, payout solutions, and treasury tools that leverage regulated stablecoins and on chain settlements for cross-border and B2B transactions, all while adhering to compliance standards.

-

Institutional and enterprise Web3 stacks

Codearies assists banks, fintech companies, and corporations in integrating custodians, analytics, KYC providers, and on chain protocols into their current systems, transforming crypto from a mere experiment into a fully operational capability.

-

AI powered Web3 platforms

For projects at the intersection of AI and crypto, Codearies creates AI agents, dashboards, and analytics that engage with wallets, protocols, and tokens to automate trading, manage risk, and enhance customer experiences.

-

Full lifecycle delivery

From initial discovery and whitepapers to tokenomics, UX design, development, audits, and post launch optimization, Codearies serves as a single partner to guide crypto initiatives from concept to production and scaling.

With a unique blend of technical expertise and market insight, Codearies is perfectly positioned to assist clients in building within the current state of crypto in 2026, utility focused, institutionalized, and brimming with opportunities.

FAQs

Q1: Is 2026 expected to be bullish or bearish for crypto?

Insights from Grayscale, 21Shares, and Silicon Valley Bank indicate a generally bullish outlook, fueled by institutional investment, stablecoins, and tokenization, even though we can still expect price volatility and corrections.

Q2: Are institutions genuinely committed to crypto, or are they just testing the waters?

Surveys and reports reveal that over eighty percent of institutional investors plan to boost their digital asset exposure, and more than seventy five percent aim to invest in tokenized assets by 2026. Developments like ETFs, custody reforms, and tokenization pilots suggest a long term commitment.

Q3: What are the biggest real world use cases right now?

Prominent use cases include stablecoin payments, real world asset tokenization, institutional DeFi treasury management, and on chain market infrastructure, along with niche areas like prediction markets and creator economies.

Q4: How does Codearies approach regulation and compliance in projects?

Codearies collaborates with your legal and compliance teams to translate regulatory requirements into technical frameworks. This includes things like permissioned pools, whitelists, KYC integrations, logging, and geo fencing, all while striving to keep protocols as open and composable as possible.

Q5 What is a typical timeline to launch a serious crypto product with Codearies?

MVPs for targeted products like a DeFi vault, RWA token pilot, or a stablecoin based payment app can often be launched within a few months. In contrast, multi jurisdictional institutional platforms and intricate token ecosystems typically roll out in phases, depending on their scope, security, and regulatory reviews.

For business inquiries or further information, please contact us at