The financial technology sector is experiencing a significant change due to improvements in artificial intelligence, particularly the rise of Large Language Models (LLMs). These AI systems are changing how financial institutions handle data, connect with customers, spot fraud, and streamline complex tasks. As we approach 2025, LLMs have become essential tools for creating smarter, safer, and faster transactions that benefit consumers, businesses, and regulators.

This blog examines the emergence of LLMs in FinTech, their main applications, advantages, challenges, and how Codearies helps companies leverage their potential to drive innovation, compliance, and user trust.

What Are Large Language Models (LLMs)?

Large Language Models are deep learning models trained on large datasets to understand, generate, and analyze human language. Using techniques like transformer architectures and natural language processing (NLP), LLMs can perform tasks such as summarizing text, translating languages, analyzing sentiments, and answering complex questions with great accuracy and fluency.

In FinTech, LLMs apply these abilities to financial documents, trading data, regulatory texts, customer communication, and more, allowing for greater automation and insights.

Why LLMs Are a Game Changer for FinTech

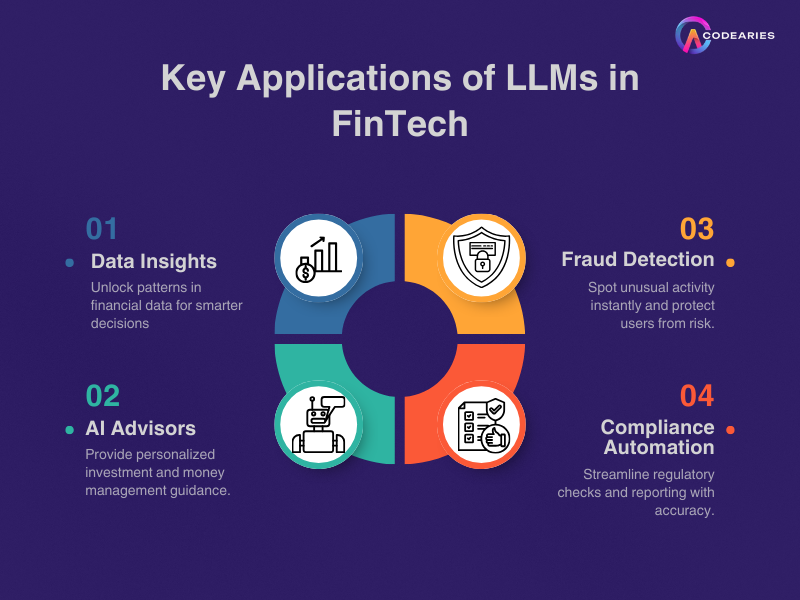

Advanced Data Processing and Insights

FinTech generates huge amounts of structured and unstructured data, including transaction logs, news articles, earnings calls, and social media discussions. LLMs can analyze and connect these various sources to reveal actionable insights, market sentiments, and risk signals that traditional tools might overlook.

Personalized Financial Advice at Scale

LLMs enable hyper-personalized financial guidance. By looking at historical behavior, goals, and market conditions, AI advisors can suggest tailored savings plans, investment portfolios, or credit offers to millions at once.

Enhanced Customer Support

Smart chatbots and virtual assistants can understand complex financial terms, engage in multi-turn conversations, and provide real-time help. They assist with tasks like opening accounts and troubleshooting payments, improving customer satisfaction and reducing the workload for human staff.

Improved Fraud Detection and Risk Assessment

LLMs can analyze behavior patterns, transaction flows, and external data to spot anomalies, flag suspicious activities, and continuously refine fraud prevention strategies at scale.

Automated Compliance and Reporting

Regulatory environments—especially in finance—are complicated and constantly changing. LLMs help interpret regulations, monitor transactions for compliance issues, and automate the creation of audit-ready reports, reducing manual effort and mistakes.

Real-World Applications and Case Studies

Personalized Customer Engagement

JPMorgan Chase uses AI-powered systems that analyze transaction data with LLMs to provide timely, personalized financial advice, increasing app engagement by 30%.

Intelligent Support Bots

Kasisto’s KAI Platform utilizes LLMs to power chatbots that can handle intricate banking questions, allowing human agents to focus on more impactful tasks.

Fraud Detection Innovation

Mastercard’s Decision Intelligence employs LLM-enhanced analytics to cut false declines by half while maintaining high standards for fraud detection.

Document Processing and Summarization

LLM-powered tools produce clear and accurate summaries of earnings reports and regulatory filings, speeding up decision-making.

How LLMs Improve Core FinTech Operations

- Speed: Automating complex text analysis and communication speeds up customer journeys and internal processes.

- Accuracy: Deep contextual understanding reduces human mistakes in customer service and compliance.

- Scalability: Companies can manage spikes in demand without needing to hire a large number of additional staff. .

- Insight: Predictive analytics blend market and customer data for proactive financial management.

Challenges and Considerations

- Data Privacy: Managing sensitive financial data needs strong encryption, anonymization, and compliance with data protection laws like GDPR and CCPA.

- Bias and Fairness: LLMs may reflect biases present in their training data, which can affect credit decisions and customer treatment.

- Model Explainability: Financial decisions need transparent reasoning; “black-box” AI can raise compliance concerns.

- Integration Complexity: Embedding LLMs into legacy systems demands skilled engineering and change management.

The Future of LLMs in FinTech

- Multimodal LLMs: Combining text, speech, and image data for richer analysis.

- Federated Learning: Private model training across institutions without sharing sensitive data.

- RegTech and InsurTech Expansion: Automated detection of regulatory changes, policy review, and claims processing.

- Hybrid Human-AI Workflows: Augmenting analysts and advisors rather than replacing them.

How Codearies Empowers FinTech Innovation with LLMs

At Codearies, we combine strong AI knowledge, a focus on security, and financial expertise to help clients develop and expand LLM-powered FinTech solutions that have a meaningful impact.

Our Services Include:

- Custom LLM Model Development & Fine-Tuning: Adapting models to your specific financial data and customer needs for maximum accuracy and relevance.

- Conversational AI & Intelligent Assistants: Creating chatbots and voice agents that handle complex banking questions and transactions with human-like understanding.

- Fraud Detection & Risk Analytics: Building flexible machine learning systems that spot suspicious patterns and lower exposure to risk.

- Regulatory Tech Integration: Automating compliance reporting, transaction monitoring, and audit tasks using AI-powered tools.

- End-to-End Platform Development: Covering everything from API integration to frontend and backend development to deliver scalable, secure, and compliant platforms.

- Ongoing Support & Monitoring: Making sure models stay accurate, secure, and in line with changing regulations and business goals.

With Codearies as your partner, you get a reliable guide to unlock the full potential of AI while addressing the risks associated with financial applications.

Frequently Asked Questions

What types of financial use cases benefit most from LLMs?

LLMs improve any text-heavy, data-intensive financial application such as fraud detection, customer engagement, regulatory compliance, credit scoring, and investment advice.

How does Codearies ensure compliance with strict financial regulations?

We integrate compliance from model intake to output, including KYC/AML checks and detailed audit trails that align with GDPR, PCI-DSS, and local laws.

Can you customize LLMs for niche financial sectors?

Certainly. Whether in retail banking, insurance, asset management, or payments, we adjust models using proprietary and domain-specific data for better performance.

Do LLMs replace human analysts?

No, They enhance human skills by managing routine data and questions while allowing professionals to concentrate on complex problem-solving and strategy.

How does Codearies support post-deployment AI models?

We provide ongoing monitoring, retraining, security updates, and feature improvements to maintain accuracy and compliance.