In the digital era, technology is changing how we use money, assets, and data. One major innovation driving this change is tokenization. This process turns real-world and digital assets into tokens based on blockchain technology. While much of the financial conversation focuses on cryptocurrencies and NFTs, tokenization is a much bigger force. It is set to redefine ownership, liquidity, and access for a wide range of valuable items.

This guide will explore what tokenization means, why it matters, real-world examples, the technology behind it, challenges, and future trends. It will also explain how Codearies helps organizations and creators harness the full potential of tokenized assets.

Understanding Tokenization

Tokenization is the digital representation of ownership or rights to an asset, whether physical or digital, on a blockchain. Essentially, any item of value—like money, real estate, art, stocks, intellectual property, carbon credits, or loyalty points—can be turned into a cryptographic token that exists and can be transferred through decentralized networks.

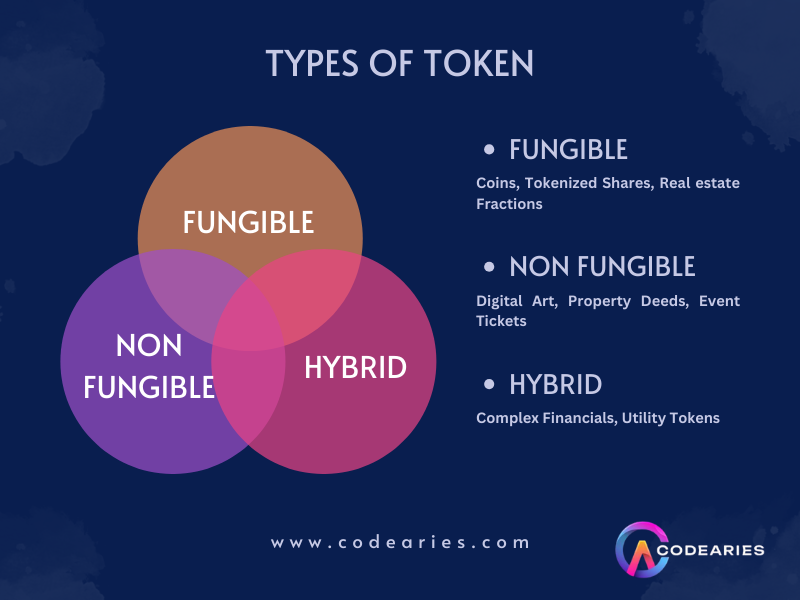

Token Types in a Nutshell

- Fungible tokens: Represent identical and interchangeable units (e.g., cryptocurrencies like USDC, tokenized shares, fractional ownership of real estate).

- Non-fungible tokens (NFTs): Represent unique assets (e.g., digital artwork, event tickets, property deeds, in-game items).

- Hybrid tokens: Combine features of both for complex financial instruments or utility tokens.

At its heart, tokenization is about improving security, programmability, efficiency, and accessibility for assets. It removes barriers caused by geography, middlemen, and outdated systems.

Why Tokenization Matters

1. Unlocking Liquidity

Many high-value assets, like real estate, private equity, and art collections, are illiquid. This means they cannot be quickly sold or divided. Tokenization allows for fractional ownership, dividing assets into thousands or millions of tokens, each representing a share. This gives a much wider pool of investors access to these assets and releases value that is otherwise tied up in hard-to-sell items.

2. Borderless, Instant Transfers

Tokens can be sent, traded, or settled in seconds from anywhere in the world, around the clock, without needing third-party approval. This simplifies cross-border transactions and eliminates delays often caused by traditional banking hours and high wire fees.

3. Transparency and Security

All transactions are permanently recorded on blockchains. Smart contracts help automate complex rules, distributions, or compliance, allowing every movement to be tracked in real-time. This significantly reduces errors, fraud, and disputes.

4. Programmability and New Business Models

Tokens aren’t just digital representations; they can also include built-in logic—such as royalty payments on resales, voting rights, time-based unlocks, or interoperability across different platforms. This leads to a wide array of new products, services, and revenue models.

5. Democratized Ownership

Tokenization opens the door for everyone to invest in fractionalized assets, whether it’s a Manhattan skyscraper, a piece of a music catalog, or a social impact bond. This access is no longer limited to large institutions or wealthy investors.

How Tokenization Works: The Technology

- Asset Selection: Identify any valuable asset, whether physical or digital, for tokenization.

- Legal/Regulatory Structuring: For regulated assets, such as securities or real estate, compliance structures are developed.

- Digital Representation: The asset’s value or rights are encoded into tokens, typically using smart contracts on blockchains like Ethereum, Polygon, or Solana.

- Custody & Management: For physical assets, a legal entity or custodian holds the actual item (like a bank vault for gold). For digital assets, custody is managed by wallets or platforms.

- Distribution & Trading: Tokens are distributed through sales or airdrops and can be traded on various exchanges or marketplaces.

Real-World Use Cases: Tokenization in Action

1. Real Estate

- Fractional property ownership: Platforms like RealT, Propy, and Brickblock let investors purchase tokens that represent shares in real estate, allowing them to earn proportional rent or gains from resale.

- Global access: Investors anywhere can participate in real estate markets that were once limited by location or regulatory complexities.

2. Art, Collectibles & Luxury Goods

- Tokenizing art (through platforms like Masterworks and Artory) or rare items (like Rolex watches and fine wines) allows buyers to claim part-ownership, trade, or use their shares as collateral.

- NFTs also authenticate digital-only artwork and enable programmable royalty payments.

3. Equities and Finance

- Security Token Offerings (STOs): Tokens represent private company shares, bonds, or funds with automated compliance and dividend distributions.

- DeFi tokens: Synthetic tokens that mimic stocks, indexes, or commodities, making them accessible to everyone.

4. Supply Chain and Commodities

- Tokenized carbon credits, metals, and agricultural products can track origins, certify sustainability, and create tradeable markets for previously difficult-to-manage instruments.

5. Gaming, Tickets & Loyalty Programs

- In-game assets, tickets, rewards, and loyalty points can be issued as tokens that can be traded, upgraded, or transferred between different platforms.

6. Intellectual Property & Royalties

- Authors, musicians, and inventors can tokenize their royalty streams or rights, allowing for immediate, fractional royalty payments and transparent settlements.

The Tokenization Workflow

- Asset identification and valuation

- Smart contract/model selection (ERC-20, ERC-721, or custom)

- Legal framework mapping (especially for real-world/regulated assets)

- Minting tokens and initializing ledger entries

- Offering, trading, and lifecycle management via compliant, user-friendly interfaces

- Custody and settlement protocols

Challenges and Considerations

Regulation: Tokens that represent securities or real estate must follow local and international laws.

Custody: It is essential to ensure the strong link between the digital token and the actual asset, and that those assets remain secure.

Interoperability: As tokens spread across various blockchains, standards and bridges are necessary for universal liquidity and function.

User Experience: Widespread acceptance relies on easy-to-use wallets, simple onboarding, and clear interfaces; these issues are still being addressed.

Valuation/Standards: New token categories challenge traditional methods of valuation, accounting, and transfer standards.

The Future of Tokenization

- Tokenized Securities and Traditional Finance: Expect a global shift toward tokenized stocks, bonds, funds, and even derivatives in mainstream markets.

- Tokenization of Everything: From real-world assets to creative works, tickets, intellectual property, and even reputations—tokenization will touch almost anything that can be owned, tracked, or valued.

- Programmable Ecosystems: Industry-specific platforms will enable seamless flow of assets, payments, and rights via composable smart contracts.

- Inclusive Investing: Widespread democratization as anyone, anywhere can take part in opportunities that were once the exclusive domain of big investors or institutions.

How Codearies Empowers Your Tokenization Journey

At Codearies, we make the tokenization revolution accessible, secure, and effective for businesses, creators, and communities around the world. Whether you want to unlock the value of physical assets or digital goods, start an investment platform, or build a token-driven economy, Codearies offers full service.

Our Core Offerings Include:

Custom Token Design & Engineering:

We create fungible and non-fungible tokens (NFTs, security tokens, utility tokens) that suit specific business models, asset types, and legal requirements.

Asset Tokenization Platforms:

From tokenizing real estate to managing commodities or royalty streams, we develop scalable, compliant systems to securely issue, manage, and distribute your tokens.

Marketplace & Exchange Development:

We design user-friendly, compliant marketplaces and exchanges that can onboard both retail and institutional clients with seamless wallet integration and strong security measures.

Legal & Regulatory Compliance:

Our legal and compliance team works to ensure your token meets all local and international regulations—especially for securities and financial assets.

Smart Contract Audits:

We prioritize security by rigorously auditing and testing all smart contracts to avoid vulnerabilities and ensure dependable operations.

UI/UX & Customer Experience:

Our designers create easy-to-use wallets, dashboards, and user flows for both Web2 and Web3, promoting widespread adoption and minimizing complexity.

Lifecycle Support:

Codearies provides long-term support for token management, upgrades, regulatory compliance, and secondary market development.

Partnering with Codearies allows you to turn the complex idea of tokenization into an actual, revenue-generating product that emphasizes security, compliance, and user empowerment.

Frequently Asked Questions (FAQ)

What types of assets can Codearies help tokenize?

Almost anything! Real estate, equity, art, intellectual property, commodities, loyalty points, event tickets, creative royalties—if it holds value, Codearies can help design, secure, and launch its digital token representation.

How does Codearies ensure our tokenization project complies with regulations?

We work closely with top legal experts to align your project with current laws (like securities, KYC/AML, and property rights) worldwide, and we design smart contracts and onboarding processes to ensure your tokens are both innovative and compliant.

How can tokenization benefit small businesses or creators?

It opens up access to global funding, fans, and investors. It allows for fractional ownership of high-value assets, automates royalty payments, and creates new revenue models through NFTs, loyalty programs, and DeFi integrations. Codearies customizes solutions for every scale and audience.

Can Codearies integrate tokenization solutions with existing platforms or apps?

Yes! Our team specializes in modular integrations, allowing wallets, token features, and marketplaces to fit into your current digital setup, whether it’s mobile, web-based, or made for enterprises.

What support does Codearies provide after launch?

We offer complete lifecycle support, including technical maintenance, security upgrades, regulatory updates, feature expansion, customer support, and strategies to evolve your tokenized ecosystem as your needs change.