The financial services industry has seen major changes in recent years. At the center of this shift is blockchain technology. With its promises of decentralization, transparency, and efficiency, blockchain has sometimes been seen as a potential threat to traditional banking as we know it. But can blockchain really replace banking institutions? Or will it serve as a complementary technology instead?

In this blog, we examine the history of banking, the strengths and weaknesses of blockchain, its current impact, and the realistic outlook for the future. Finally, we explore how Codearies helps banks and fintech innovators succeed in this changing landscape.

The Foundation of Traditional Banking

Traditional banking has supported the global economy for centuries. It facilitates payments, savings, loans, investments, and cross-border commerce. Banks maintain centralized ledgers, ensure compliance with regulations, provide trust through government support, and offer customer service.

Key characteristics of traditional banking:

- Centralization of authority and data

- Regulatory oversight and depositor protections

- Layered intermediaries for payments and lending

- Role as custodians of identity and creditworthiness

Despite their critical role, legacy banks face challenges such as high operational costs, slow interbank settlements, geographic limits, and growing customer demands for digital services.

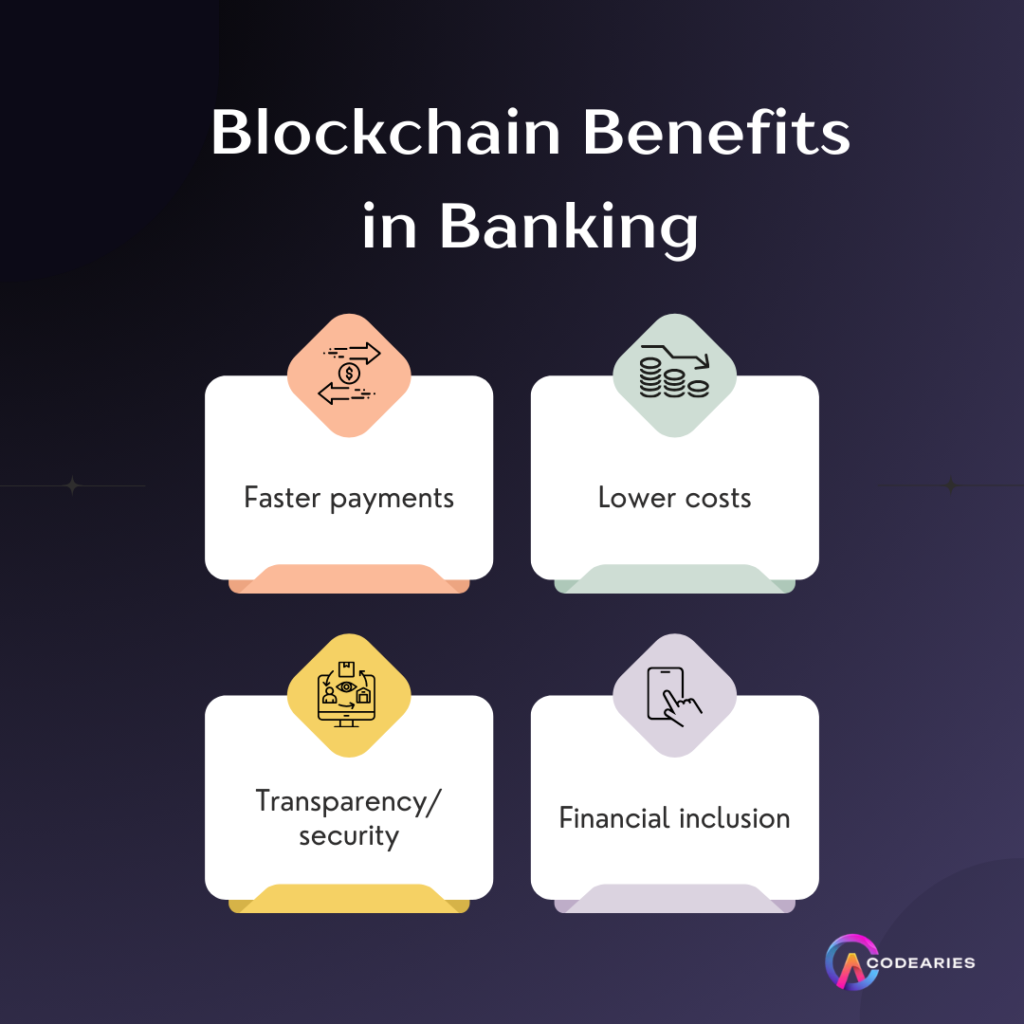

What Blockchain Brings to the Table

Blockchain is a decentralized, permanent digital ledger that offers potential solutions to many banking inefficiencies:

1. Decentralization and Trustlessness

Blockchain eliminates the need for a trusted central intermediary. It allows peer-to-peer value transfer and record-keeping. By spreading consensus and cryptographic validation across a network of computers, blockchains significantly reduce single points of failure and improve security.

2. Transparency and Immutability

All transactions on a public blockchain are permanently recorded and verifiable by all participants. This fosters transparency and reduces the risk of fraud.

3. Faster and Cheaper Cross-Border Payments

Traditional cross-border payments rely on banking networks like SWIFT, which can take days and come with high fees. Blockchain-based payment systems enable near-instant settlement and lower costs through tokenized fiat or stablecoins.

4. Programmable Money and Smart Contracts

Smart contracts are self-executing codes stored on the blockchain. They automate complex financial agreements like loans, insurance payouts, and derivatives, reducing manual work, errors, and disputes.

5. Financial Inclusion

Blockchain can help unbanked populations by providing access to finance with just a smartphone and internet connection. There is no need for physical branches or extensive paperwork.

Can Blockchain Replace Banks?

The Case For Replacement

Some believe that blockchain’s advantages—like the absence of gatekeepers, disintermediation, real-time settlements, and open access—might make traditional banks unnecessary.

- Decentralized Finance (DeFi): Platforms such as Aave, Compound, and Uniswap allow lending, borrowing, and trading without banks..

- Central Bank Digital Currencies (CBDCs): Initiatives like China’s e-CNY show governments testing digital currency alternatives to cash and traditional payment systems.

- Tokenization of Assets: Real estate, stocks, and commodities can be divided into tradable tokens, which might replace custody services.

- Global, 24/7 service: Blockchain doesn’t close, serving users across time zones without interruptions.

The Reality Check

While blockchain offers significant innovations, fully replacing banks encounters challenges:

- Regulatory Complexity: Banks face intense oversight to protect consumers, manage systemic risk, and enforce anti-money laundering and sanctions. These challenges are tough to replicate in decentralized networks.

- User Experience & Adoption: Managing private keys, wallets, and decentralized applications remains complicated for the average user.

- Scalability & Performance: Blockchain networks still deal with issues related to throughput, latency, and energy consumption.

- Trust & Stability: Banks offer deposit insurance and remedies for errors—protections that blockchain does not inherently provide.

- Interoperability: Banks interact with various legacy systems, governments, and payment networks, while blockchain ecosystems continue to develop interoperability frameworks.

How Banks Are Adapting Blockchain

Rather than replacement, the future likely lies in collaboration and integration:

- Hybrid Models: Banks are using blockchain for back-end ledgers, KYC/identity management, and cross-border payments.

- Tokenized Stablecoins: Issued by banks or consortia for fast settlements.

- Smart Contract Automation: This streamlines processes in mortgages, trade finance, and insurance.

- Fundraising & Digital Assets: Banks are involved in the custody and issuance of tokenized securities.

- Blockchain Analytics: Enhancing fraud detection and compliance.

These strategies combine blockchain’s strengths with the regulatory compliance and customer trust that banks provide, helping to build the next generation of financial infrastructure.

Why Blockchain Complements Rather than Replaces Banks

- Custodial Role: Safeguarding financial assets and managing credit risk requires legal and operational structures.

- Customer Trust: Banks have built reputations over decades, ensuring regulatory protection and resolving disputes.

- Financial Ecosystem Complexity: Banks support many stakeholders—including governments, other banks, fintechs, and customers—demanding reliability and standards.

- Technology Maturity: Though blockchain continues to evolve, it has not yet fully replaced bank infrastructure at scale.

In summary, blockchain enhances and updates banking rather than entirely replacing it.

How Codearies Enables Banks and Fintechs to Harness Blockchain’s Power

At Codearies, we recognize that the future of finance relies on innovation built on trust and compliance. We work with banks, fintech startups, and large businesses to create hybrid, scalable, and secure blockchain solutions that boost efficiency and enhance customer experience.

Our Offerings Include:

- Blockchain Strategy & Roadmap: Customizing use cases that fit your existing systems and regulatory requirements.

- Permissioned & Public Blockchain Development: Creating scalable ledgers that provide transparency without sacrificing confidentiality.

- Smart Contract Engineering: Automating essential workflows—payments, loans, KYC, asset tokenization—with reliable, error-free code.

- Compliance & Regulatory Integration: Incorporating compliance tools for KYC/AML, reporting, and audit readiness.

- Hybrid Cloud and On-Prem Solutions: Developing blockchain systems that balance on-chain security with off-chain flexibility.

- UI/UX & Mobile/Web Apps: Designing user-friendly digital experiences that simplify blockchain complexities for end users.

- Security Audits & Ongoing Support: Monitoring, updating, and evolving your platform as regulatory and market conditions change.

Our diverse teams create solutions that integrate blockchain innovation into your trusted financial systems.

Frequently Asked Questions (FAQ)

Will blockchain completely replace banks anytime soon?

While blockchain is changing the industry, regulatory, technological, and user experience challenges mean it will likely complement, not replace, traditional banks in the near future.

Can Codearies help traditional banks adopt blockchain?

Yes, we assist banks with blockchain strategy, development, integration, and compliance to help them modernize without disrupting day-to-day operations.

What are the main benefits of hybrid blockchain-bank systems?

They mix blockchain’s transparency, immutability, and efficiency with the security, liquidity management, and regulatory structures of banks.

How do smart contracts improve banking operations?

Smart contracts automate agreements like loans and insurance, which reduces manual errors, speeds up settlements, and increases transparency.

Is Codearies experienced in multi-jurisdictional financial compliance?

Yes, our legal and compliance teams ensure your blockchain projects follow global regulations, including GDPR, KYC/AML rules, and new crypto legislation.